Chanda Kochhar: Making ICICI Bank's digital strategy click

Chanda Kochhar is revving up ICICI Bank's digital strategy by drawing on the power of mobile and social platforms. The result: The bank is likely to end FY16 with Rs 80,000 crore worth of transactions from mobile banking alone

Sometime in the early-2000s, when every new automated teller machine (ATM) would be inaugurated by banks with much fanfare, an ICICI Bank customer came up to Chanda Kochhar excitedly. He told her that the new ATM was a great machine and congratulated her and the bank for it. But he had one question. “It’s such a fine machine,” he told Kochhar. “But I can’t see the person who is pushing out the cash.”

Cut to 2015, and Chanda Kochhar, managing director and chief executive officer of the $132 billion (Rs 8.26 lakh crore) balance sheet size ICICI Bank, India’s largest private sector lender, chuckles while recalling that incident. Times have clearly changed since, both for her bank and the banking sector as a whole. ATMs are par for the course and banks across the spectrum are racing to capture and deliver the latest in technology to deliver a better experience to the customer. For ICICI Bank—an institution that has projected itself as a first-mover on many fronts—the changing banking landscape, where digital delivery of services is becoming more the norm than a nice thing to do, has meant devising an aggressive digital strategy.

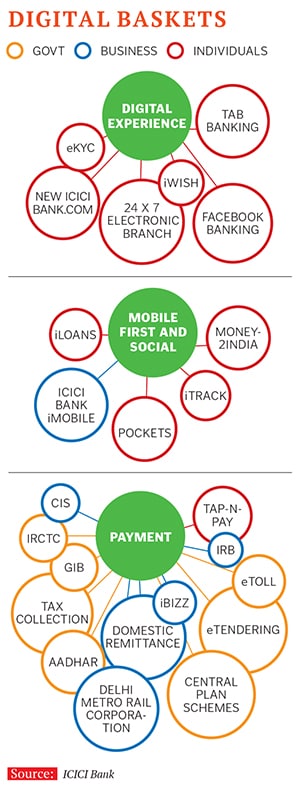

Kochhar, 53, who won the Forbes India Leadership Award in 2013 for the Best CEO–Private Sector, says ICICI Bank’s digital strategy is based on three key pillars—digital, mobile and social—where the bank not only digitises its own operations and offers key banking functions on the digital platform, but also extends them to mobile and social media platforms where younger customers spend a large part of their time. “Our belief is India’s youth live around the fulcrum of digital, social and mobile. So all of us have to see how the business fits in with this,” says Kochhar.

She says a number of customers today, and most of them tomorrow, will conduct banking transactions around these three pillars and ICICI Bank needs to retain the first-mover advantage. As part of the plan to grab a greater share of the digital space and beat competition (most of ICICI Bank’s key competitors, including public sector giant State Bank of India, the country’s largest bank, are rolling out major digital banking initiatives too), ICICI Bank wants to add to its many firsts on the digital front with more offerings even while revamping existing ones.

The bank has been an early adopter in areas like internet banking, mobile banking, tab banking, fully automated 24X7 touch banking, banking on Twitter (icicibankpay), and Pockets, the digital wallet, among others. These initiatives, Kochhar says, are helping the bank get new customers, as well as optimising revenue among existing ones.

If recent figures are any indication, the focus on digital initiatives has begun yielding results already. With more customers getting access to digital options, close to 60 percent of the bank’s total transactions for savings account customers are now undertaken through new-age digital channels, and only 10 percent by way of branches. In FY2015, the share of current and savings accounts (CASA) for the bank was 3 percentage points higher at 46 percent, compared to the previous fiscal, indicating a healthy increase. With digital channels reducing costs, the bank’s cost-to-income ratio has also improved to 36.8 percent, down from the previous fiscal’s 38.2 percent.

“The 36.8 percent we’re at is by far the best by any standards,” points out Kochhar. “While the exact cost-savings on account of our digital initiatives is difficult to quantify, technology clearly has a role to play.”

