Fixing Air India

Competition is the least of the problems for the national carrier's boss Arvind Jadhav. Much of his problems are in-house

It is difficult not to feel philosophical when you sit across the table with Arvind Jadhav at his office in New Delhi. What, you wonder, goes through a man’s head when he is hated by the rank and file in the organisation he heads? What, you wonder, does a man feel like to be the lone wolf with no pack to call his own? Before the questions coalesce, the answers shake you out of your reverie. Arvind Jadhav, chairman and managing director at Air India, doesn’t give a rat’s backside. Really!

“The first day I came into work, I looked at the airline’s books and told myself we’re in for a strike,” he says. Calmly. Without any trace of emotion. And damn right he was. There was just about enough cash to run the airline for four months. At Rs. 5,000 crore, the losses were unacceptable. And each month, it was burning up about Rs. 400 crore. Because desperate times call for desperate measures, four months into the job, he asked the pilots and senior managers to take a 50 percent cut in their allowances and incentive pay. A few days later on September 25, the 300-odd executive pilots on the airlines roster started reporting sick and rapidly brought the airline to its knees.

For four days, at the airline’s headquarters in the capital city, the war of words between the management led by Jadhav and the pilots unions escalated. Apparently, they came close to blows and when all dialogue broke down, at 10 p.m. on September 29, the no-nonsense, no bull-shit chairman was set to sign an order to shut the airline down; that would have been the second lock out in Air India’s 77-year-long history.

Later that night, Jadhav took a call from the prime minister’s office (PMO). The caller asked Jadhav to back down. It left him with no choice but to rescind the notice. The agitation was called off and yet another nail was struck into Air India’s proverbial coffin. “It’s a bit like shadow boxing,” he says. “There are many connections between the government and the employees. So at times, you don’t know who’s standing behind whom.”

Almost 1,000 miles away in Pune, Shashi Ramdas winced. A few weeks ago, he had written a note to Jadhav. Eighteen years ago, he used to work out of the same second floor wood panelled office at Airline House. A former Indian Air Force hand who had seen action in two wars, Ramdas was drafted by the government to bring order into what was then Indian Airlines. He was fighting an identical battle with the pilots then. The airline needed a team stationed in Kolkata. But the pilots insisted on staying in Delhi. It left the airline with a ridiculously expensive option. Fly them down from Delhi to Kolkata to operate flights in the east.

Before then, Ramdas had been asked twice to take it easy in his skirmishes with the union. The third time around, he ensured he had Madhavrao Scindia, then the minister of civil aviation, to back him. ‘Take them on and sort them out once and for all,’ Scindia had told Ramdas.

But as the agitation continued and pilots started to report sick, pressure mounted on the minister. He finally announced the setting up of a committee to look into their grievances. Ramdas heard about the move in the newspapers the next morning. He resigned the same day. “I was simply not allowed to run the company as a chairman and managing director should,” he says.

But Jadhav, Ramdas figured, is made of sterner stuff. A few days after taking over at the airline, he gave an unusually candid interview to Businessworld. “The debt of the company is 100 times the equity. This is unsustainable,” Jadhav told the magazine. His candour disarmed Ramdas. He wanted the incumbent to hang on in there. Which is why, he wrote the note.

A Troubled Legacy

Jadhav is no dyed-in-the-wool aviation wonk. He’s a career bureaucrat. His last assignment was as principal secretary at the department of infrastructure development in Karnataka. In the job, he had had his fair share of public skirmishes on the controversial Bangalore International Airport. While on that assignment, he caught the PMOs attention, which sounded him off as a potential candidate to take over the troubled Air India. Finally, in March, the committee of secretaries asked him to make a presentation on how he intended to turn the airline around if he was given the job. Sources say it was clear and lucid enough to convince everybody that Jadhav was indeed the best man for the job.

