FedEx Tries To Catch Up in India

FedEx has missed the India bus so far. Can the logistics giant win back lost ground from the competition that is miles ahead?

The Tortoise and Achilles both stood at the starting point for a race. The puny tortoise looked at Achilles, the mighty and powerful Greek warrior, and asked, “Do you think you can give me a 10-metre lead; it would make the race interesting, don’t you think?”

Achilles smiled and agreed. After all, how long could it possibly take him to race through 10 metres and overtake the tiny tortoise? According to Zeno, who lived in the city of Alea 2,500 years ago, this was a bad move by Achilles. This mathematical puzzle called Zeno’s Paradox says that, assuming their speeds didn’t vary (though one ran fast and the other slow), by the time Achilles covered 10 metres, the tortoise would have moved two metres further. By the time Achilles covered those two metres, the tortoise would have moved a little ahead. Thus, whenever Achilles reaches somewhere the tortoise has been, he still has further to go. Therefore, because there are an infinite number of points Achilles must reach where the tortoise has already been, he can never overtake the tortoise.

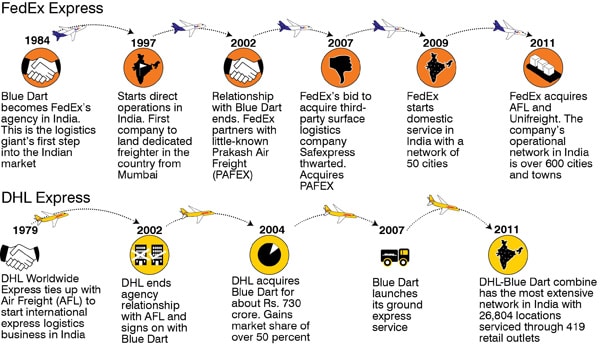

Zeno might well have been talking about logistics rivals DHL and Federal Express (FedEx). Across the world, the $39-billion FedEx is clearly Achilles, the sector leader. But in India, even after running for 15 years, it hasn’t been able to close the gap with DHL.

DHL’s Indian operations closed 2010 with Rs. 823 crore in revenues and a profit of Rs. 31 crore. FedEx’s income statements for its Indian operations are not readily available (only the balance sheet is), but our estimates (calculated using earnings per share and changes in balance sheet) show that it incurred losses of Rs. 4 crore for 2010. Forbes India sent this figure to FedEx for clarification. In its reply, FedEx did not confirm or deny these numbers. It added that the company does not report numbers on a country or regional basis.

Why has FedEx fallen behind and can it catch up? One key reason is that FedEx had never taken the India opportunity seriously and was caught napping as the Indian logistics market exploded. According to a study by Frost and Sullivan, the Indian logistics market is pegged at $75.19 billion, about 6.2 percent of India’s gross domestic product (GDP) and 11.6 percent of the services GDP in 2010. It is projected to grow to $120.42 billion in just three years from now, as manufacturing expands faster and gives a fillip to the logistics business.

But it appears FedEx has finally woken up. “We now have our stake in the ground there,” says Rajesh Subramaniam, senior vice president, international marketing, FedEx Services, speaking on the phone from Memphis, USA. Subramaniam, born in Thiruvananthapuram and a graduate of the Indian Institute of Technology Bombay, has been bullish on India for years. It is clear that the top brass in Memphis now agrees with his view because early this year FedEx acquired AFL (formerly known as Airfreight) and its subsidiary Unifreight for about Rs. 200 crore. Even three years ago, such an acquisition would have been unthinkable.

Late Starter

In early 2008, FedEx officials in India thought of Project Indigo (the India Domestic and International Growth Opp-ortunity), a plan to bring about structural changes in the way FedEx was running its India operations for the past 11 years.

Project Indigo listed out several plans: The first was to invest in infrastructure near factories in Tier II and Tier III cities. The second was to build ground infrastructure or an express trucking unit to increase reach and reduce costs. The third plan was to add capacity by connecting India to other Asian countries through more flights, including one to China, and by putting Bangalore on the global FedEx network. Several other initiatives were also planned.

But within six months of its launch, Project Indigo was dead.

What happened? As things turned out, Jacques Creeten, the then managing director of FedEx Express India, didn’t believe that such drastic changes were needed. He’d been with the company for more than a decade and, according to insiders, Creeten felt that an agency model was the best approach for India. In the model, the franchisee does the last mile pick up, movement and delivery of FedEx’s consignments without FedEx necessarily investing in setting up the network. The insiders point out that Creeten could have been influenced by his stint in the Middle East and Africa where FedEx’s operations were run on this model.

“I remember the debates within the company at that time. Jacques never really supported the idea to take it to the next stage,” says a former FedEx official who was part of the Indigo project and didn’t want to be named. Creeten did not respond to mails sent by Forbes India.

Rival DHL fared much better. It acquired Blue Dart, FedEx’s former domestic partner, in 2004 and began to dominate the Indian market. When Forbes India asked Jerry Hsu, CEO of DHL Asia Pacific, about his competitor in India, he laughed. “Competition here? We don’t have competition here. We have a market share of over 40 percent, both domestic and international. My mandate to the team here is to grow as fast as you can, as big as you can, while the economy is developing,” he says.

