Amazon: Pampering with Prime

Within a year of starting the service in the country, every third order Amazon gets in India is a Prime order, says Amazon India chief Amit Agarwal. Add to that the launch of the Prime Video subscription, and the rate of growth of such customers has doubled. Clearly, the company's obsession with customer satisfaction is bearing fruit

Amit Agarwal, senior VP at Amazon.com, Inc and head of the company’s India operations, was founder and CEO Jeff Bezos’s shadow from 2007 to 2009

Amit Agarwal, senior VP at Amazon.com, Inc and head of the company’s India operations, was founder and CEO Jeff Bezos’s shadow from 2007 to 2009Image: Aparna Nori for Forbes India

Bala Sarda sells tea online. To 80 countries. And he only started two years ago. His Vahdam Teas, based out of Delhi, holds the promise of shipping the freshest possible tea leaves from the hills of Darjeeling, the Nilgiris and every other important tea-growing region in India to drawing rooms in New York, London, Tokyo.

Though Sarda, 25, is a fourth-generation entrepreneur in a family that’s been steeped in chai—as bulk exporters—for decades, Vahdam Teas is a strictly online affair that he started in 2015 with the ambition of building his own, very Indian, brand. Sarda, the founder and CEO of his profitable company, sells on his own website and on Amazon’s marketplace. The latter has proved particularly fruitful recently. “This year, Prime Day sales were 5x in comparison to Prime Day sales last year,” says Sarda in a phone interview from Delhi. The market that accounts for half his sales—America.

Fair to say, Sarda is, literally and figuratively, sold on Amazon.

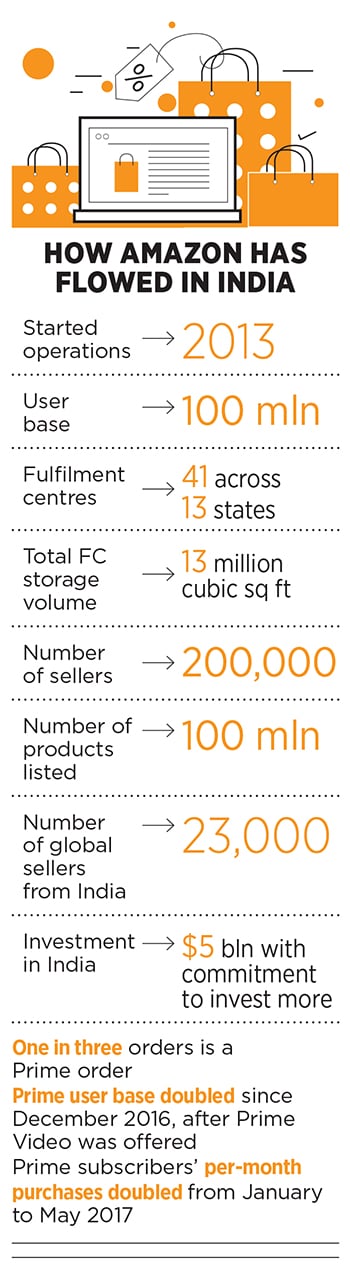

He doesn’t seem to be the only one. Amazon—which recently celebrated its fourth anniversary in the country— has racked up over 100 million customers; it ships to 97 percent of all of India’s pin codes; and has, on board, over 200,000 sellers offering more than 100 million products across an ever growing list of categories.

This year, it brought Prime Day, which is yet another step in the $500-billion behemoth’s obsession with the ultimate customer satisfaction. Sample this: During Prime Day, around 23,000 sellers and manufacturers, including Sarda, saw their volumes double during the 30-hour event over sales on the same occasion last year. Together, they had listed about 65 million products.

