Marico 3.0: From Single-brand to Diversified Consumer Goods

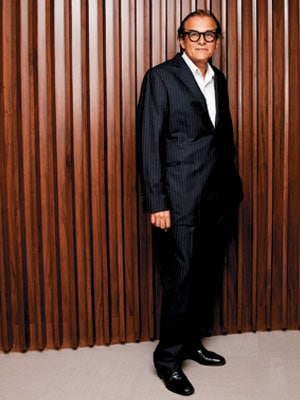

Through organisational transformation and by reshaping business strategy, Harsh Mariwala is giving his company its best shot at growth in a competitive, ever-changing landscape

There is an impeccably landscaped terrace garden outside Harsh Mariwala’s new office, just off Mumbai’s Bandra-Kurla business district. A mere 25 metres away is the clearest view of Mumbai’s gleaming new airport we’ve had yet, where huge Boeing 747s vie with midget Airbus A320s for a sweet spot on the apron. Twelve flights take off and land during the course of our interview. By the time we’re done, we can’t resist the inevitable analogy.

Unquestionably small fry in the early 2000s, Marico, the fast-moving consumer goods (FMCG) company 63-year-old Harsh Mariwala founded in 1990—breaking away from his family-owned Bombay Oil Industries—now has a market cap of over Rs 15,000 crore and international ambitions. It is well on course to becoming a jumbo.

While it is unlikely that the company will reach the size and scale of a Hindustan Unilever or a Nestle India anytime soon, what Mariwala has achieved is creditable.

The last year has been tough for consumer goods companies; a sagging economy has slowed volume growth. For Marico, surging prices for copra (dried coconut kernels, a key ingredient in its Parachute brand of oil) dented profitability. Saffola, its premium cooking oil brand, saw muted growth as consumers shifted to cheaper variants. But in the last quarter, the company surprised the market. There was a revival in volume growth. While net sales were up 2 percent to Rs 4,686 crore, net profit surged 24 percent to Rs 504 crore. The stock, flat over the last year, rallied 12 percent to an all-time high of Rs 241 on May 8, 2014. (It has since corrected to Rs 226 as of May 20.)

But like any ambitious entrepreneur, Mariwala is nowhere close to done. Over the last year, he has gone about quietly executing fundamental changes to the company. A makeover, if you will, that suits Marico’s scale.

International and domestic operations have been combined and Kaya—the skin care clinic that started over a decade ago and had become a drag on profitability—is now a separate company.

This, then, is the story of how Mariwala is putting the building blocks in place for the next phase: Transforming what was a single brand company in 1990 to a diversified consumer products player keen to leverage the heft of its multiple marquee brands.

These changes have touched every facet of the business, including Mariwala’s own role. For one, he has passed on the oversight of the company to a professional manager, something Indian entrepreneurs are typically loath to do (Dilip Shanghvi at Sun Pharma is a notable exception). In April, Mariwala moved into a new role as executive chairman and promoted his 46-year-old chief executive Saugata Gupta (who joined the company in 2004) to managing director. Now that he has shifted away from the day-to-day operations, his main aim is to enhance the effectiveness of the Marico board.

The Board, Redux

“A large part of my variable pay is tied to how effective I am as chairman of the board,” Mariwala says with a smile, adding that he can make as much as an additional Rs 2 crore a year if he does a “good job”. He gets evaluated by fellow board members and better ratings mean more remuneration.

This focus on the role of the board sharpened a couple of years ago when Mariwala was looking for ways to fortify Marico. He admits that it took time and several consultations to kickstart this evolution. His aim: Make the board a source of strength for the company. There could have been an underlying profit-seeking motive as well: The last five years have seen equity markets reward companies which have displayed good corporate governance and Mariwala, who has seen his stock price rise 10 times in the last decade, would have doubtless considered that.

He began by consulting management guru Ram Charan, who has worked with several boards in corporate India (Refer to ‘Analjit Singh’s Future-Proof Strategy’ in the April 18, 2011 issue of Forbes India), for his inputs on shaping Marico’s strategy to increase board effectiveness.

