Double-digit Growth Dangerous for China

CEIBS Economics Professor Wang Jianmao Shares his Outlook for the Chinese Economy in 2010, and Beyond

To help CEIBS Alumni assess their business strategy for this year, the school’s alumni magazine TheLINK interviews a top economist.

TheLINK: What do you expect for China’s economic development in the short term?

Professor Wang Jianmao: One of the points I have been emphasizing recently is that even without the global financial crisis, China’s growth rate would have had to come down in 2008, 2009 and the near future. For the 31 years of 1979 to 2009, China’s compound annual GDP growth rate was 9.9%. The growth rate of 2007 was recently revised to 14.4%. These levels are simply too high and had to come down.

What will happen in 2010? If we look at exports, of course they dropped in 2009, by -16%. This year, they will rebound, but only by single digits according to my prediction. In China, exports still accounted for 24.5% of GDP in 2009, which was much lower than the peak of 35.7% in 2006 but still too high compared with other large economies. In the U.S., exports are around 10% of GDP. I expect China’s ratio to return to its pre-WTO level of about 20%, which will be healthier.

Ideally, China will have moderate GDP growth of 7-8% for the next three years. We need three years for adjustment and reform. That will lead to a soft landing of the economy and a U-shaped recovery. If the economy grows by double digits this year, no one will want to adjust or reform anything – why change? Double-digit growth for a few more years will trigger a really painful W-shaped adjustment process. If the government becomes reckless and allows the economy to overheat again, there would be another bigger crisis. Don’t forget: Success can be the mother of failure.

TheLINK: How can China shift from exports to domestic consumption?

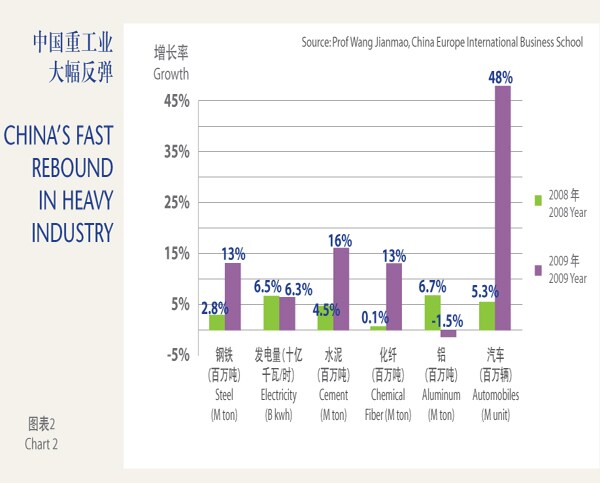

Prof Wang Jianmao: To make up for the loss in exports, China has to shift toward the domestic market. If you look at the country’s heavy industries, you can see why China must rely on the domestic market. In 2009, for nearly all major heavy industry sectors except aluminium, the growth rate already came back to double digits (see chart). And automobiles rose by 48% in unit sales last year. My point is that the scale of production in China is already too huge for the external market to absorb. Look at steel production. Not only is China the #1 steelmaker in the world, it is bigger than the combined total of the U.S., the EU and Japan. Not may people realize that. That’s why we must rely on the domestic market – the Chinese economy is already too big to rely on exports. We are much bigger than Japan!

[Reprinted with permission from The China Europe International Business School.]