While Indian consumers got a shot at Prime Day for the first time this year, on July 10 and July 11, the event was in its third edition globally in markets including the US, Britain and Canada. Indian sellers, who have been part of Amazon’s Global Selling Program since 2015, have benefited. They, like Sarda, have participated in at least one previous Prime Day event, selling from India to the rest of the world via Amazon’s many online marketplaces in various overseas markets. This year, they had access to 10 marketplaces, including in the UK and the US.

Supervising this growth, from his eyrie in Bengaluru’s World Trade Center tower, is Amit Agarwal, 42, senior vice president at Amazon.com, Inc and the head of the company’s operations in India. It seems fitting that his view from the 23rd-or-thereabouts floor he happens to be on at any given moment is the Yesvantpur railway junction, tracks snaking out to the rest of India on one side, and Bengaluru’s chaotic sprawl on another.

Manish Tiwary, vice president for category management, Amazon India, feels providing solutions is critical to retaining customers

Manish Tiwary, vice president for category management, Amazon India, feels providing solutions is critical to retaining customersImage: Nishant Ratnakar for Forbes India

Within the 10 or so floors that Amazon occupies in the tower, which one can only get into via access-controlled lifts, offices are functional, comfortable, mostly open-plan and largely unremarkable. The focus is on the people the company obsesses about—its customers. Brightly painted walls of corridors are covered with synopses of success stories of people like Nadeem, for instance, a seller of high-quality leather products from the slums of Dharavi in Mumbai.

“It’s our first Prime Day, and like the previous two Prime Days in other countries, we wanted to make it a special day in India,” says Agarwal, dressed in a formal blue shirt which is open at the collar and a darker pair of denim trousers.

The hectic nature of the work in the months and weeks and days that led up to the sale shows by way of about a day’s worth of stubble around his jawline. There might even have been just a wee bit of the sheer physical strain—it was hard to tell—but what comes through is the sense of purpose that Agarwal exudes. Specifics are held close to the chest as the numbers are competition-sensitive, but he does say: “It’s been a record number of people who have come and signed up… very, very excited and humbled.”

Amazon’s efforts over the last four years in India have dovetailed into Prime Day, Agarwal says. When the Seattle-based online-bookseller-turned-Everything Store—as writer Brad Stone called it in his book The Everything Store: Jeff Bezos and the Age of Amazon—started in India, ecommerce in the country was mostly about electronics and discounts, Agarwal says. This was in mid-2010. The smartphone boom in India was just around the corner and people, mostly from the metros, were beginning to buy online, more so because it was cheaper to do so.

Manish Tiwary, vice president for category management, sees delivering not just a product, but also a “solution” as critical to winning and retaining customers. To that end, Amazon works with businesses several steps back along the supply chain before a customer even clicks on a product to buy it. For instance, feedback from Amazon played a role in how the Moto G5 was shipped with Prime Video embedded in it—as users of the G4 were seen to have a strong bias towards entertainment.

The Nokia 6 is said to have a tough body, and work on that aspect relied in part on the feedback from Amazon on how consumers associated the word “solid” with Nokia phones. While setting up an experience store on Bengaluru’s Brigade Road, sort of the heart of the city’s central commercial area, OnePlus collaborated with Amazon, relying on findings that the smartphone company’s user base comprised a large segment that wanted to touch and feel the phone.

“My job is to get the selection in, to make sure that the customers see value in it. Anything a customer can think of, he or she should be able to find it on Amazon,” Tiwary says. For a customer who wants an out-of-print book on an esoteric subject, Amazon has a print-on-delivery service, which it launched in India five months ago via a growing roster of partnerships with publishers. Buy a television or a fridge or a geyser, Amazon has a service that will ensure its installation and see to it that it is operational. In a growing number of locations, one can choose the day and time of the installation. Agarwal believes that ‘Aur Dikhao’ (Hindi for show me more), its ad campaign, “was an inflection point in ecommerce in India because it, in some ways, educated people about expecting choice online”.

