At Tata Group, the spotlight is now on independent directors

The role of independent directors comes into sharp focus as the Tata-Mistry spat spills over to group firms

Bumpy ride ahead: Ratan Tata

Image: Shailesh Andrade/ Reuters

It is shaping up into a fight to the finish. Cyrus Pallonji Mistry, the 50-year-old former chairman of Tata Sons, appears to be ready to take his battle against Ratan Tata, 78, and Tata Sons, from where he was ousted unceremoniously on October 24, to its logical conclusion. Mistry, whose family owns an 18.4 percent stake in Tata Sons, is undaunted even in the face of the value erosion which Tata group companies have been facing ever since the bruising face-off began.

“Cyrus believes what is happening is catharsis. If there is value erosion in the process, he is willing to take the hit because his family’s fortunes aren’t solely dependent on the holding in Tata Sons,” says a source close to Mistry.

While the initial exchange of fire between the two sides was restricted to the group level and to Tata Sons, it has now spread to group companies, with the focus sharply on the role—read independence—of independent directors including Ratan Tata’s old friend-turned-foe and Bombay Dyeing patriarch Nusli Neville Wadia.

On November 15, a bizarre drama played out at the board meeting of Tata Global Beverages Limited (TGBL), where the company’s second quarter results signed by Mistry were released to the exchanges at 6.02 pm and another statement replacing him as chairman reached the exchanges at 6.12 pm. Mistry was replaced by Tata loyalist Harish Bhat, who also has been given an important role in the group (including that of custodian of the Tata brand) in a recent round of restructuring following Mistry’s ouster as Tata Sons chairman.

Mistry reacted swiftly, saying the manner in which TGBL replaced him was “nothing but a repeat of the illegality that the board of directors of Tata Sons did on October 24”. He claimed there was nothing on the agenda about replacement of the chairman, just as there was nothing on the Tata Sons board agenda. Tata Sons sources have, however, said there was nothing illegal about it since seven of 10 TGBL directors present voted in favour of removing Mistry. Max Group founder Analjit Singh, an independent director on the TGBL board who voted in favour of Mistry, told CNBC-TV18 that what was happening was “uncharacteristic of the Tata Group”.

Image: Arjit Sen / Hindustan Times via Getty Images

The TGBL episode underscores the deep divide among group operating companies with independent directors of Indian Hotels Company (IHCL), Tata Chemicals and Tata Motors issuing statements supporting Mistry’s leadership. On the other hand, Mistry was replaced as chairman of Tata Consultancy Services (TCS), the group’s cash cow, virtually overnight, and Tata veteran Ishaat Hussain was installed in his place. The Tata Steel board has stayed silent thus far.

Tata Sons, where Tata Trusts (headed by Ratan Tata as chairman) hold 66 percent, is not taking this divide and the role of independent directors lightly. In a nine-page statement justifying its stand on the Mistry issue, Tata Sons has indicated that Mistry was using the independent directors to garner support in his battle with Tata Sons. “Having been replaced as the chairman of Tata Sons, where the majority of the board and the major shareholders had expressed lack of confidence, Mr Mistry is trying to gain control of IHCL with the support of the independent directors of the board,” the statement of November 10 says.

