Vishal Sikka, the outsider at Infosys, wants change

Vishal Sikka wants to jettison some of Infosys's traditional businesses and focus on innovation and new technologies. In the one year since he took over as CEO and MD, he has been attempting to steer the IT giant towards his vision

The mood at the Infosys annual general meeting on June 15, 2013, was jubilatory. Long-time shareholders were celebrating what was being hailed as the ‘second coming’: The information technology (IT) giant’s co-founder NR Narayana Murthy, after having relinquished executive duties for nearly a decade, was returning as executive chairman. But amid the praise and adulation, one shareholder stood out from the crowd. In a room packed with Murthy’s supporters, software engineer and former Infosys employee Neel (he did not want to disclose his second name) raised concerns about the company’s stodgy human resource management policies. He used a necktie to get his point across: “It is a very outdated concept and your employees hate it to the core. Poor employees, when they come to work, have to fight with the security people if they are not seen wearing one. I believe that your employees are getting charged Rs 200 [as a fine for not wearing a necktie]?”

Two years later, he isn’t quite as miffed. The company’s dress code policy has finally been relaxed. “When I was at Infosys, I fought for five years to get it changed. Vishal Sikka came and changed it in one year and I’m happy about it,” says Neel, who worked at Infosys Labs, the research and development wing of the IT firm, between 2004 and 2013.

If the tie is a metaphor for all things traditional at Infosys, then Sikka is being hailed as its game-changer. Even his hiring marked a new chapter in the 34-year-old company’s history. On the morning of June 12, 2014, Murthy, who had been searching for an external candidate to head the company, tweeted: “Happy to welcome @vsikka to Infosys. I am confident that Infosys is in capable hands.” With that, Sikka, the new chief executive officer (CEO) and managing director, became the first non-founder to head it.

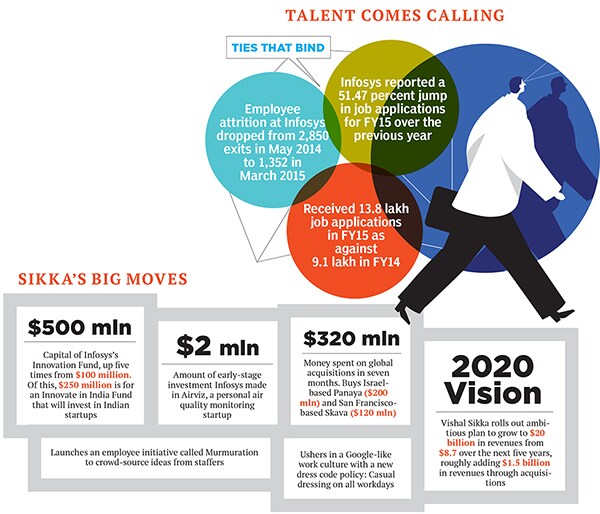

Sikka wants to reverse Infosys’s shrinking fortunes (its growth rate has been below industry projections for the last few years), stem the tide of exits (between 2013 and 2014, the attrition rate was as high as 18.7 percent), find solutions through innovation and, crucially, dismantle what he calls an “old model” that is “no longer relevant”. It’s been almost a year since he officially took charge on August 1, and he has already started making operational and structural changes to the $8.7 billion company. This determination to change the company’s trajectory is perhaps why he has not quite shrugged off his ‘outsider’ tag.

Building an international team

The most visible change is a shift towards making Infosys more US-centric. Sikka is the company’s first CEO to be based out of Palo Alto, California, and not Bengaluru, its headquarters. Some of his more recent hires are not based in India either. Earlier this year, he appointed Ravi Kumar S, who lives in New York, as its chief delivery officer. He also has a 13- to 15-member team, many of whom like Stefanie Mueller (Infosys executive director, who lives in Germany) were former senior colleagues at German software multinational SAP, where Sikka was chief technology officer and a member of the executive board. In an interview with Forbes Asia (page 46), the CEO reiterates that while the company’s nerve centre will always be Bengaluru, there’s no denying that it is a global player.

“This is unlike traditional Infosys thinking, which believed that senior managers are high-cost people, and therefore they should not be based in the US,” says Shriram Subramanian, founder and managing director of InGovern Research Services, a proxy advisory and research firm that assists institutional investors on corporate governance issues. Charles Sutherland, executive vice-president (research) at US-based outsourcing advisory firm HfS Research, noted in a May 2015 report that such appointments will help Infosys better understand the needs of its clients in the US, its largest market that accounts for about 62 percent of its total revenue. Analysts say this strategy is similar to that of Infosys’s closest rival, New Jersey-headquartered and Nasdaq-listed Cognizant Technology Solutions. While most of Cognizant’s senior management is based in the US, the bulk of its software engineers work in India. (The company follows the calendar year and posted revenues of $10.26 billion for 2014 compared to Infosys’s $8.7 billion at the end of FY2014-15.)

