Spoilt for choice: Luxury has made its home in India

The affluent Indian's desire for 'the good life' has lured the world's biggest luxury brands to the country despite the real estate and regulatory quagmire

India continues to miss a Rodeo Drive or an Avenue Montaigne—we’re not quite there yet—but barring a road dedicated to über luxury, there is little that the upscale shopper here can complain about. Walk into Delhi’s DLF Emporio in Vasant Kunj or Mumbai’s Palladium in Lower Parel—the top-of-mind shopping destinations—and there’s a veritable smörgåsbord of options to feast—or even just snack—on.

Luxury has made its home in India. From Armani to Chanel and Ermenegildo Zegna to Vacheron Constantin, renowned global brands have set up shop here. And not only in the obvious categories of apparel, accessories, home decor, watches, wines and jewellery, but also in fine dining, concierge services, travel and yachts. According to a February report by KPMG-Assocham, India’s luxury market grew at a healthy 30 percent to reach $8.5 billion in 2013, and is likely to grow at 20 percent to $14 billion by 2016. The report states that this growth has been primarily driven by lifestyle segments such as fine dining, gadgets, hotels, jewellery, personal care and wines, as consumers refused to compromise on the ‘luxe’ life.

India’s luxury potential has attracted several brands to the country in recent years. Some others such as Godiva Chocolatier and Fabergé Jewellery plan to start operations shortly. Additionally, some firms such as Villeroy & Boch and Bvlgari, which had earlier exited India, are showing renewed interest in the market. This momentum has been driven by an ever-increasing base of ultra high-net worth households (HNHs), which are likely to grow at 27 percent till 2017-18.

Those that are retailing in India are of the opinion that the profile of the customer has changed noticeably over the last decade. For one, there is a lesser diffidence about living the good life. “Today, customers want to reward themselves. They want to feel good about themselves, their position, and show it to friends and family. The mentality has changed,” says Rishab Suresh, country manager at luxury watchmaker Vacheron Constantin. “There has been an increase in wealth amongst new generation entrepreneurs, and they are willing to look at options beyond the obvious,” he adds.

Also, the market is no longer restricted to metros. Around 70 percent of luxury handbag-maker Judith Leiber’s customers now come from tier-2 and -3 cities, and this is without depending on store-based expansion, says the KPMG-Assocham report. Instead, Judith Leiber’s local partners showcase select products to potential consumers through exhibitions.

Currently, Indian luxury consumption constitutes only 1-2 percent of the global luxury market. However, a significant increase in high net-worth individuals (HNIs) and the overall rise in disposable incomes places India among the top global destinations for luxury. This, however, does not imply ease of doing business in the country.

The problems are multifold. To begin with, the India partner, who brings in the brands, needs to be patient as it could take 5-10 years (with exceptions though) for a business to become sustainable. Plus, the presence of luxury brands is concentrated only in malls, high streets and upscale hotels. There are limited luxury malls (among them DLF Emporio, Palladium, Bangalore’s UB City and the latest entrant, Kolkata’s Quest) in India, and setting up stores in high streets affects the retailer’s profitability due to sky-rocketing rentals. Also, luxury retail demands an exclusive ambience.

More significantly, despite the momentum in demand, India is not seen as a regulations-friendly place to do business in. Case in point: Import duties (that range from 20–150 percent) are much higher here, and is a key deterrent for international luxury players. The counterfeits epidemic poses another challenge. The ‘fakes’ constitute about 5 percent of the Indian luxury market and have been growing at a rate almost double that of genuine products.

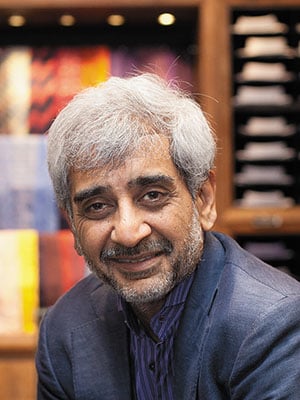

Genesis Luxury

Owner: Sanjay Kapoor

Corporate office: Gurgaon

Brands brought into India between 2010 and 2014

Michael Kors: 4 stores across Delhi, Mumbai, Bangalore and Kolkata

Villeroy & Boch: 3 stores across Mumbai, Bangalore and Kolkata; opening shortly in New Delhi