Given India’s demographics, ICICI Bank wants to grab a large share of the social media pie to ensure younger customers gravitate towards it. “Youngsters spend a lot of time on social media platforms like Facebook and Twitter, and most often complete the social part of the transactions there, whether it’s a dinner or a movie. What we are aiming to do is to help them complete the financial part of their transactions also on social media,” says Kochhar.

Consequently, the bank launched what it claims is the world’s most comprehensive offering on Facebook in September 2013, and has recently followed it up with icicibankpay, the banking-on-Twitter service, which was rolled out in January this year, making it the first bank in Asia, and only the second bank in the world, to allow money transfer on the Twitter platform. The service enables ICICI Bank customers to transfer money to anyone in the country who has a Twitter account, check their account balance, view their last three transactions and recharge prepaid mobiles.

The social media thrust apart, the bank’s mobile banking application, iMobile, has recently been upgraded, taking the total number of services on offer under it to more than 100. Among other features, the app has an integrated view of all ICICI Bank relationships with the customer, a facility of alerts and notifications through Google Now and an in-app chat function for quicker resolution of customer queries. iMobile also provides options for transfer of funds, including to phone contacts, and allows cash withdrawal at any ATM of ICICI Bank without using a card. Customers can also apply for loans and pay utility bills.

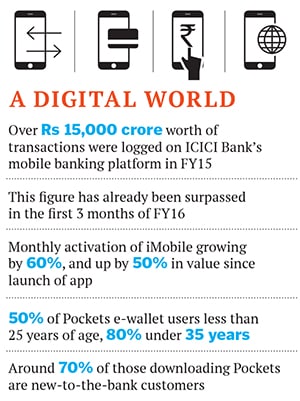

The upgrade seems to be working: The monthly activation of iMobile by new customers is growing by close to 60 percent and the value of transactions is increasing by about 50 percent per month.

Says Kochhar: “The application has been made much more powerful. It’s no longer just the retail or individual customers—small businesses and corporates will start using it and larger payments will get made through it. Besides, the very, very small customers for very small remittances also use it. If the app becomes powerful, it opens itself up to more transactions.”

But while iMobile is getting in the numbers, ICICI Bank is equally excited about its e-wallet, Pockets. It calls this India’s first digital bank for the youth. With e-wallets becoming an important option for payments in the country, Pockets is ICICI Bank’s way of offering an easy payment option to young customers and also getting new customers to the bank. Anyone, including those who are not customers of ICICI Bank, can download the e-wallet from Google Playstore, fund it from any bank account in the country and start transacting immediately.

Pockets has already garnered over a million downloads in the first three months of FY2016, with more than half of those transacting on it being new-to-the-bank customers. The unified offering on the mobile phone combines banking transactions, non-banking transactions, ecommerce payments and social integration. “We are also pushing Pockets aggressively by targeted mobile campaigns,” says Abhijit Singh, head of retail technology at the bank. Pockets’s user base tells its own story: As many as 50 percent are under 25 years of age; 80 percent are less than 35.

In absolute numbers, the results of all these mobile banking initiatives are proving to be quite dramatic. In April 2015 alone, the bank witnessed a hefty Rs 5,343 crore worth of transactions on the mobile banking platform. While the full FY2015 numbers were in the region of Rs 15,000 crore, the first three months of FY2016 have already seen this number being surpassed. The bank now expects a staggering Rs 80,000 crore worth of transactions to be conducted through mobile banking.

The bank’s aggressive digital drive is also reflected in its retail loan portfolio, which has increased to 42.5 percent of the total loan book as of March 2015, from 39 percent the previous year. Given the momentum of growth being shown by the digital channels, this figure is expected to improve. The markets and the analyst community are also watching the bank’s digital strategy closely, and so far the response has been positive.

Says Suruchi Jain of Morningstar in a recent report, after the bank’s first quarter results were announced: “Operating costs were up 9 percent, primarily due to technology expenses to launch several automated banking services and improving the bank’s digital offerings. Management guided that cost-income will remain at the same level as last year, as the benefits of operating leverage will be spent on branches and digital banking initiatives, which we consider a wise use of cash.”