There was a time when the Bengaluru company, with its efficient outsourcing model, seemed unbeatable. Its annual revenues ballooned from $1 billion in 2004 to $5 billion in just six years. But after outperforming the IT industry growth rate for many years, it tripped. Today, market leader Tata Consultancy Services (TCS) leads the Indian IT pack: For FY15, it posted a net profit of Rs 21,696 crore compared to Rs 12,329 crore reported by Infosys.

To regain its past glory, Infosys has to innovate and evolve as a technology services provider that can meet the needs of a growing army of companies which is shifting operations to the cloud. In cloud computing, services like servers, storage and applications are delivered to a company through the internet. But the Indian IT industry, of which 70 percent constitutes software exports, is centred on businesses such as application development and maintenance, verification of software, business process outsourcing (BPO) and infrastructure management. The rise of cloud computing will upend this traditional structure, and top-tier IT firms such as TCS, Wipro, HCL Technologies and Infosys have already started offering cloud computing services.

When change comes, Infosys will have to be ready, and that is where Sikka’s vision comes into play.

Thinking big, thinking new

The CEO is relying on a two-pronged path of innovation and acquisitions. Although 90 percent of the IT company’s existing services still follows the traditional model, a 2015 UBS Securities Asia report notes that Sikka calls its ‘yesterday’s business model’. Not everyone is cheering him on. Former Infosys chief financial officer and board member V Balakrishnan is critical of Sikka’s plan. “When he came in, he only spoke about products, new technology and artificial intelligence. That’s his comfort zone and hence he’s not being able to connect with the legacy people at Infosys who understand the traditional businesses,” says Balakrishnan, whose career at Infosys spanned over two decades.

Criticism from the old guard can be expected. Sid Pai, a Bengaluru-based analyst in the IT-BPO space, says: “It is extremely difficult for any firm to jettison its cash cows and to train its focus on making technology bets instead. In essence, Infosys will have to become a venture capitalist of sorts—and this is far from its current core competence.” But he’s quick to add, “That’s not to say it can’t be done, just that the going will be very tough.”

Sikka has already started putting his plan into action. Infosys has made two acquisitions totalling $320 million: In February this year, it acquired Israel-based software vendor Panaya for $200 million, and two months later it bought San Francisco-headquartered Skava for $120 million. While Panaya is a provider of cloud-based services for major global players such as Apple, Johnson & Johnson, Coca-Cola and General Electric, Skava is a digital commerce platform company that develops and hosts mobile websites and apps. With the acquisition of Panaya, Infosys has a ready clientele of some of the top-performing companies in the world.

At the start of the year, Sikka increased the capital of the company’s Innovation Fund to $500 million from $100 million. The fund will invest in startups in the fields of automation, machine learning, big data, and artificial intelligence. In April 2015, it invested $2 million in Airviz, a US-based clean-air technology company. This investment in a startup is yet another first for Infosys under Sikka. Of the $500 million Innovation Fund, it has set aside $250 million for an ‘Innovate in India Fund’ that will be dedicated to investments in Indian startups.

Sikka is infusing the rank and file with the rather radical idea that a traditional IT company can be a leader in innovation. His past lends weight to his vision. He has a reputation of being an innovator in the global IT industry given his strong background in the software products space. He has a PhD in computer science from Stanford University in California, and was one of the key people to have developed Hana, SAP’s flagship product, which helps companies analyse large volumes of data in real time.

In a highly commoditised $146-billion Indian IT industry, he has decided to create a differentiating model for the software-services firm, which would be built on newer technologies such as automation and artificial intelligence (AI). The Infosys chief has a vision for an AI that can perform complex tasks that traditional IT and engineering have so far not been able to do. This is AI in a purer avatar, which, as the company writes on its website, “can replicate human decision-making in areas such as financial service regulation”.

Earlier this year, Infosys held a 21-day training session in artificial intelligence at its Mysore campus. The classes were conducted by Stuart Russell, professor of computer science at University of California, Berkeley. Sikka’s “big idea” is to bring automation, productivity improvement and artificial intelligence to the existing business verticals at Infosys, including the BPO business. So far, Infosys has applied AI to create forecasting and predictive services, real-time analytics, and data science modelling. It has delivered nearly 30 projects (many in manufacturing and financial services) using AI.

“There is a more charged atmosphere at Infosys today,” says InGovern’s Subramanian. He recalls a conversation with an institutional investor who compared Sikka to Louis V Gerstner Jr, the former IBM CEO, who transformed the technology giant from a hardware to an IT-services company. “Sikka should be able to change the focus of the company over the next five years. The entire focus of Infosys may change from a pure IT-services company to a broader technology-focussed company with non-linear revenue streams,” says Subramanian, who had been critical of Murthy’s return as executive chairman of Infosys. (Murthy stepped down from his role as executive chairman in June last year.)

In his report, Sutherland (of HfS Research) sees these initiatives and the building of expertise in new technologies as a response to the underlying changes in the IT-BPO market, and says that the need of the day is “new capabilities in design thinking, intelligent automation, data analytics, software development and engineering prowess on the part of service providers”.