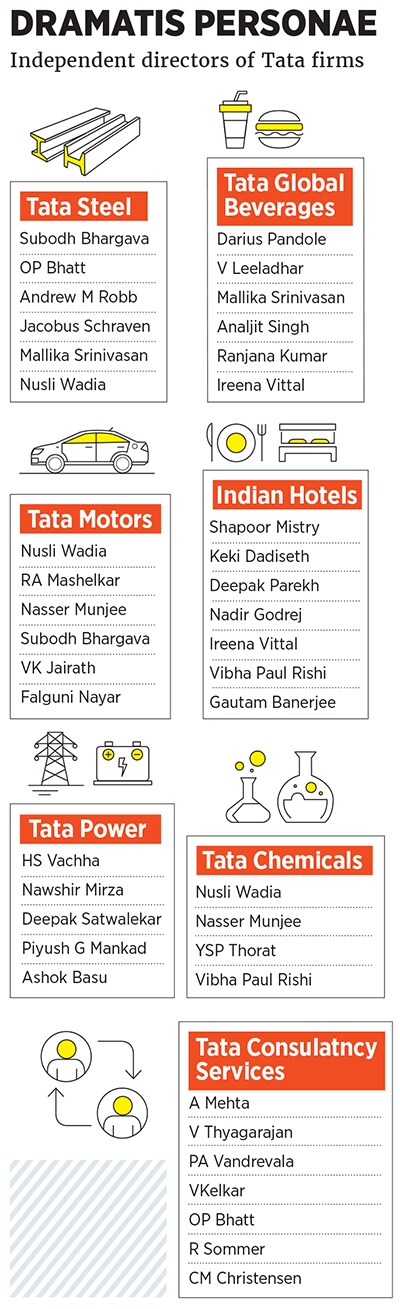

Mistry invoked the stature of those serving as independent directors of the operating companies, among them Deepak Parekh, Keki Dadiseth, Nadir Godrej, Nasser Munjee and Nusli Wadia (see chart), and pointed out that many of them were appointed before he took over as Tata Sons chairman in December 2012. Significantly, sources in Tata Sons had also used a similar argument extolling the stature of the independent directors of Tata Sons, among them Venu Srinivasan (who has since been appointed a trustee of the Sir Dorabji Tata Trust) and Ajay Piramal, to justify Mistry’s ouster.

Mistry invoked the stature of those serving as independent directors of the operating companies, among them Deepak Parekh, Keki Dadiseth, Nadir Godrej, Nasser Munjee and Nusli Wadia (see chart), and pointed out that many of them were appointed before he took over as Tata Sons chairman in December 2012. Significantly, sources in Tata Sons had also used a similar argument extolling the stature of the independent directors of Tata Sons, among them Venu Srinivasan (who has since been appointed a trustee of the Sir Dorabji Tata Trust) and Ajay Piramal, to justify Mistry’s ouster.Besides, Tata Sons has also issued a subsequent statement saying: “In light of the developments since November 4 [the day the IHCL directors backed Mistry], Tata Sons reiterates that it is crucially important for boards, including independent directors, to consider that their views and positions ensure that the future of Tata companies is protected taking into consideration the interests of all stakeholders.”

Opinion is divided on the role of the independent directors in this face-off. Some analysts and Tata-watchers feel independent directors must use their own discretion at such a sensitive juncture rather than vote in line with the principal shareholder. Says corporate lawyer HP Ranina: “Independent directors must act independently. This is also reiterated in the Companies Act of 2013. Just because the principal shareholder has lost confidence in Mistry, it cannot be grounds for independent directors to follow the same line.” He points to Section 166 (3) of the Act which says “a director shall exercise his duties with due and reasonable care, skill and diligence and shall exercise independent judgement”. He says the role of independent directors on the boards of Tata Sons and its operating companies needs to be examined in this perspective. However, Section 166 (2) says: “A director of a company shall act in good faith in order to promote the objects of the company for the benefit of its members as a whole, and in the best interests of the company, its employees, the shareholders, the community and for the protection of the environment.”

JN Gupta, a former executive director of the Securities and Exchange Board of India who runs proxy advisory firm Stakeholders Empowerment Services (SES), differs with Ranina: “Opposition cannot be seen as the only measure of independence. A divided board causes tremendous erosion for shareholder wealth and can lead to potential disaster.” In a report on the imbroglio, SES says it “finds that somewhere, in the anxiety to project and prove the independent mind, IDs [independent directors] have forgotten about stakeholders’ interest. Once again we have a situation where form has won over substance.”

The battle at the House of Tata is now set to intensify and shift to the extraordinary general meetings called by Tata Sons to oust Mistry from the boards of various operating companies like IHCL, Tata Motors, Tata Chemicals, TCS and Tata Steel. This apart, Tata Sons also wants Wadia removed from boards of the companies where he sits. Sir Dorabji Tata Trust member VR Mehta, in an interview to CNBC-TV18, has alleged that Wadia “orchestrated” support for Mistry.

The outcome of the EGMs will also depend on which way Life Insurance Corporation (LIC), a major institutional shareholder in several Tata firms, votes. It is not without reason that both Ratan Tata and Cyrus Mistry are making the rounds of the corridors of power in New Delhi to present their sides of the story to the government.

“The key to future events lies with the institutions,” says the SES report. “The future will tell whom LIC has insured.”

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)