Dixon Technologies: From a single factory in 1993 to a Rs 10,700 crore electronic manufacturer for the world

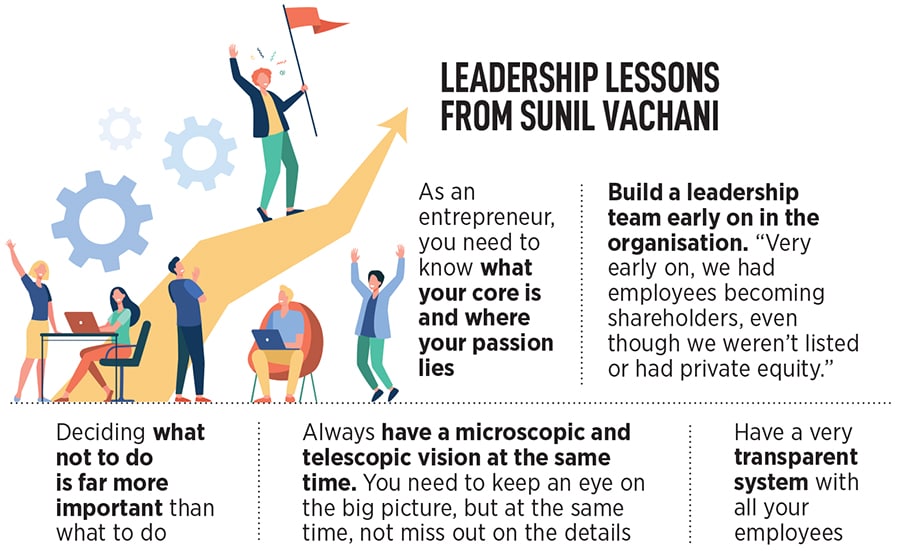

Sunil Vachani and Atul Lall have built Dixon Technologies from the ground up, focusing on quality, trusting its people, and keeping a keen eye on capital efficiency. Today it is India's largest electronics manufacturing services company that boasts of over 60 Indian and global clients it manufactures TVs, consumer electronics, lighting, home appliances, mobiles, and more, for

Sunil Vachani, co-founder and chairman, Dixon Technologies

Image: Madhu Kapparath

Sunil Vachani, co-founder and chairman, Dixon Technologies

Image: Madhu Kapparath

As I entered the first basement of the seven-storeyed Padget Electronics factory in Phase 2, Noida, I was offered an anti-static coat and shoe covers. As we passed through the metal doors, a blast of air hit us—another sanitisation protocol—as we were about to enter a dust-free zone. In front of me was a sea of machines spread across 20,000 sq ft, with close to 600 employees. I was standing in a mobile phone manufacturing unit, or that’s what I thought. But to my surprise, the first basement was only working on manufacturing the motherboards of the device.

“Operations on this floor run 24x7 since they are completely automated. Our machines can manufacture 40,000 units per day,” says the floor operations manager. Since it was an automated unit, there were fewer employees, with most focusing on quality checks. The rest of the assembly took place on the other floors, each with close to 2,000 people.

