Pooja Jain Is Rewriting Luxor's Future

After her father's demise, Pooja Jain has stepped up to lead one of India's largest family-run stationery companies. She eyes the FMCG space next

It took two months for Pooja Jain to clear her schedule for this interview. But she wasn’t always this busy, insists the 37-year-old executive director of the Luxor Group, one of India’s largest stationery companies. “Had you met me three months ago, I could have spent hours with you,” she says. But in March 2014, her father Davinder Kumar Jain—the founder and chairman of the Luxor Group—succumbed to a cardiac arrest. He was 71. Now, though her mother Usha is the chairperson of the group, Pooja holds the reins of the family-run company. “Other family members (she has two sisters and a brother) are not trained in the business. I am running things on their behalf. Before this tragedy, I was in charge only of the writing instruments venture, but now I look after everything,” she says.

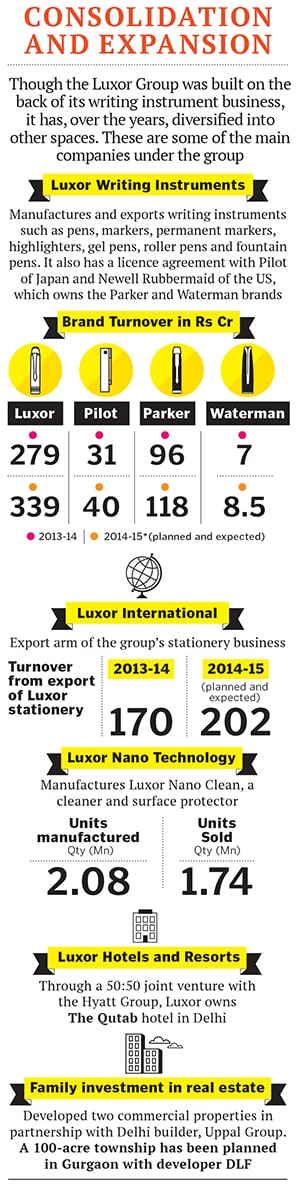

The story of Luxor began in 1963 when her father started the company with five employees and an initial investment of Rs 5,000. Today, the Luxor Group—it celebrates 50 years of operations this year—has over Rs 500 crore in revenues. Of this, almost 80 percent comes from the writing instruments business which started it all; in the last five years, this business has grown at a CAGR (compounded annual growth rate) of 17.65 percent year-on-year. It has four brands: Luxor, Pilot, Parker and Waterman. Under the homegrown Luxor brand, the firm manufactures fountain and ball pens, markers, highlighters, gel-pens, notepads and other writing accessories. It also has a licence agreement with Pilot of Japan and Newell Rubbermaid of the US, which owns the Parker and Waterman brands.

Pooja also oversees Luxor’s nascent foray into the real estate and hospitality arena as well as its plans for diversification into the fast-moving consumer goods (FMCG) space. She spent the better half of the past few months abroad assuring international business partners that the company is in safe hands. It’s not just outsiders that Pooja has to convince. She is bent on proving to herself, her family and her employees that she can lead the company her father built.

Pooja’s father was the heart and soul of Luxor. His demise has left some very big shoes to fill.

“He [DK Jain] lost his father last year at the age of 91, so his untimely death came as a shock to us,” says Raji Iyer, who started out as a secretary with the company about 35 years ago, and is now president of Luxor International, the export arm of the writing instruments business. According to Iyer, DK Jain was humble, polite and patient, and always cared about the personal well-being and growth of his employees. “He inculcated Japanese work culture in the company; he didn’t believe in hierarchies and encouraged participatory management,” says Iyer. “He only looked at the balance sheet and took the larger decisions.”

In contrast, Pooja likes to micromanage and is demanding of her employees. She is known to work almost 24 hours a day, even on Sundays, but she doesn’t like the word workaholic. “I enjoy what I do, so it doesn’t seem like work,” she says. Her colleagues say they can expect calls from her at any time of the day or night, even on weekends. An employee says it’s not unusual for Pooja to call them at 1 am to talk about the business or brainstorm for new ideas.

It’s almost as if she’s in a hurry to prove that she is a worthy successor. In this, she has an uphill task. The popular feeling in Luxor is that her father was a true entrepreneur, whereas Pooja has only inherited the business. It is perhaps this that drives the executive director to leave her mark on Luxor. She intends to achieve that by increasing the company revenue from Rs 520 crore to Rs 2,000 crore in three years. This ambitious goal is limited to Luxor’s writing instruments business, and does not include the Jain family’s investments in real estate and hospitality.

It helps that Pooja has been associated with the family business since her school days. The third of four children, she spent her after-school hours at Luxor’s sales office learning the ropes. After she graduated from Delhi’s Lady Shri Ram College, Pooja formally joined Luxor as assistant product manager and worked her way up to executive director in 2006.

BS Bhatia, senior vice president (technical and R&D), who has been with the Luxor Group for more than three decades, says that though Pooja has no technical background, she can “embarrass engineers” with her incisive questions. “Because she started from the factory level, she has excellent technical knowledge. She is a very fast learner and has a good memory,” Bhatia says.

Her determination and ambition were noticed by her father, and in the years preceding his demise, Jain had relinquished the running of the writing instruments company to his daughter while he concentrated on Luxor’s diversification portfolio. She intends to fulfil her father’s vision and begin the diversification process by aggressively expanding the Luxor brand into the FMCG space. “I haven’t identified the product categories as yet. By the end of this year, I will have more clarity,” says Pooja. In a few weeks, however, the company will have a new chief executive officer who has experience in this sector.

