Restarting India's growth engines must be Jaitley's priority

The Indian economy is today akin to a single-engine Cessna with three of its growth engines—private investment, domestic consumption and exports—sputtering. Public investment, its fourth engine, does not have the required thrust. The budget is an opportunity for Finance Minister Arun Jaitley to put all growth drivers on full throttle

Budget 2017 is an opportunity for Finance Minister Arun Jaitley and PM Narendra Modi to start creating a favourable report card of the government

Image: Kuni Takahashi / Bloomberg via Getty Images

A couple of months ago, a sudden spurt in transactions worth Rs 1,100 and Rs 2,100 caught the attention of the team that undertakes anomaly detection at FreeCharge, the digital payments platform backed by Snapdeal. This was after the demonetisation of high-value notes on November 8. The team—which uses technology, algorithms, device fingerprinting and more than 500 real-time checks to keep its platform secure—found that these amounts were auspicious gifts for newly-weds. “We realised that consumers are putting digital payments to new use,” says Govind Rajan, CEO, FreeCharge.

In November, FreeCharge’s merchant transactions per day rose 12 times over pre-demonetisation levels. In December, they were at three times the November volumes. “We are seeing a massive surge in transactions, and the average value of transactions has fallen from Rs 750 to Rs 500. That is because people have begun to use digital payments for transactions of smaller value,” Rajan adds.

An Assocham-RNCOS study has revealed that the number of mobile wallet transactions in India will grow at a compounded annual growth rate of 160 percent between now and 2022, to 260 billion from just over half a billion in 2016.

“Increase in digital payments and the GST (Goods & Services Tax) rollout will widen the formal economy as it forces business establishments to disclose transactions. This means higher revenues for the business entity which will translate into higher indirect taxes first, followed by higher direct taxes as the entity’s profit rises,” says Samiran Chakraborty, chief economist for India at Citi. “Today, India’s tax to GDP ratio is between 10 and 11 percent compared to over 30 percent in high income countries. If the tax base increases by even 2 percent of GDP, the additional tax collected would be Rs 1 lakh crore.”

Some early evidence of this is already visible. “Advance tax collection this year has risen by 15.7 percent at a time when the economy is sluggish. This means people have declared much higher incomes,” says Girish Vanvari, head of tax at KPMG India. However, economists caution that the full benefits of demonetisation, in terms of widening the tax base and higher tax revenues, will happen over time.

The Jolt

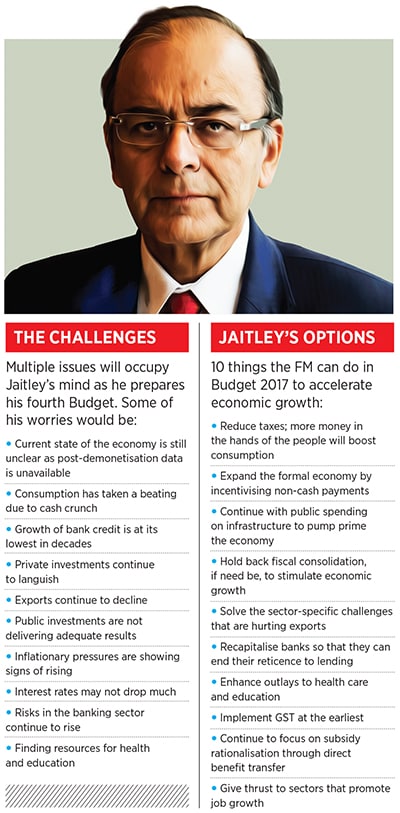

As Finance Minister (FM) Arun Jaitley prepares to present his fourth Union Budget, he has more immediate challenges to address. The decision to withdraw Rs 500 and Rs 1,000 notes, which accounted for 86 percent of the currency in circulation, and the subsequent patchy re-monetising have had an unintended effect. They have hurt a critical engine of growth—domestic consumption.

Sales of consumer durables—including TVs, refrigerators, washing machines—have fallen by 40 percent, according to Consumer Electronics and Appliances Manufacturers Association. A Nielsen study pegs the sales lost by the FMCG sector at Rs 3,800 crore.

Automotive sales in December fell to a 16-year low with overall volumes declining by 19 percent. According to data from Society of Indian Automobile Manufacturers, all segments of the industry have been hit. Two-wheeler sales dropped by 22 percent, cars by 8 percent and commercial vehicles by 5 percent.

Housing sales across the top eight cities fell by 44 percent in the October-December quarter of 2016, shows a study by real estate consultancy firm Knight Frank. The sales volume was the lowest in six years.

Nikkei India Manufacturing Purchasing Managers’ Index in December dropped to 49.6 from 52.3 in November. A score below 50 indicates that the manufacturing sector has contracted. Not surprising that the growth in bank credit fell to 5.1 percent for the fortnight ended December 23 as per data released by the Reserve Bank of India (RBI): Economists point out that this is the slowest growth in decades.

