Clash of civilizations

Under R. Seshasayee, truck maker Ashok Leyland became efficient — but forgot how to grow. Today, a new breed of young leaders is helping him put together a survival strategy

Name: R. Seshasayee

Age: 61

Designation: Managing Director, Ashok Leyland

Number of years in the Company: 33

Attributes: Careful, believes in gradual change and focus

Achievements: Cost Cutting, reducing flab and salvaging Ashok Leyland from the economic slowdown in the late nineties

Quotable Quote: "First you have to ensure that you build your strengths to defend."

Name: Vinod Dasari

Age: 43

Designation: Chief Operating Officer, Ashok Leyland

Number of years in the company: 4

Attributes: Entrepreneurial , quick adaptability and multi-faceted approach

Achievements: Taking the focus back to the customers and bringing Entrepreneurial flair back to the company

Quotable Quotes: "As long as the customer is more profitable we will get more market share."

To understand the journey of a 60-year-old company like Ashok Leyland, you need to know two stories.

First: In 1948, Raghunandan Saran, the son of a Delhi-based car dealer, laid the foundation of Ashok Motors and began the assembly of Austin cars in a northern suburb of Madras (now Chennai). There weren’t many takers. He realised that the market in India for vehicles lay in trucks and buses, to serve the public, and not cars that served only a few. Even as the first Austins began to roll out from the Ennore facility, Saran was contemplating the manufacture of chassis for motorised public transport and later forged an alliance with British Leyland. That’s how Ashok Leyland was born — in an era when the appetite to take risk was a scarce commodity, Saran decided that trucks would be the next big opportunity.

Second: Vinod Dasari, the newly appointed COO at Ashok Leyland, was perplexed. At around 4:00 p.m. on the second day of a crucial marketing meeting recently, the key managers gathered around the table suddenly appeared restless. They asked Dasari if they could wind up work and come back early the next day. Though the work was still incomplete, he agreed. On his way out, Dasari asked one of his colleagues, why was the entire team in such a tearing hurry to leave? The answer — it was the day of a solar eclipse. Everybody wanted to be home. In many ways, this epitomises the Ashok Leyland of the last two decades — conservative, god fearing and bureaucratic.

This inward looking culture was now beginning to take its toll on the way the company was performing in the marketplace. While Tata Motors has straddled the entire gamut — from heavy to medium and light commercial vehicles — Ashok Leyland has been content making medium and heavy commercial vehicles like tippers and tractor trailers. And while Tata Motors built a pan-India distribution, Ashok Leyland stayed put in South India.

The result wasn’t difficult to guess: Tata Motors is today the undisputed leader in both the medium and heavy commercial (M&HCV) and light commercial vehicle (LCV) market. It has a 63 percent share in commercial vehicles, while Leyland is satisfied with a 25 percent share of the M&HCV segment.

Tata Motors spotted market opportunities better. The mini truck, Ace proved that in a big way. Within just 22 months, Ace coasted ahead registering sales of one lakh units. Ashok Leyland simply watched from the sidelines.

Ashok Leyland’s one big consolation is that the company has never made a loss in the last 60 years of operation. Tata Motors made a historic loss of Rs. 500 crore in 2001 and followed it up with a loss of Rs. 100 crore in the next year too. But while Tata Motors’ market capitalisation has nearly doubled during the last 14 years, Ashok Leyland’s went up by just a third.

Today, at least three major international truck makers — Navistar, Man and Volvo — are expanding their presence in India. And Leyland looks more vulnerable than ever.

“Ashok Leyland is a story of refused opportunities over the last decade in the great marketplace of India where Ace and Scorpio (the SUV from M&M) blazed trails,” says Subir Raha, former independent director on the board of Ashok Leyland and the Hinduja Group, which holds a majority share in the company. It is obvious that the company that Saran founded today needs a complete makeover.

Breaking the Inertia

Experts believe that Ashok Leyland has been complacent just because the money kept coming in. “The company has not really grown even when the market had opportunities because the people here have been happy doing what they are and they feel they have done a great job,” says a consultant who didn’t want to be identified. And so, Tata Motors expanded from M&HCV to LCVs, low cost passenger vehicles and is now the owner of the world’s two largest luxury auto brands, Jaguar and Land Rover (JLR). And it would be fair to say that chairman Ratan Tata almost bet the house on Tata Motors’ JLR acquisition last year.

But the man in the hot seat at Ashok Leyland doesn’t quite agree that his firm has missed out on all the growth opportunities. Managing director R. Seshasayee, 61, is the old war horse at Ashok Leyland. This is his 33rd year at the company and the 10th year as MD. To be fair, he did a fantastic job of cost cutting, reducing flab and almost salvaging Ashok Leyland from the economic slowdown in the late 90s.

And Seshasayee remains a believer in gradual change, rather than biting off more than the company can chew. Comparisons with Tata Motors don’t bother him because he says it mostly comes from people who don’t know the company well.

“First you have to ensure that you build your strengths to defend. If you are in the M&HCV market, unless you are putting in money to defend that market against onslaught of new competition; bringing in new technologies, building the people and process capabilities … and when you are half way done, you want to say that let’s do something else because this morning there is a news item on some new project, I think that is a complete lack of focus,” he says. Today, he is willing to admit that they should have jumped into the LCV segment at least two or three years ago. “But it was clear to me and the board that we could not have put all the money into M&HCV which was required and also do LCVs and other value added services. We were clear that we must do this in sequence and we need a partner. We will readily concede we took time to get a partner,” says Seshasayee.

He chooses his words carefully, but in many ways, this is the humbling of Ashok Leyland. Today, it understands and accepts what it could have done better. A couple of years earlier, such talk would have been roundly dismissed. But now, Seshasayee is willing to concede that change is critical. “I feel very proud of the fact that we have a very objective assessment taking place inside the organisation where we are up to speed and where we are not. The things we are doing today mark a complete departure from our earlier manner,” he adds.