Once inside Air India, he quickly figured out the operational, financial and strategic issues at stake. For instance, 98 percent of the routes Air India operates on lose money. Then there is this little matter about Air India having 32,000 people on its rolls and much of its functions outsourced. Similar international airlines though operate with half the number of people. And if that isn’t enough, the much written and spoken about merger between Air India and Indian Airlines was in tatters. Except a common board, the two airlines continued to operate like separate companies on the ground. There were huge differences in pay scales across functions and levels.

The biggest issue on hand was that being a government-owned enterprise, nobody at the airline believed their jobs could come under threat. History was with them. Air India, everybody was convinced, would never be allowed to go down.

That changed in July this year when employees found their salaries were not credited to their bank accounts on the last day of the month. It was Jadhav’s way of telling folks at Air India the ship is sinking. The ripples were felt as far away as Frankfurt where the airport authorities were convinced the airline was headed into bankruptcy. They wanted bank guarantees on their payments and Jadhav had to fly to the city to convince them Air India wasn’t going belly up — not yet.

But there was one thing that he wasn’t prepared for. Unknown to the mandarins in the civil aviation ministry, for two years, Air India had ratcheted up a mountain of short term debt to meet its working capital needs. To be precise, Rs. 16,000 crore. Insiders say none of this was apparent from the airline’s accounts. As many as 18 public sector banks had offered an overdraft facility to the bank. Invariably, the public sector banks would roll over the dues every 90 days. And the burden has continued to grow, like a ticking time bomb.

Bharat Bhushan, the airline’s financial advisor from the ministry of finance, who joined the board of National Aviation Company of India Ltd. (NACIL) in March this year, calls this a text-book case of mismanagement. “Borrowing money at 12 percent to pay employee salaries is unprecedented,” he says. The loans grew by as much as over 250 percent over the last two years.

Much of the rot, insiders say, set in during the five year tenure of Vasudevan Thulasidas, a Tripura cadre IAS officer, who was for the most part, out of depth at the airline. During his reign, Air India lost money for most of the good years. Industrial harmony was bought through liberal agreements with unions, even as the red on the balance sheet got deeper. As a result, for two years, even as the airline made losses, productivity-linked incentives paid out to employees actually increased by 15 percent.

Over the years, the balance of power decisively swung in favour of the unions. “Many decisions that should have rested with the management are now enshrined in union agreements. For instance, irrespective of whether the aircraft is 80 percent full or 20 percent, the management does not have the right to reduce the size of the cabin crew,” says a senior advisor to the airline.

Towards the end of Thulasidas’ term in 2007, the government finally cleared the long pending aircraft acquisition plan so that Air India could compete in the market with a modern fleet. There was one hitch though: With its operations woefully out of whack, there was little hope of the airline being able to service the long-term debt needed to buy the aircraft. Yet, it went ahead and raised long-term debt from the US EXIM Bank.

“I have nothing to gain by looking at the past,” says Jadhav. “I am looking at a three year turnaround plan. We need to make sure that our costs are structurally lower than the market.”