Agarwal, a Stanford University computer science grad, chucked thoughts of a PhD and joined Amazon over 18 years ago; he has been there since and found himself among the few to earn a spot as a shadow to founder and CEO Jeff Bezos—an assignment that typically runs for two years and is usually followed by some prestigious and challenging posting.

Agarwal’s stint as Bezos’s shadow lasted from 2007 to 2009, and when Amazon opened shop in India in 2010, he was given the top job here. However, this wasn’t the first time he had run something for the company in the country. Agarwal had previously managed Amazon’s software development operations in India, established in 2003-04.

His responses to questions about Amazon’s contribution towards changing ecommerce in India are clear and structured. Including embedding, in consumers’ minds, the notion of greater choice online, Agarwal says there are specific areas in which the company has made a difference.

Convenience, for both buyers and sellers, demonstrating that ecommerce doesn’t have to replace the ecosystem, but coexist and take advantage of it; and loyalty, which is where the Prime service kicks in. So much so that India-specific innovations have spread to some of the advanced economies such as the UK, says Akhil Saxena, vice president of India operations. An example is the service Easy Ship, where sellers still pack their own ware, but Amazon picks it up from their premises and is then responsible for delivery. For larger sellers, there is Seller Flex, for which Amazon uses its technology and experience to set up a mini warehouse at the seller’s premises.

Amazon has also created a Service Partner Network in India, currently with some 250 service partners, comprising entrepreneurs with experience in logistics and supply chain, and even NGOs.

This, in combination with the merchant-fulfilled network (where sellers are responsible for their own shipping) and Amazon’s gold-standard product, ‘Fulfilled By Amazon’, helps the company guarantee deliveries that will arrive two days hence, the very next day, and the same day as well. Fulfilled by Amazon, where sellers bring their ware to Amazon’s centres and from that point it is Amazon’s responsibility, has seen strong growth and continues to rise, Saxena says. Amazon has so far built 41 fulfilment centres in India, which account for close to 14 million cubic square feet of space, he adds.

In October 2016, Amazon India surveyed the locations from which orders were placed over a 15-day period and “we found that 97 percent of India’s pin codes had placed at least one order, which was mind-boggling for me”, says Agarwal, adding, “We are operating at scale, creating jobs and livelihood for many people.” Through its own direct recruitments and the extended supply chain, he reckons Amazon has created 150,000 jobs over the last four years. That is excluding those hired by the 200,000 sellers.

The stage, then, was set for Prime, which Amazon launched about a year ago in India, offering free deliveries on millions of eligible products for an annual fee of ₹499. In December 2016, it followed with Prime Video, included in the same fee. In April this year, came the Fire TV Stick, and in July, consumers in India were primed for their first Prime Day.

“Prime is one of the best multi-benefit subscription services across the globe,” says Nitesh Kripalani, 36, head of Prime Video at Amazon India till a few days ago (news of his resignation came in just as this issue was going to print). Apart from free shipping on eligible products, Prime brings exclusive deals, unlimited streaming of movies, TV shows and children’s programming and in other locales, e-reading benefits as well, on Amazon’s Kindle device and app. And since the launch of Prime Video, about eight months ago, the rate at which people are signing up has doubled and in the first six to seven months, the subscriber base itself has more than doubled, says Kripalani.

“India is super strategic for Amazon… it has the commitment of the top leadership,” Kripalani adds, and Prime Video is a very powerful way of getting people to come back to Amazon literally every day—shopping might still be an intermittent thing, even the impulsive kind, but entertainment is a daily affair.

The Fire TV Stick, which Amazon offered at ₹2,500 during the Prime Day sale versus the usual price of ₹3,999, sold out rapidly, Agarwal says. The reason is easy to fathom—it streams not only Prime Video, but also Hotstar, Netflix and around 3,000 other apps and video services on to the preferred screen in the house, which in India is typically the one in every middle-class home’s living room.