“Demonetisation has hurt the economy badly,” says former Finance Minister P Chidambaram (see interview, page 62). “Growth will slump by 0.5 percent to 1 percent in the current fiscal year.” However, RBI and Central Statistics Office estimates put 2016-17 GDP growth at 7.1 percent as against 7.6 percent in 2015-16. That too without factoring in the full impact of demonetisation.

Economists aren’t as optimistic. “I see 2016-17 growth at around 6.8 percent,” says Ajit Ranade, chief economist, Aditya Birla Group. Pranjul Bhandari, chief India economist at HSBC, also sees a growth lower than 7 percent. “There is weakness across all corners of the economy. Impacted by demonetisation, I expect the economy to grow at 5.5 percent in the second half of the current fiscal—two percentage points lower than our earlier estimates,” she says.

For 2017-18, the GDP growth is estimated to be at around 7 percent levels, not at the 8 percent mark the government would like to see. The Forbes India- BMR Advisors Pre-Budget CEO Poll (page 74) reveals that 64 percent of the respondents expect GDP growth to be between 7 and 8 percent; 32 percent expect it to be lower than 7 percent while 4 percent estimate it at above 8 percent.

To get the economy to cruise faster, Jaitley has to ensure that all the four engines of growth—domestic consumption, private investment, exports and public investment—fire together.

Domestic consumption

The debate today in economist and corporate circles is on the degree of demand destruction that the withdrawal of high denomination currency has caused; also, on the extent to which the postponed purchases will return as pent-up demand, once the cash infusion into the system is complete. Indications are that the adverse effects of demonetisation will be temporary. “Recovery will be V-shaped,” says Ranade. He also points out that the consumption boost from the Seventh Pay Commission largesse is yet to play out fully. That is, government employees are yet to spend the arrears they received weeks before cash withdrawal was announced.

The FMCG sector is already seeing a strong recovery. “In the months preceding November, we were growing at 22 percent month-on-month. In November, that growth fell to 16 percent. We are now back to earlier growth rates,” says CK Ranganathan, founder chairman of CavinKare, the FMCG player which introduced the sachet revolution in shampoos. “If you ask me the extent of demand destruction, I would put it at 6 percent of my monthly sales.”

Experts say that the adverse effects of demonetisation are temporary and will not spill over to fiscal 2017-18

Experts say that the adverse effects of demonetisation are temporary and will not spill over to fiscal 2017-18Image: Mukesh Gupta / Reuters

FMCG major Marico also expects the situation to return to normal soon. “December was better. The extent to which a company is impacted would depend on how deeply it is dependent on the wholesale network, the region it operates in, the presence of unorganised players and the share of the portfolio that is discretionary in nature,” says Saugata Gupta, MD and CEO, Marico. He adds that demonetisation has led to a pipeline correction as wholesalers and dealers sat on 30-40 days stock, “so not everyone ran out of stock”. He says “this correction [or liquidation] was due as implementation of GST nears”.

The government is also pressing banks to reduce interest rates in a bid to push up consumption. They have not passed on to borrowers the entire 150 basis point reduction that the RBI had made so far, although most banks have responded with a cut. An interest subvention scheme for low-cost houses has also been announced by the government. These measures are expected to push up demand for steel and cement sectors.

Gupta and others believe that the FM will give a stronger fillip to consumption by leaving more money in the hands of the people. “There is a high probability that income tax exemption limits will be raised,” says Ranen Banerjee, leader, public finance and economics, at PwC. “This will assuage the feelings of people who faced hardships and, at the same time, leave them with more disposable income.” As taxpayers form a small part of the population, the government may well put money into the Jan-Dhan accounts of poor people created as part of its financial inclusion thrust.

“Giving cash directly to the poor is a lot better than subsidies as it does not vitiate the marketplace,” says HSBC’s Bhandari. Both these measures have gained credence as the government is keen to make a success out of demonetisation and has said that it would lead to lower taxes.

Public Investment

This is the only engine of growth that is still firing. The government has spent substantial amounts over the last couple of years in the hope of triggering private investment. This year too, it is expected to spend on infrastructure, education and health. Some even anticipate the FM to slow down on the path to fiscal consolidation by further delaying the fiscal deficit target of 3 percent and using the money that the move releases to raise public spending. “When you are staring at an economic slowdown, a stimulating fiscal policy is likely,” says Chakraborty. “In the past, the path towards fiscal consolidation has been with some pauses. There will be one more pause.”

But not all agree. “If he pushes the target back by one year or resiles on his promise, the market will react adversely,” says Chidambaram. Jaitley, points out Bhandari, may choose a middle path. “He could well settle for a number between 3 percent and 3.5 percent. That way, he will not give up fiscal consolidation completely and thus not antagonise the market much while at the same time free up enough money for public spending.”

Jaitley may have some leeway when the five-member committee set up under former revenue secretary NK Singh, to draw up the fiscal responsibility and budget management roadmap, submits its report. “There are some indications that rather than sticking to an annual hard fiscal deficit number, the committee may recommend a deficit target over a business cycle,” says Ranade.