A Tough Future

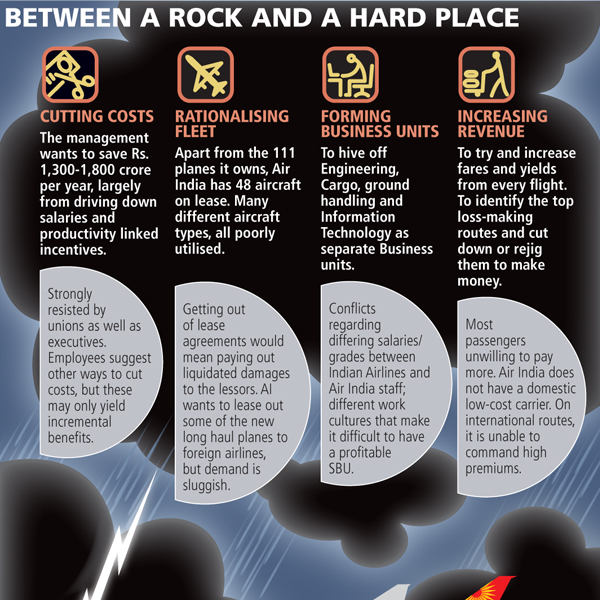

Over the last couple of months, Jadhav has spent hundreds of hours in meetings with unions, trying to work on ways to cut costs and boost income. Air India earned about Rs. 13,400 crore last year while expenditure was Rs. 19,100 crore. Since interest payment accounts for a substantial portion of the annual outgo, there is an immediate need to retire high-cost debt. And so, within days of taking over, he set the alarm bells ringing inside the government by asking for fresh equity and loans for capital purchases. Currently, the airline’s total equity is, believe it or not, a mere Rs. 145 crore.

That is when the enormity of the situation dawned on the government. Since then, the PMO has been closely monitoring the situation. Cabinet Secretary K. Chandrasekhar and Finance Secretary Ashok Chawla are working on the revival package. And word has gone out that Praful Patel, the civil aviation minister, has been asked to stay out of Air India’s affairs.

At the first Group of Ministers (GoM) meeting that discussed the bailout package for Air India in October 27, Home Minister Palaniappan Chidambaram is said to have taken Patel to task for failing to pick up the warning signals. He came down heavily on the earlier chairmen as well and demanded the civil aviation ministry take full accountability for the mess.

That said, Jadhav still has to convince the finance ministry to shell out the dough. He wants Rs. 5,000 crore this year, and another Rs. 5,000 crore over the next three years. Getting the government to loosen its purse-strings on this one is tough. He has been turned back by the group of ministers already. If senior bureaucrats are to be believed, the funding is unlikely to be cleared by Parliament without an extensive debate in this winter session. And it won’t come without a commitment from Jadhav to pare down costs by about Rs. 1,500 crore and also take steps to enhance revenues by Rs. 1,800 crore a year.

Over the next four months, Jadhav will look to firm up a turnaround plan with global management consultants Booz and Company. They’ve flown in a team of experts, of which at least three have actually worked at Lufthansa. N.M. Rothschild has been selected to work on the debt restructuring plan.

The Next Move

Clearly, the battle to save Air India is at a particularly interesting juncture. “Right now my turnaround strategy is like a chess game,” says Jadhav. “My opponents are waiting to find out what my next move will be.” A lock-out would have broken the back of the unions. And if it lasted 15 days, all the existing wage agreements with the unions would have lapsed, allowing the airline to push for a big round of cuts and more flexible employment terms.

Instead, his opening gambit — to cut the pilots’ allowances by half — may have backfired to some extent. The airline has had to restore payments on the advice of its legal team. Besides, a strike in the crucial winter season — when load factors are likely to peak — would be debilitating. But now, in return, if Jadhav is able to get the unions to agree to a new set of employment terms that allows the airline to push through structural changes on its fleet and routes, losing the first battle may well be worth in the war that’s still waging.

Getting the government to buy into his plan is another huge challenge. Inside the government, there is still no consensus on how to deal with recalcitrant unions. Allowing a disruption in Air India’s schedule is not in the nation’s interest, says a senior bureaucrat at the PMO. “After all, in many cases, it is the only airline that connects some locations around the country,” she says. “The big question is, how much can the government stomach?’’ asks Jadhav. “As CEO, I can only present a set of options. How much they are willing to take up is entirely up to them.”

“The problems that Air India faces today are not all that different than the ones that confronted several state-owned European airlines in the past,” says Perry Flint, editor of US airline trade magazine Air Transport World, who has been tracking the industry for long. “A bloated workforce, constant meddling and interference from the government in important decisions like labour contracts, fleet and network, weak balance sheets and an overall mindset among staff (and many managers) that their status as a state-owned airline guaranteed them jobs for life were common in British Airways, Lufthansa and Air France,” he says.

All three were privatised and turned viable. Air France and Lufthansa received substantial cash-injections from the government in the early nineties to prepare them for privatisation. The airlines have since consolidated operations through a series of mergers with smaller carriers and remain the flagship carriers for their countries, despite being privately traded companies.