This required an evaluation which threw up several issues, among which was the fact that the board was functioning in a silo. They would meet every quarter and sign off on decisions but Mariwala felt that the members could not have had enough time to adequately research those decisions. To rectify this, prior to these meetings, Marico now practices “board insighting”, where reports on the company’s businesses are sent to members a month in advance. This allows for more informed decision-making.

Another impediment was the formality of the board meetings. The members didn’t know each other too well and only interacted during the meetings. Mariwala gradually set about fixing this. For the past three years, at retreats such as the one in Muscat this year, members spend time discussing how the board can become a competitive advantage for Marico. The members are now clear that the board will no longer get into strategic planning. Instead, it would critique, and provide suggestions on, areas such as succession planning and acquisitions. In addition, board members would also become mentors to company managers and work with them to improve specific skill-sets.

The composition of the board has been well thought-out too: It comprises members with a range of experience in running both family businesses as well multinationals.

These new initiatives have ensured that board members are better prepared for meetings which, in turn, have become more useful. Board member BS Nagesh, former managing director of Shoppers Stop and founder of TRRAIN, a retail consultancy, says, “I am far more comfortable with the new board as it allows me to understand issues better before I vote on resolutions.” He cites the increased fiduciary responsibility of directors after the Satyam saga and points out that company boards can no longer be rubber stamps.

According to Nagesh, this journey at Marico has been a reflection of how Mariwala’s own thoughts have taken shape over the years. For instance, last year, Mariwala met as many as nine independent directors—from Omkar Goswami, founder of CERG Advisory, to former chairman of Microsoft India Ravi Venkatesan—who sit on the boards of other companies to understand what senior members expect from professional boards. These insights, Mariwala says, sharpened his own perspective on how to make his board more effective for the company.

The Business Front

Business-wise, Marico is in the thick of hectic activity as it prepares for the next big leap: Marico, version 3.0.

A decade ago, Mariwala was considering entering a new line of business. And at the top of his mind was a business with high entry barriers. The idea germinated when a friend approached Mariwala to explore if they could distribute hair-removal laser machines in India. After substantial research and a trip to New York, Mariwala zeroed in on skin care, and an incubation cell was set up.

The first Kaya Skin Care Clinic came up in Mumbai’s Bandra suburb in 2002. However, the business faced immense challenges over the years. Well-trained staff would leave, often taking their customers with them. The company struggled with real estate costs and profitability was a problem. After almost a decade of learning and perfecting the model, Marico demerged Kaya into a separate company.

Kaya now focuses on anti-ageing services, pigmentation and acne. There are also Kaya Skin Bars (small stores of 300 sq feet) where the company sells its range of products. S Subramanian, CEO, Kaya, says, “The idea is to bring the Kaya brand to many customers who have not experienced it before.” Ten years and 85 clinics later, the business is finally on its way to making profits this year. Mariwala concedes, “I did not anticipate this level of complexity.”

For its other consumer businesses, Marico started by devising a more focussed strategy. Mariwala acknowledges that the approach earlier was “hit-and-run” without a broad overarching plan. The company joined forces with consulting firm Bain & Company to draft a new vision. Bain had earlier worked with Godrej Consumer Products (GCPL), helping them put in place a 3x3 strategy, which included a presence in Asia, Africa and Latin America and in the personal wash, hair care and insecticides categories. Marico’s MD, Saugata Gupta, acknowledges that the focus helped GCPL; Bain has since put in place a 2x2 strategy for Marico where the company straddles Asia and Africa and is focusing on nutrition and nourishment. But even as he gets his ducks in a row, Mariwala is all too cognisant of the fact that more challenges lurk around the corner. One of them relates to his flagship Parachute brand.

The coconut oil brand has been instrumental in catapulting Marico into powerhouse status, but the canny entrepreneur is aware that it is hardly a category of the future. But, he says quite firmly, the category has not declined: “Otherwise we would not have been able to grow in a place like South Mumbai, where usage habits are changing and people are moving from post-wash to pre-wash.”