But Balakrishnan remains sceptical. “The company has got over $8 billion in revenues to protect and that’s all traditional businesses. So the focus should be on that,” he says. “If you don’t grow that business, there’s no way you can get closer to industry levels.”

Report card

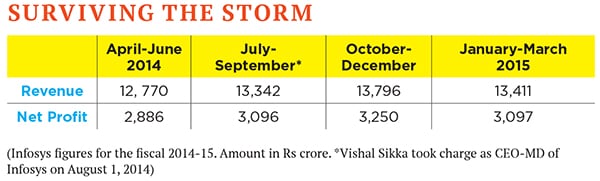

The company’s performance does not reflect these changes. For FY2014-15, Infosys recorded revenue growth of 5.6 percent, much below its projected growth rate of 7-9 percent for the same period. Even for the current fiscal (2015-16) Infosys expects revenue to grow between 10 and 12 percent (constant currency), lagging behind the 12-14 percent growth projected for the IT sector by industry trade body Nasscom.

Sanjeev Hota, assistant vice-president (IT research) at brokerage firm Sharekhan, points out that the changes initiated under Sikka will not be reflected in the company’s financials anytime soon, and that it will take two to three years for that. “He is taking the right direction by making Infosys more equipped for disruptive technologies, but it will take time to adopt,” says Hota.

As part of his long-term strategy, Sikka has laid out a 2020 Vision for Infosys: An ambitious plan to scale the company to $20 billion. Former Infosys CFO Balakrishnan is sceptical about this too and says “there is no clear direction” coming from Sikka on how he plans to achieve that target. To meet its goals, Infosys will have to clock a compound annual growth rate (CAGR) of 26 percent over the next five years. And that’s a tall order given that it expects its FY16 revenue growth in constant currency terms to be in the region of 10 and 12 percent.

Experts point out that to develop the base for newer technologies, Sikka will also need to invest in manpower, and not just at the senior management level. He needs to make Infosys attractive to a new generation of talented engineers. But first, he has to retain his existing staff.

Attracting talent

Sikka is in damage control mode, and is looking to build stronger ties between the company and its over-1.76-lakh workforce. On January 9, 2015, in a quarterly earnings call with analysts, Sikka said, “We have taken several steps to increase engagement with our employees in our mission to make Infosys a great place to work. We have set up dedicated teams that are working on and have already implemented several changes to simplify policies while stressing accountability and values.”

Some of the changes that he spoke of included allowing employees to bring their own devices such as laptops and tablets to office, flexible work-from-home structures, increased team engagement budgets and easier transfer policies across development centres.

Sikka told analysts that in the July to September quarter last fiscal, Infosys gave a hundred percent bonus payout and a special holiday bonus to high-performing employees. In January this year, 3,000 top performing employees were given an iPhone 6 (its launch price was over Rs 52,000), a grand gesture, the kind the company is not known to have made in the past.

A recent report by UBS notes that these initiatives have had a “noticeable positive impact on employee morale, as indicated by the drop in attrition for the company”. The report goes on to note that, “In addition to changing the behaviour and mindset of over 170,000 employees, the company also faces the task of motivating those working for ‘yesterday’s business’. We see significant effort being devoted to addressing this issue if the company wants to sustain the positive momentum in employee attrition and morale.”

Neel believes that Infosys under Sikka is communicating better with its employees, but, “when I speak to my current friends at Infosys, they say it is mostly the low hanging fruits and superficial changes such as dress code policy”.

The company’s salary hikes have been on the lower side. This year, Infosys gave its employees in India an average hike of 6.5 percent, while top performers got an increment of 9 percent. For its workforce abroad (onsite), the salary increase was 2 percent. This is lower than that of its competitors. Wipro gave a salary increase of 7 percent to its employees in India and 2 percent in overseas markets. TCS’s average was 8 percent in India and 2-4 percent abroad.

At the same time, recruitment firms say Infosys’s drive to revamp its HR policy seems to be one of the reasons why the company reported a healthy 51.47 percent jump in job applications under Sikka for the year ending March 31, 2015, when compared to the previous year. Infosys received 13.8 lakh job applications in FY15.

In May last year, Subramanian of InGovern had to deal with multiple institutional investor concerns (both foreign and domestic investors) over the issue of who would head the company. By then many Infosys veterans who were tipped to become the first non-co-founder CEO and MD, had left the IT firm. This had made investors all the more anxious.

One year on and Subramanian says, “Sikka has definitely stabilised the ship [Infosys] that was caught in a storm and buffeted on multiple fronts. He [Sikka] took charge and has delivered up to the diverse expectations. He has also won the confidence of stakeholders like customers, investors and employees.”

The company’s future will depend on whether Sikka can deliver on the promises he’s made. But whatever the outcome, his reign will be more than a just footnote in Infosys’s history.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)