Why the IPL is a Money Spinner

Despite short-term losses, IPL teams bring returns in more ways than one

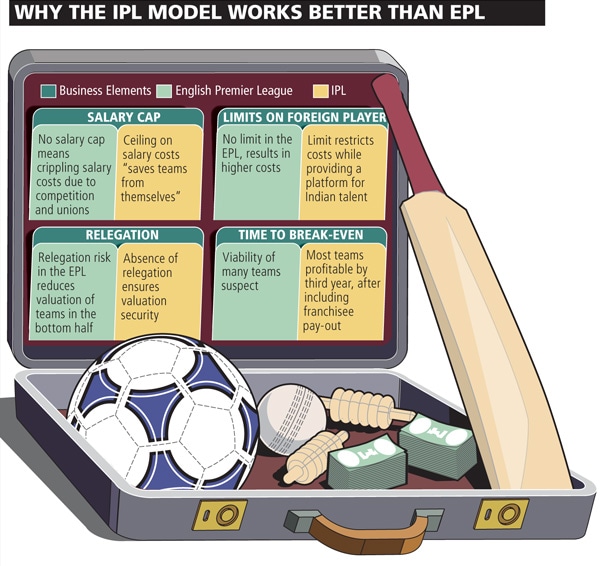

Was Sahara’s $370 million bid for the Pune Indian Premier League (IPL) team too high? The buzz around the IPL valuations has varied from a layman’s perspective —This is too much money! — to that of a conventional financial analyst — So what are the forward multiples looking like? Both are equally simplistic.

So why would anyone want to pay so much money for a cricket team? Aren’t the first eight IPL teams in losses after forking out so much?

The answer: Sports teams are valued differently from normal businesses, and financial parameters are not the only factors to be considered. There are the emotional variables such as the trophy value attached to the location or team, the number of prospective buyers with a personal or professional link to the location, and in a broader sense, the scarcity premium. All of these vary quite drastically in the eye of the beholder.

When Vijay Mallya bought the Bangalore franchise, that acquisition could be compared to the hypothetical purchase of a heritage palace in Mysore by a buyer. Grand as it looks, the palace isn’t a convenient permanent home. Government regulations forbid rentals or conversion to a hotel. But the buyer’s motivations go beyond a simple return on investment. Maybe he wants to market his (or his company’s) image. His palace can easily host parties for hundreds of guests, it is featured frequently in global media and tourists flock to the adjoining palace museum — and maybe it is minutes away from the village where the buyer grew up. And there are only 10 palaces still surviving.

The buyer knows that he could make substantial profits if he were to sell the palace in five years hence — there’s a new Indian billionaire every month — and the world’s going to be interested in getting a piece of the India action too.

So that’s why an IPL team makes sense.