And here’s the good news: Ashok Leyland is preparing for battle. The old timer and the fresher are cooking a new revival recipe. Cooking? Yes, that’s what they call it, “a lot of work in the kitchen which is not out on the dining table yet.”

The Unlearning

At 43, Dasari is the youngest member on the board of Ashok Leyland. In 2005, he was handpicked by Hinduja scion Dheeraj Hinduja, 39, the co-chairman who had joined the board in 2003. Dasari was meant to bring in fresh thinking into the company, a role he executed with flourish in his last assignment as the joint managing director at Cummins India. One of his former colleagues at Cummins describes him as a ‘very people oriented, open minded and entrepreneurial sort of a guy.’ It shows.

His first move at Ashok Leyland has been to take the company back to its core — the customer. The company engaged Dr. Shoji Shiba, internationally renowned breakthrough management expert, to understand how to listen and process the voice of the customer. “The demands of the markets are changing and the customers are getting more knowledgeable because they have more options available, we found that their voice is also changing,” says Dasari.

Dasari is quite the outsider in the system. And he’s already been put through the paces — in a quintessential South Indian fashion, expanding his influence slowly but steadily. “It started with manufacturing, purchasing, marketing and then the engines business. He has had to prove himself again and again,” says a leading consultant.

Around the time Dasari came on board, Ashok Leyland used the old Leyland engines for its trucks. Because of the new emission norms, it had to junk the old engines and replace them with the Hino engine. Dasari decided to sell the engines to genset makers, thereby fashioning a neat Rs. 500 crore business. That’s the kind of entrepreneurial flair that Leyland could do more of — but experts are wary of how far he will be allowed to experiment and force the pace of change.

Seshasayee is still very much in control. Last year, the board extended his term as MD for another three years. “Both these guys’ thoughts aren’t generally in sync,” says an insider on condition of anonymity. But the differences are not irreconcilable except in the pace of change.

There is also a change in the strategic thinking of the company. Earlier, obsessed with how to defend its market share, today the company is taking a much more holistic view of revenue growth. “The objective over the last couple of years has been to try and make the truck business less than 50 percent of our turnover so that the company doesn’t have to fire fight every four-five years because this business is very cyclical,” says Dasari. Hinduja feels the same.

So far, the responsibilities have been clearly delineated. New product ideas and new business concepts come from Dasari — while Seshasayee still retains control over product development and shop floor manufacturing. And the teamwork is beginning to show results. Take for instance, the recent breakthroughs in the construction equipment sector.

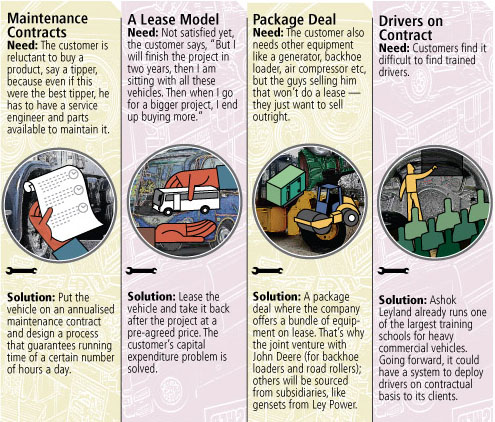

Instead of selling a tipper alone to the construction equipment company, Ashok Leyland intends to offer a whole bouquet of services to make life easier for the customer — the tipper is sold on lease, it comes with an annualised maintenance contract, the company also provides a backhoe loader, road roller, compressed air and generators (for illumination at night) on lease and even drivers. “The customer wants a solution that makes him more profitable as he builds roads. So one of the corner stones was that as long as the customer is more profitable we will get more market share but to just increase his profitability we can’t be solely focusing on making our trucks better and better. You have to meet his latent needs,” says Dasari.

But that requires an environment where ideas aren’t held back, there is freedom to express ideas and people can derive their own conclusions. “I think this is one very important change which supports all the rest. If it would not have been there, there would have been silos and it would have been a lot more difficult to make it happen,” says Seshasayee. He sounds convincing, but you can’t help notice that the ‘change in culture’ is still work-in-progress.

Dasari is 18 minutes and 16 seconds late for our meeting. He walks into the board room with a casual air, remains completely detached for the next 45 minutes speaking for five minutes, only when asked to and lets the MD do all the talking.

But Seshasayee has one advantage: Having led the efficiency drive inside, he knows the company’s strengths and weaknesses inside out. And he’s the best person to clean up the innards of the shop floor and product development process.

For the past 36 months, sections of the company’s oldest factory at Ennore have been torn down and refurbished. Old engineers have been retrained, new ones hired — and automation levels have touched 60 percent, says M. Mohan, deputy general manager (manufacturing). In 1997, Ashok Leyland made 96 vehicles a day with 7,200 people on its rolls.

Today, its makes 135 vehicles with 4,200 people. Along with Dasari, the other big revamp was to bring in the 44-year-old Sarvanan as head of research. Codenamed UNITRUCK, Sarvanan’s team is betting big on a brand new truck platform which offers customers a plethora of choices in terms of chassis, cab, electronics and engine.

When it makes its debut early next year, the vehicle will take on the new global truck from Tata Motors and the rest of the international competitors on both price and fuel efficiency. “I don’t want to name people who believed that bringing in a product from the West into India will open up the market. [They felt that] because this is the way Brazil went — given its demographics — this is the way India will go. [These people] have got it completely wrong,” says Seshasayee.

By 2011, Seshasayee’s term will end. And by then, it’ll be clear whether he’s able to put Ashok Leyland back on the rails.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)