The De-risking Strategy

Sensing this shift early enough, Marico began looking beyond its traditional bastions and pumped a substantial Rs 740 crore into the acquisition of Paras Pharma’s personal care portfolio from Reckitt Benckiser in 2012. The brands, Zatak deodorants and Set Wet hair gel, have given Marico a position in categories that are on track to grow exponentially. (Since the acquisition, Fogg, a deodorant by Vini Cosmetics, former Paras co-founder Darshan Patel’s company, has become a major player in the category too.)

Going forward then, the Marico gameplan will be less dependent on the oil business, moving into markets that are likely to mature.

Like its successful entry into the breakfast foods category, via its wellness brand Saffola. While the business is still Rs 50 crore in topline, Gupta says it uses the same distribution and backend as Saffola Oil. This gives it the potential for higher margins in the years to come. “In an emerging market,” Gupta says, “getting consumption is more important than margins. Every doubling of sales results in a 2-3 percent jump in margins.”

Among the key drivers of Marico’s future growth is the international business. Set up in 1995, it was incubated separately from the domestic operations. Mariwala says he wanted it to receive adequate focus and the attention it deserves, and not allow managers to have any “escape buttons”. However, with the international business now contributing 24 percent to its topline, Marico no longer feels the distinction is necessary and has brought it under a single umbrella alongside the domestic business. Besides, combining the two leads to advantages from synergies: There is now a cross-pollination of people and products across geographies.

Margins for the international business, which essentially comprises the geographies of the Middle East, Egypt and Bangladesh, have improved from 9 to 14 percent (B Sridhar, head of Marico’s international operations, acknowledges that forex gains played a role too).

Marico, which is listed on the Dhaka Stock Exchange and is the largest Indian company in Bangladesh, views Vietnam and Myanmar as two big emerging geographical opportunities and has moved quickly to tap them.

As the company has grown, a key part of Gupta’s job has been getting structures and processes in place without losing the agility of a smaller entrepreneurial company. Gupta cities the role of consumer research in marketing campaigns. Where campaigns would often be gut-driven, younger managers increasingly rely on research. However, Gupta cautions them against using research as a crutch: “Ultimately what makes for a good consumer insight is your own conviction. You use research to back that hypothesis, not the other way around.”

For now, Marico has managed to keep a large part of its entrepreneurial energies alive. Gupta says that they are probably done with acquisitions for now and organic growth has to be the focus. That, perhaps, is one reason why Marico’s stock had been largely flat for the last year. Buying Paras brought down the ROCE (return on capital employed) as well, which Marico has tried to fix by increasing its dividend payout.

Mariwala, who meets investors—both domestic and foreign—regularly, admits that they are concerned about ROCE and not looking at acquisition-led growth. Acquisitiveness is too much a part of him, though: He maintains a diary where he jots down the names of potential targets (he requested Forbes India not to mention names) and tracks them closely.

Mariwala tells us that the questions from investors are mainly about how the business is shaping up and how Marico is moving up the value chain. “There are some other issues like dividend payout which, in our case, was lower than some other FMCG companies as a percentage of profit. We have taken one jump and, maybe, over a period of time, we will take one more.”

Whatever the strategy or the route, the ultimate objective continues to be growth. “Fundamentally, I am centred around issues of growth. Growth in topline and growth in bottomline where the margins are relatively lower today.”

Margins are a bit of a worry with the international business and a few new brands; here, the company says, it is taking more of an investment approach rather than pushing for immediate returns. Mariwala promises the markets will also start seeing the benefits of the combined India-international strategy by next March.

For now, large shareholders are reasonably happy with Marico’s performance. Rahul Bhasin of Baring Private Equity Partners, which owns 1.4 percent of the company, has this to say: “If I look at management capability, I would say the company will do well. I feel quite relaxed and comfortable about my investment.” This, for the time being, should make Harsh Mariwala breathe easy.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)