“The important question is whether the Indian government can step back or whether it will it be unable to let go like in the case of the Italian and Greek governments?” Flint asks. Incidentally, Alitalia and Olympic Airways have both been privatised this year after a long struggle with bankruptcy. Government ownership has not proved to be uniformly bad for airlines. One of the world’s greatest airlines, Singapore Airlines, though a listed company, is majority-owned by Temasek, an arm of the Singapore government.

Getting Things Done

Privatisation of Air India is nowhere on the horizon, says a highly-placed official in the PMO. The government has no option but to fix things before it can attempt an IPO or set it up for divestment. But Jadhav isn’t looking that far. He has more pressing problems on hand.

For instance, he’s been asked again and again why the airline isn’t advertising its new fleet. The super-luxurious cabins in it are on par with the best in the world. “I don’t have the money to market. Besides, spending money on marketing means wining and dining large clients. But when it comes to the moment of truth, they fly another airline,” says Jadhav.

That, he argues, is partly because the product quality today starts deteriorating at the first point of contact — the booking interface. This continues at the airport — the process of checking in and boarding, at the gates, to the aircraft and in it and finally at arrival with the baggage, he says. “We’ve got to recognise we are in the hospitality business,” he adds.

His first port of call though is improving on-time performance. The focus on monitoring departure time is now relentless. The entire team, from the check-in staff to pilots and crew are gearing up for the chocks to be off by D-10 (departure time minus ten minutes) and ask air traffic control for clearances to take off. “There is [an] urgency for on-time departure that was never seen before,” says a traffic in-charge at Mumbai airport. Everybody is clear they have to slice minutes off the departure time. Counters have to close at D minus 30, irrespective of pressures from high-profile passengers.

Jadhav is also phasing out older aircraft. While it spruces up the image, it also saves dramatically on fuel costs. The older Boeing 747 burnt 12 tonnes of fuel for each hour of flying. The new 777 though consumes half that much.

While he has scored a few early wins, not everybody is convinced Air India can fly yet. Kapil Kaul of CAPA (Centre for Aviation in Asia-Pacific) is among the sceptics. Firstly, such a change cannot be led by one person, he says. There is a need for multiple change agents to head crucial functional areas like commercial, finance and operations. CAPA research indicates that Air India’s debt will grow to $12 billion by the time new aircraft acquisitions are complete. This, he says, will lead to an interest burden of Rs. 9,000 crore over the next three years. Air India is one issue in India that gets perfectly rational people to think irrationally. There is just too much emotion and politics, he laments.

Meanwhile, Air India has begun looking for the change agents. It has advertised for a new position, that of a chief operating officer (COO). Jadhav says the response to the global ads has been encouraging and the possibility of hiring an expat with experience is not ruled out.

For the moment though, Jadhav will be the lone wolf dealing with the challenges of a fractured organisation. There is little cohesion among the 40 executive directors and the hundred-odd general managers on the team. In an early circular, he took away most of the decision making from them. “It is impossible for the CMD to work with some of them, because they have been part of the problem,” says a director, who did not want to be named.

Getting things done through the team is tough. Three of the operational heads of customer services (Manjira Khurana), integration (Vineeta Bhandari), ground handling (Anita Mitroo) and marketing (Rohita Jaidka) have dug their heels in Delhi and refused to move to Mumbai, despite the management ordering them to do so. Dozens of letters and notices have been exchanged, with no result.

A similar situation continues down the line with the executive directors not seeing eye-to-eye with line managers. Over the past two years, that the merger is being implemented, the focus has been completely on integrating positions at the top. This has clearly not worked. This is now being given a quiet burial. Integration of the business and operational parts are likely to be pursued much more closely now.

As things stand, the unions aren’t ready to accept the kind of changes that the management and the group of ministers seem to be trying to drive. A lockout is clearly the elephant in the living room. The sooner everyone acknowledges it the better.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)