Rajiv Mehta, head of Amazon India’s devices business, which is also the team that sells the Kindle ebook reader (3 million e-books in India, including in five regional languages—Hindi, Marathi, Gujarati, Tamil and Malayalam), points out that the Fire TV Stick is accompanied by a voice remote handset, which already supports Hindi. And “we put some intelligent data monitoring into the stick itself so people can know how much data they’ve consumed,” particularly relevant in India, where data plans and broadband access are still relatively expensive.

Ratcheting up the effort, Amazon has announced 18 Amazon India-specific originals, partnering with top studios, writers and actors not just in Bollywood but also for shows in Marathi, Tamil, Telugu and Bengali. The first of these, Inside Edge, a fictionalised account based on the Indian Premier League, was launched on July 10.

Says Agarwal: “It is only when we had the confidence that customers would come to Amazon for all their needs, and frequently, that we could become a daily habit for them, and that we could provide differentiated, fast and reliable delivery, that we launched Prime.”

Satish Meena, senior forecast analyst at Forrester Research, expects Amazon to eventually turn India into its largest market outside the US. “It’s not a short-term goal for them, they will be investing in the Indian market over the next 10 years.” Jeff Bezos agrees: “Terrific meeting with @narendramodi. Always impressed and energised by optimism and invention in India. Excited to keep investing and growing,” he tweeted after meeting the prime minister during the latter’s recent US visit. Bezos has already committed to investing $5 billion in Amazon India.

Akhil Saxena, vice president of Amazon’s India operations

Akhil Saxena, vice president of Amazon’s India operationsImage: Nishant Ratnakar for Forbes India

This doesn’t mean Amazon’s way ahead is an easy one.

“Our actions grew this market,” Nitin Seth, the then COO of Flipkart, told Forbes India in an interview in March. The following month, the Bengaluru-based homegrown ecommerce major—and Amazon’s prime rival—announced it had raised $1.4 billion from eBay Inc, Microsoft Corp and Tencent Holdings. Seth was referring to local innovations such as cash-on-delivery, which helped Flipkart win customer trust and build its user base. The credit for every third phone sold in India being sold online goes to Flipkart, Seth said, adding that 60 percent of that volume is accounted for by Flipkart. That’s important because, overall, mobile phone sales still account for about half of all the ecommerce purchases in India, barring those such as airline tickets and hotel bookings.

Future growth for the industry will really come from “middle India”, Flipkart’s CEO Kalyan Krishnamurthy has said. Which means that India-specific innovations—for a type of consumer the world hasn’t seen before, with high aspirations, but low spending power—will decide the long-term winner in Indian ecommerce.

While Flipkart’s top executives believe they have a strong chance to be that winner, Amazon seems to be making the right moves in a key under-penetrated area: Groceries, which is about 0.1 percent in terms of online penetration, Seth had said, compared with 30 percent for mobile phones. As this copy goes to print, Amazon is reportedly in talks to acquire bigbasket, India’s largest online grocer. (Flipkart’s own groceries foray is widely seen as imminent.)

Amazon knows just how much people buy their food and supplies offline—even in the most advanced of economies. In July, it agreed to spend $13.7 billion to buy Whole Foods, a 460-store chain in America.

Buying Supermarket Grocery Supplies Private Limited, the company that operates bigbasket, will only be one aspect of Amazon’s plan for selling groceries in India. It is not inconceivable that when the rules regarding foreign food retail change in India, Amazon will be ready to go offline here as well.

For now, Amazon’s groceries play in India comprises its Amazon Pantry option, which is similar to buying products on Amazon, and its Amazon Now app-only option. Download and install the app, use it to order what you want and Amazon India’s delivery people will pick it up at your friendly neighbourhood supermarket and deliver it to your doorstep. Amazon’s app product page promises two-hour delivery in some locations in Bengaluru, Delhi and the National Capital Region, Mumbai and Hyderabad.

