From Ninjacart to Vegrow: 5 Indian agritech startups to watch out for

Riding on technological innovations, a clutch of agritech startups has created value in the sector but they will have to tough it out through this slowdown

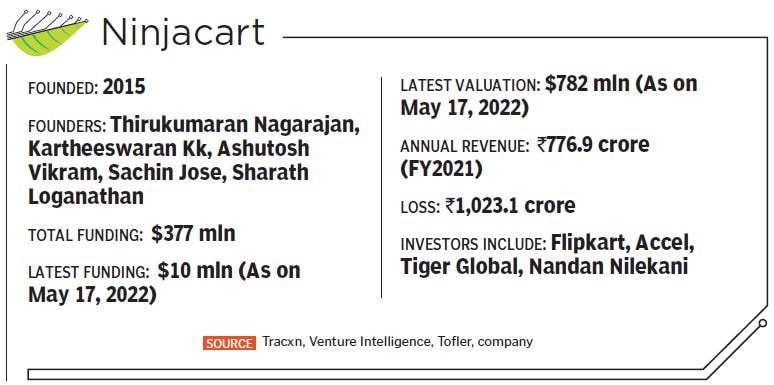

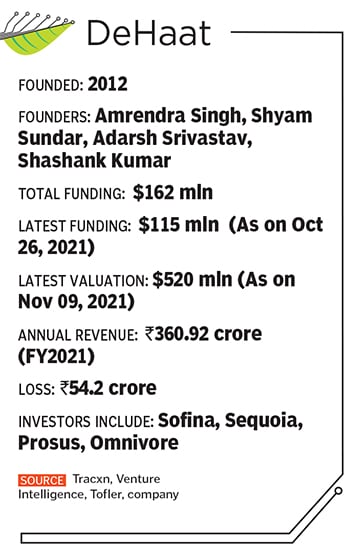

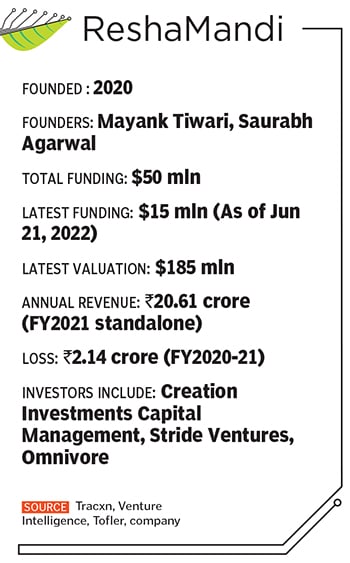

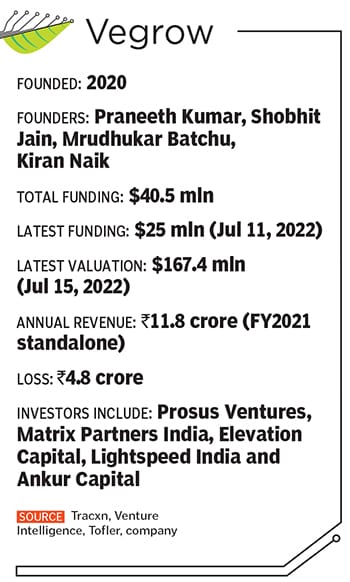

India’s most valued agri-tech startups

India’s most valued agri-tech startups

Before the current slowdown began to show its effect on India’s startup scene, a small number of agri-tech startups were privately valued highly enough for them to become unicorns the next time they raised a big funding round, perhaps.

As the slowdown deepens, and before these startups turn the corner, they are digging in and preparing for the long haul. Some, like DeHaat, have made a course correction or two, while others like ReshaMandi, see explosive growth ahead, having nailed their business model.

What follows is a small series of snapshots of some of India’s most valued agri-tech startups. Before the slowdown, they were seen as ‘soonicorns’, or soon-to-be-unicorns, meaning ventures privately valued at $1 billion. Now they will have to prove their worth.

Ninjacart: Solving the supply chain

Thirukumaran Nagarajan

Thirukumaran Nagarajan

In an email to Forbes India, Kumar didn’t say how many people were laid off, but said it was a “corrective course of action internally based on performance and cultural misfits with few colleagues” after the company had hired more than 1,500 staff in the last one year. DeHaat’s current staff strength is 2,000 and 80 job offers were made in July and August as well, he says.

In an email to Forbes India, Kumar didn’t say how many people were laid off, but said it was a “corrective course of action internally based on performance and cultural misfits with few colleagues” after the company had hired more than 1,500 staff in the last one year. DeHaat’s current staff strength is 2,000 and 80 job offers were made in July and August as well, he says.

Started in 2020, ReshaMandi is working to take the ‘farm-to-fashion’ platform to markets including the US, Latin America, Europe, the Middle East and Southeast Asia to sell natural and recycled fibre products. It has also taken some early steps to add African mulberry, an ingredient vital to silk production. The company has built a strong tech backbone for quality testing and advisory, and its procurement and sales operations help farmers get better prices.

Started in 2020, ReshaMandi is working to take the ‘farm-to-fashion’ platform to markets including the US, Latin America, Europe, the Middle East and Southeast Asia to sell natural and recycled fibre products. It has also taken some early steps to add African mulberry, an ingredient vital to silk production. The company has built a strong tech backbone for quality testing and advisory, and its procurement and sales operations help farmers get better prices.

India’s fruit market is valued at $60 billion, where “every fruit is a multi-billion-dollar opportunity”, the two-year-old venture said, adding that it has taken the lead with pomegranates and is among the top five marketplaces for various other fruits. Just like fresh produce and animal protein, the fruit market in India is also “historically unorganised, fragmented and inefficient… poised for tech-led disruption,” said Ashutosh Sharma, head of investments for India at Prosus, in the press release.

India’s fruit market is valued at $60 billion, where “every fruit is a multi-billion-dollar opportunity”, the two-year-old venture said, adding that it has taken the lead with pomegranates and is among the top five marketplaces for various other fruits. Just like fresh produce and animal protein, the fruit market in India is also “historically unorganised, fragmented and inefficient… poised for tech-led disruption,” said Ashutosh Sharma, head of investments for India at Prosus, in the press release.

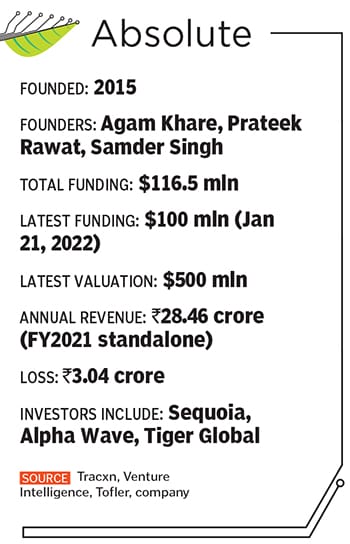

Absolute is also another venture that is attacking multiple problems in the agri ecosystem and the ‘value chain’, as businesses like to call it. It has established three distinct pathways for itself, comprising a science and engineering research and development platform called BioX, a ‘Universal Farm OS,’ and a global trading platform that has reached 12 countries so far.

Absolute is also another venture that is attacking multiple problems in the agri ecosystem and the ‘value chain’, as businesses like to call it. It has established three distinct pathways for itself, comprising a science and engineering research and development platform called BioX, a ‘Universal Farm OS,’ and a global trading platform that has reached 12 countries so far.