Hsu has every right to be smug. By acquiring Blue Dart, DHL got access to more than 400 towns and cities in the country and a service quality far superior to DHL’s earlier agent, AFL (which FedEx has just bought). Needless to say, it also brought down costs in terms of shared infrastructure and a common information technology (IT) platform. “It is a mix of network, cost and the service standard of Blue Dart which makes DHL a strong leader in India,” says Anil Khanna, managing director, Blue Dart.

Losing Blue Dart proved to be a costly mistake for FedEx. Acquiring it was a masterstroke for DHL. Blue Dart had grown to become the market leader in the express logistics business in India.

But DHL is not the only one that pipped FedEx. In 2006, TNT strengthened its position in India by acquiring SpeedAge, a move that allowed it to get a toehold in the domestic road transport business. “Converting [SpeedAge] into a fully formed company meant a lot of pain and hard work, but [it was] totally worth it,” says Abhik Mitra, former managing director at TNT.

Making Amends

Early in March 2010, senior executives from FedEx met in Mumbai to map the company’s acquisition strategy in India. Buying AFL was part of this strategy. “We did face hard times over the years, to get where we are,” says Kenneth F. Koval, vice president, India operations, FedEx Express.

But if FedEx wants to play catch up with DHL-Blue Dart, it needs to strengthen its network. Express logistics is, perhaps, one of the toughest businesses to be in. And the key to success is to have fantastic ground infrastructure (logistics companies like to call this ‘the first and last mile’). This is the main reason why airlines such as Jet Airways or Kingfisher Airlines never branch big time into the express logistics business. Yes, they have more than a hundred flights daily connecting several cities across the country. But without a good ground network, it’s impossible to succeed.

“To begin with, you need expensive real estate all over the city because a customer is always looking for a local, friendly, booking centre,” says a former senior FedEx executive, who was with the company for nearly 10 years and did not want to be named.

All this costs money. Moreover, the office has to be connected to a server, which means investments in IT. “Blue Dart has 500 such offices across the country. And to build such a network takes time, effort and a lot of money. So much so that money just flies out of the window and I am not talking about the working capital that each office needs to have,” adds the executive.

If you don’t want to build and you don’t have time, you go out and buy companies that have the network. However, FedEx’s acquisition of Prakash Air Freight (Pafex) in 2007 did nothing to expand its presence. “It was more of a defensive acquisition as we wanted to protect the market we had built up with them,” says Koval. Pafex was the backbone of FedEx’s delivery and pickup capability in India and there was a threat that it might end up in competitors’ hands because Rajan Manchanda, the promoter of Pafex, wanted to exit it. “And obviously he came to FedEx to say I want to sell, if you are not interested then I will look at others. And FedEx couldn’t afford having the entire system disturbed again after taking over from Blue Dart a couple of years before that,” adds another former FedEx executive, who also did not wish to be named.

Moreover, not having the first and last mile right has a direct bearing on cost and quality standards. “Domestically, we operated in the US and Canada for a long time but other countries were a whole new world and we did lack the experience,” says Koval. As things turned out, FedEx did the next best thing to make up for it; buy AFL.

Cyrus Guzder-led AFL has been in the third-party logistics business for more than 25 years and brings in much-needed scale and volume for FedEx in India. While AFL operates on a licensee model, through its courier and trucking arm, it is present in more than 160 cities in India and has about 50 warehousing facilities.

Infographics: Sameer Pawar

“When we offered AFL to FedEx we gave them a domestic network, IT, trained people and ground infrastructure. So what you have is a company that can offer varied products and services and the opportunity to become powerful in both domestic distribution and international freight,” says Guzder, chairman and managing director of AFL and an industry veteran. However, experts believe that AFL was fast becoming a peripheral player as Blue Dart gobbled up its turf, and that was partly a reason to sell to FedEx.

From a FedEx point of view, this is clearly the chance to break into the big league in India. And what holds the company in good stead is its global experience of cracking markets and its deep pockets. There’s no denying that FedEx is most effective in expanding into new markets when it spends on infrastructure. Take the case of China, where FedEx is now the market leader. Way back in 1989 CEO Frederick W. Smith shelled out $895 million to buy Tiger International Inc., a struggling cargo hauler but which had assets FedEx wanted: Flying rights into most major Asian airports and a management team with a deep knowledge of the Pacific rim business. With the AFL acquisition, FedEx gets a lot of similar benefits in India.

Wall Street panned FedEx’s move then, as many Asian economies were unstable at the time, but Smith’s vision proved prophetic, giving FedEx a 10-year jump start on rivals.

That experience will prove handy in India. But AFL is just the starting point. Now, FedEx has to get its approach and business model right. With that in place there’s no reason why the most-admired express logistics company in the world can’t win back lost ground in India. After all, history tells us that once man had the right tools — like calculus — even Zeno’s paradox was solved and Achilles did catch up with the tortoise.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)