As far as the 2016-17 fiscal is concerned, the government is likely to meet the fiscal deficit target of 3.5 percent comfortably. Jaitley has said that he is confident of meeting the direct and indirect tax collection of Rs 8.47 trillion and Rs 7.79 trillion respectively. Additionally, he is anticipating a substantial inflow from the Income Disclosure Scheme, 2016, and the 50 percent tax that will be levied on cash deposits made post November 8. There have also been significant savings in the subsidy bill due to direct benefit transfers. All this will make up for the shortfall that divestment and spectrum sale will cause.

However, high public investment has not triggered an investment cycle in the last couple of years and may not do so this time too. “Public investment makes up for only 25 percent of the overall investment; with private investment accounting for the rest. You cannot see a recovery unless private investment kicks in,” says Bhandari.  Demonetisation may lead to lower taxes and an increase in income tax exemption limits

Demonetisation may lead to lower taxes and an increase in income tax exemption limits

Image: Sivaram V /Reuters

Private investment

The gross fixed capital formation, a measure of the investment taking place in the economy, at 28.3 percent, is at its lowest in a decade. Also, it has contracted for the third consecutive quarter. “There is too much of excess capacity in the economy and that has created an output gap. Private sector would start to invest only if this gap closes,” says Bhandari. According to her research, prior to demonetisation, assuming a GDP growth of 7-7.5 percent, she expected this gap to close in mid-2017 and private sector investments to kick in by end-2017. “Demonetisation has pushed the closure of the output gap by at least two quarters to end-2017. The private investment cycle will now resume by mid-2018,” she adds.

Another major reason for poor private investment has been the reticence among the banks, weighed down by non-performing assets (NPAs), to lend. That situation has not improved as per the Financial Stability Report of the RBI released end-December. Gross NPAs of commercial banks rose to 9.1 percent in September 2016, up from 7.8 percent in March 2016. What is worse is that application of stress tests portended a rising NPA scenario. Gross NPAs are expected to go up to 9.8 percent by March 2017 and 10.1 percent by March 2018. Public sector banks were expectedly worse off. Their NPAs, when subjected to stress tests, were seen rising to 12.5 percent in March 2017 and 12.9 percent in March 2018 from 11.8 percent in September 2016.

“The banking stability indicator shows that the risks to the banking sector remained elevated due to continuous deterioration in asset quality, low profitability and liquidity,” the report said. What it said next was more worrying. “Given the higher levels of impairment, SCBs [scheduled commercial banks] may remain risk averse in the future as they clean up their balance sheets and their capital position may remain insufficient to support higher credit growth.”

Availability of funds apart, lower interest rates (assuming a pick-up in consumption) could motivate the private sector to revive their investment cycle. Here too, Jaitley will face some roadblocks. The RBI is unlikely to cut interest rates sharply. “Inflation could come under pressure with oil prices and prices of various commodities beginning to rise,” says PwC’s Banerjee. “When it comes to wholesale prices, we have hit a low base and we are now seeing an uptick.” The RBI in its December credit policy meeting refrained from cutting rates citing sticky inflation. The Monetary Policy Committee unanimously decided to maintain status quo. “There is a limited room for a rate cut. At best, one rate cut of 25 basis points in February,” says Ranade.

All that Jaitley can hope for is that consumption picks up fast enough for the capacity overhang to evaporate and private sector to start investing. Now, if there is one area that he can do something to improve capacity utilisation, it is exports.

Exports

Indian exports have been falling for the last three years. In 2015-16, they declined by as much as 15.9 percent. In the first half of 2016-17, the slowdown has been moderated but exports still contracted by 1.74 percent. A global slowdown and an adverse currency movement are typically attributed as the reasons for this poor show.

But, Bhandari says, “To blame poor exports on global factors and currency fluctuation is being lazy. If that is the case, why have other emerging markets outperformed India? There are sector-specific issues that are hurting exports.” Textile exports are affected due to cotton availability and a policy that supports natural fibre over man-made fibres at a time when the global demand is shifting to the latter. Agricultural exports are affected by lack of irrigation infrastructure. The list goes on. “The government does not think in this manner. Export sops have only a limited effect,” she says.

The budget is also expected to lay down the GST roadmap. The April 1, 2017, deadline has been all but given up. Unresolved issues such as jurisdiction are delaying the process. “It is expected that the initial few months will see a lot of issues before GST settles down,” says MS Mani, senior director, Deloitte, who expects the roll-out by September. An April 2018 rollout will make the government uncomfortable as it may not want to head into the 2019 elections with GST implementation issues fresh in the minds of the people.

Prime Minister Narendra Modi had sought time till 2019 to face the people with his report card. For that to look good, the economy should be buoyant. It should be creating jobs, delivering inclusive growth and attracting investments. Budget 2017 is an opportunity he and Jaitley should not miss.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)