Despite the emergence of new players—like mobile payment companies Paytm and Mobikwik—banks like the one Kochhar leads will continue to have an inherent advantage in the digital era, analysts say.

Banks have the advantage of depth since they are relationship-driven,” says Shinjini Kumar, leader, banking and capital markets, at PricewaterhouseCoopers (PwC) India. “They have comprehensive offerings and their clients cut across strata. Their relationships will grow as they offer greater digital offerings.” Kumar says banks which are drawing up digital game plans will not differentiate between their customer strategies and the digital ones, but rather mesh the two together to offer an enhanced customer experience. Some banks, for instance, may put greater accent on customer convenience vis-à-vis security, while others do the opposite. But as digital banking itself gets commoditised, the key differentiator between competing banks will be customer experience.

She says there are also efficiency gains from this for banks. “If you use technology to assess what is the next best product for the customer and do your cross-selling and up-selling on the basis of what the data tells you, it’s definitely much more effective.”

It should come as no surprise then, that ICICI Bank’s biggest rival, SBI, is also in the midst of rolling out a slew of digital offerings aggressively. SBI, helmed by Arundhati Bhattacharya, lists ‘Unleashing the Power of Digital’ as one of its six key objectives. This includes offering cutting-edge digital products and payment services and building strategic partnerships in the digital space. And Bhattacharya too has been working at this at a frenetic pace. SBI recently launched SBI Buddy, its own mobile wallet app in conjunction with Accenture and MasterCard, in a bid to be what it calls ‘the banker to Digital India’. SBI has also been tying up with entities like Snapdeal and PayPal to widen its digital reach and is also a joint venture partner in a payments bank with Reliance Industries Ltd. (Disclaimer: RIL owns Network 18, publishers of Forbes India.)

Amidst this digital rush, is branch banking going to be a thing of the past?

Kochhar does not think so. “Branches can never go away. Branches are an integral part of creating presence and trust. Branch sizes are becoming smaller, but they are doing things which are more than and different from what they were doing in the past. Branches are becoming more relationship-oriented now, with transactions moving to digital channels. Productivity per branch is only increasing,” says Kochhar.

Adds PwC’s Kumar: “I don’t think branches will disappear. They will be around. They will transform into places where they engage with the customers. With transactions going digital, the customer who wants a distinctive experience will go to the branch in future for a more personalised experience. Branches will be about customer relationship.”

Digital banking also merges with banks’ objectives of reaching the bottom of the pyramid. And that’s smart business sense as well. For example, Kochhar’s ICICI Bank, like many others, is looking at digital banking also through the strategic lens of financial inclusion. ICICI Bank’s tab banking initiative, which uses tablets for complete registration and know-your-customer (KYC) formalities for potential customers at home or the workplace, can also prove to be a powerful tool for rural banking, and the bank’s tab footprint already extends to 3,000 branches across the country.

In January this year, the bank also launched a ‘Digital Village’ initiative, adopting Akodara village in Sabarkantha, Gujarat, to provide a range of services from cashless banking to digitised schooling. The project, inaugurated by Prime Minister Narendra Modi, involves, among other things, using tab banking to open savings accounts and providing tech-enabled banking services to the villages. “The bank is creating a cashless, digital payment ecosystem for the village,” says Singh. Digitising school records and implementing a school management software will be a part of the programme. Another dimension of the Digital Village will be to provide high speed broadband connectivity throughout the village via wifi, using wifi towers, enabling farmers to access latest price information on agricultural commodities and creating a website for the village.

Banking in India has travelled quite a distance since that day when Kochhar was asked about the man behind the ATM. And the astute banker that she is, she knows speed is of essence in this game. As the ICICI Bank digital rollout gathers momentum, only time will tell how nimble the banking giant has been in taking on rivals in the battle for the customer’s e-wallet.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)