The FMCG space is not unfamiliar territory for Luxor, though the group has yet to enjoy the kind of success its writing instruments business enjoys. Two years ago, Luxor Nano Technology—a part of the family group—launched Luxor Nano Clean, a premium surface cleaner and protector. “Luxor Nano Clean was one of my father’s dreams. It is an area I would like to move forward in,” says Pooja.

Luxor Nano Clean has multiple variants for steel, glass, wood, leather, imitation leather, gadgets, home appliances and optical lenses. Till date, two million units of the product have been manufactured, of which 1.74 million units have been sold. The business contributed Rs 20 crore to the group’s revenue this financial year. And until six months ago, Bollywood star Amitabh Bachchan was its brand ambassador.

The product, however, failed to touch a chord with consumers. “Luxor Nano Clean is not a cleaning product which is used every day. It not just cleans but also protects the surface, something that regular cleaning products don’t do,” says Pooja.

Unfortunately, the company couldn’t get this message across to buyers. “If we could have done that, the product would have been a big success,” says Pooja, who plans to relaunch Nano Clean in the metros. “We will look at ways to increase our market share in this segment. In the next three years, Luxor Nano Technology will be a Rs 100 crore company,” she adds.

The group will expand into other product lines as well such as household articles, office accessories and, of course, stationery. “We will not move away from writing instruments, but we will build a complementary business which suits our core,” says Pooja. She also wants to leverage Luxor’s manufacturing strength to break into the FMCG sector. The group has seven plants that manufacture pens and the cleaning product. “We will launch products that require a manufacturing strength of our scale,” says Pooja.

This kind of manufacturing heft may offer some lead time advantage, but not for long. According to Ankur Bisen, senior vice president (retail and consumer products) at management consulting firm Technopak, brands have moved away from “owning manufacturing” to contract manufacturing. “Today, companies prefer investing in front-end, branding, product innovation and R&D,” he says.

While Pooja is enthusiastic about the FMCG space, it is still unclear whether her views on real estate and hotels match her father’s. Under Jain, the Luxor Group partnered in the development of two commercial properties with Delhi-based real estate developer, Uppal Group. A 100-acre township has been planned in Gurgaon with India’s leading developer DLF. In all of its real estate projects, the family owns the land which it develops in partnership with a developer. Pooja declined to talk about the land the family owns, shrugging it off as a “family matter”, and it’s not clear whether Luxor will continue to foster more real estate partnerships. Hospitality will also not be its core business, though Luxor owns a 50 percent stake in the South Delhi hotel, The Qutab. “The decision to remain in it or not will be taken in two years by the family,” she says.

There are also plans to strengthen the stationery arm of the group. Luxor claims to be the market leader in pens and writing instruments with a 20 percent market share. The company wants to consolidate its position in the market by expanding its retail presence. While Luxor’s stationery products are stocked in almost every store in the county, it also has 25 showrooms called Luxor Explore. There are plans to increase this to a hundred over the next three years. The shops showcase all the brands that Luxor manufactures or sells. “There is no good retail experience for stationery products today,” says Pooja. “We want to change that with our shops, so that people can see all our products in one place.”

She also wants to popularise the Parker brand through increased retail visibility and expanding into other accessories. “It could be leather accessories, a laptop bag, a briefcase, anything that a business executive would like to use,” says Pooja.

Industry reports value the Indian pen (all writing instruments) industry to be about Rs 2,500 crore; nearly 75 percent is in the organised sector. Luxor’s competitors include Reynolds, Cello, Add Pens, Linc and hundreds of small-scale players. While Luxor claims to be the overall market leader, the company says Reynolds is a close second with a 17 percent market share. Linc and Add Gel also claim to have a market share of 10 percent each.

Sushil Patra, associate vice president (retail & consumer products) of Technopak, says the growth rate of the industry has dropped to five percent a year from a 10 percent annual growth till 2009. He cites lack of innovation from existing players as the main reason for this decline.

“A few players have even had to shut down or scale down their business,” says Patra. It could perhaps explain why Luxor is considering other avenues of growth.

Pooja doesn’t see either domestic competition or the shrinking growth of the industry as hurdles especially because almost Rs 200 crore of its revenue comes from the export of its Luxor brand of products to 210 countries. (The company does not export the Parker, Pilot and Waterman brands.)

“Our export revenue, which was Rs 55 crore a couple of years ago, is now Rs 200 crore and is growing at a fast rate. The reason for our diversification has more to do with establishing Luxor as a brand both in the domestic and international markets,” she says. The aim is to take export revenues to Rs 500 crore in three years.

The company also enjoys support from retailers. Nikhil Ranjan, founder and CEO of William Penn (a multi-brand retailer of premium and luxury writing instruments that stocks Luxor’s products), agrees that the group doesn’t have much to worry about “because it has the advantage of knowing the industry well”.

The bottomline: Pooja wants Luxor to become a household name, be it in stationery, home cleaning products, or other new ventures, which are part of her diversification strategy. But so far, Luxor Group’s foray into other (non-stationery) products is still a piecemeal effort. Pooja is determined to rectify this. “Luxor has to become an institution. There will be transformation, integration and consolidation in the company.”

If Luxor’s plans sound a little hazy, it is because Pooja is still grappling with the details. “I will have more clarity in six months,” she says, preparing to wind down the meeting. It is already 8pm but, for Pooja, the day hasn’t ended. She has another meeting to attend. And some shoes to grow into.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)