Agarwal confirms that the Indian government has approved a plan by the company to initially invest some $500 million in its own food retail business. “We have received approval from the government for our proposal, and we are excited that the government is keen to streamline the whole supply chain for food processing and consumption and we are excited to be a part of that,” he says, declining to add any specifics, saying it is early days.

During Prime Day this July, around 23,000 sellers and manufacturers, saw their volumes double during the 30-hour event over sales on the same occasion last year

He did bring the conversation back to Prime, though, saying: “I think it’s a natural piece in our Prime evolution, and we want Prime to be a habit and we want our customers to think about Amazon for all their needs. We already have our consumables category—it’s our fastest growing category, growing by 500 percent in the last one year.”

Forrester’s Meena is in agreement: “For Amazon, a Prime customer is the most important customer. In the US, Prime customers spend almost twice as much as those who don’t subscribe to the service,” he says. “They buy across more categories, they buy more frequently, and they are sticking to the platform. That’s the intent.”

Also, the Indian government’s demonetisation policy [in effect since November last year] has created a favourable landscape for ecommerce and mobile money services, Ruomeng Wang, an analyst at consultancy IHS Markit, wrote in an email to Forbes India. “Amazon’s key advantage to compete in India is its global scale and comprehensive digital content. This will attract both local and international merchants to join the platform, thereby increasing user adoption,” says Wang.

The analyst adds: “Taking advantage of the demonetisation policy and further developing its mobile wallet services will be crucial for Amazon to add value to its platform.” Amazon has already launched its Amazon Pay closed wallet in India, which makes it convenient—and impulse purchases that much more addictive—to buy something on the site. One transfers money from a bank account or card onto Amazon Pay, which can then be used across the Amazon platform.

For now, Agarwal and team are building on the success of Prime. While membership numbers aren’t forthcoming, sales to Prime-member-driven sales in May 2017 saw a 100 percent increase over January, Agarwal says. “They are just shopping more. Just the lift that we get when a person becomes a Prime member, it’s comparable to what we see in other geographies—they just shop more.”

Leading up to the July Prime Day, “we’re just humbled by the number of people who signed up. Every day one out of three units on Amazon are ordered by Prime members. It shows that a large proportion of our business has transitioned to Prime. That customer base is shopping more, shopping more categories”, he says.

Agarwal says the net effect is to create a positive feedback loop. “We have a very good funnel of new customers experiencing Amazon for the first time because we have a wide selection; most likely we would satisfy their needs, they like the experience, they shop more and when they shop more, they sign up for Prime, when they sign up for Prime, they shop more.”

Amazon’s obsession with customer experience is something one has to be at the company to understand, Agarwal says, recalling the first of three important learnings from his stint as Bezos’s shadow. The second thing was just what it meant to invent on behalf of customers. “Be willing to fail, to be misunderstood by people, experiment, move fast, work backwards from customers, but also invent on their behalf even when they are not vocal about their needs,” he says.

The third lesson is to think long term. “Be tactically impatient with defects in the customer experience, but strategically patient with things that you are investing in,” like selection, low prices and convenience. “All of these things are relevant in India. We’re talking about a landscape where it’s not even Day One in India, it’s probably Minute One of Day One. It will take many, many years of investment.”

And sellers like Sarda are betting on Amazon staying the course. In January, Sarda himself raised $650,000 (about ₹4 crore) from investors, including Kanwaljit Singh, formerly of Helion Ventures. The money will help him invest in boosting the quality of his products, market Vahdam in its biggest markets, and set up a warehouse in the US. Even as this copy goes to print, Sarda is negotiating his Series A funding.

“Prime Day 2017 over-exceeded all our expectations,” he said in a press release Amazon circulated a couple of weeks after the event. True to being an entrepreneur, he also put his finger on the fact that it all went off “without a single hitch”, adding that “it literally felt like Christmas, in July. We plan to be much more prepared for an even better and bigger Prime Day 2018”. That could well be Amazon India’s plan too.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)

X