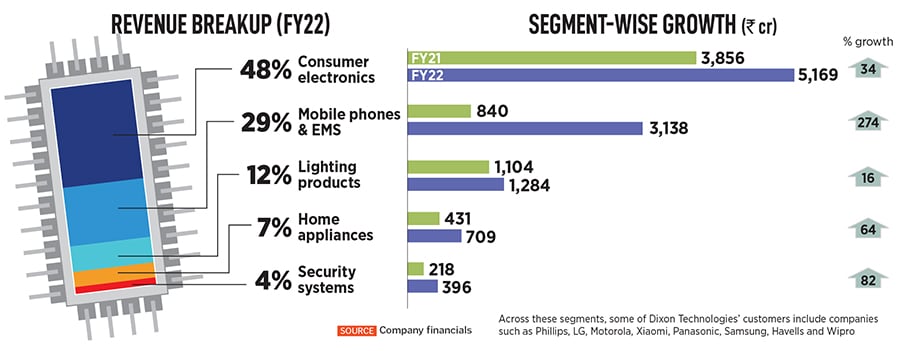

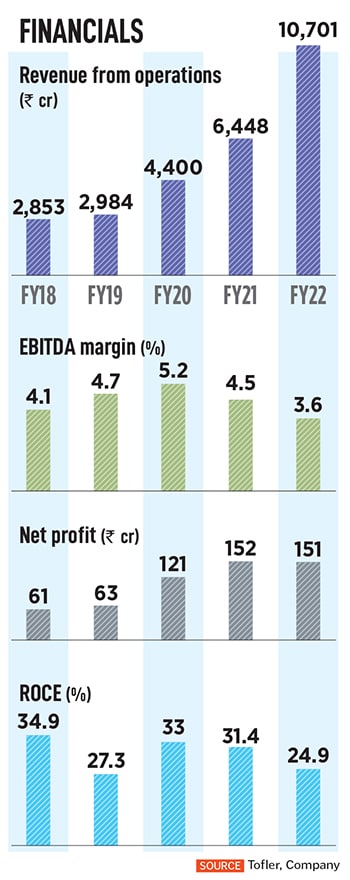

This was one of the 17 manufacturing units across the country—from Noida in Uttar Pradesh to Chittoor in Andhra Pradesh—that one of India’s largest electronics manufacturing services (EMS) companies, Dixon Technologies, runs. It has expanded from CRT televisions (TV) to consumer electronics, lighting, home appliances, mobiles and a lot more, growing into a ₹10,700-crore powerhouse that is valued at ₹20,000 crore on the stock market.

All this began with one factory that co-founder Sunil Vachani set up in 1993, to manufacture CRT: A 10,000 sq ft rented plot in Noida, a few machines, 15 employees and ₹15 lakh that he borrowed from his father, Sundar Vachani.

In September 2017, it went for a public listing, one of the very few companies in the sector to IPO. The big trigger was to provide an exit to Motilal Oswal. When Dixon got listed, the turnover was around ₹2,000 crore; in the last five years it has grown by 5x. “I think it was the the most subscribed IPOs in the history of electronics manufacturing in India,” claims Vachani. The split-adjusted listing price was ₹352, which has since increased by over 10x, to ₹3,546, at the time of writing. Even now, in FY22, the company’s net debt-equity ratio is 0.1.

In September 2017, it went for a public listing, one of the very few companies in the sector to IPO. The big trigger was to provide an exit to Motilal Oswal. When Dixon got listed, the turnover was around ₹2,000 crore; in the last five years it has grown by 5x. “I think it was the the most subscribed IPOs in the history of electronics manufacturing in India,” claims Vachani. The split-adjusted listing price was ₹352, which has since increased by over 10x, to ₹3,546, at the time of writing. Even now, in FY22, the company’s net debt-equity ratio is 0.1. He feels a lot of these are covered in the production-linked incentive (PLI) scheme, which was announced in 2020 to encourage domestic manufacturing, across sectors, including mobile and electric components. “The PLI scheme can be a real game changer, if executed well and incentives are disbursed on time. It has the potential to transform the sector,” says Vachani. So far, Dixon is part of five PLI schemes—mobiles, IT hardware, telecom, LED lighting components and air-conditioning components. The production for mobiles and IT hardware has begun. “Dixon has been aggressive in terms of having partnerships with multiple brands. The PLI scheme has benefited them and they are aggressively expanding their capacities and showing their capabilities to multiple brands,” says Prachir Singh, senior research analyst at Counterpoint Research.

He feels a lot of these are covered in the production-linked incentive (PLI) scheme, which was announced in 2020 to encourage domestic manufacturing, across sectors, including mobile and electric components. “The PLI scheme can be a real game changer, if executed well and incentives are disbursed on time. It has the potential to transform the sector,” says Vachani. So far, Dixon is part of five PLI schemes—mobiles, IT hardware, telecom, LED lighting components and air-conditioning components. The production for mobiles and IT hardware has begun. “Dixon has been aggressive in terms of having partnerships with multiple brands. The PLI scheme has benefited them and they are aggressively expanding their capacities and showing their capabilities to multiple brands,” says Prachir Singh, senior research analyst at Counterpoint Research.