JP Morgan's New Fund for Investing in Europe

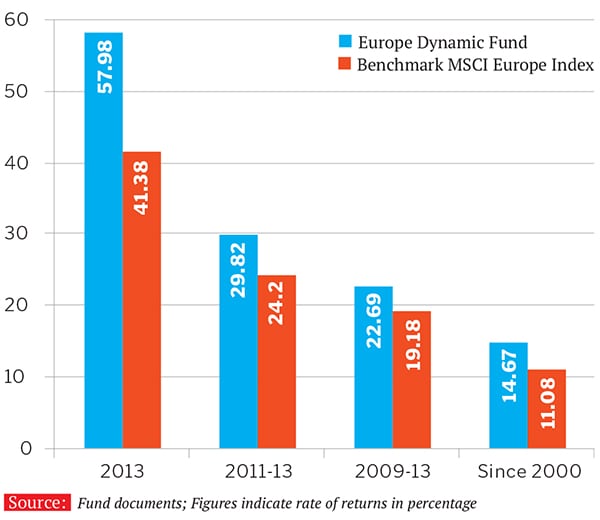

JP Morgan Asset Management (JMAM) has launched the JP Morgan Europe Dynamic Equity Offshore Fund, which reopens for subscription from February 10. The fund will give Indians the opportunity to invest in European companies. The fund has a size of $2.4 billion with almost 50 percent of its assets invested in the UK and France.

Fund managers feel Europe is in recovery mode and is at the same level where the US was in 2011.

Indian investors who invested in the US markets by the end of 2012 were able to make huge returns—between 40 and 70 percent—backed by a fall in the Indian rupee.

“Europe is down and at a point where most investors have ignored this market. We feel it is a good idea for Indian investors to diversify into this market as it has huge potential for the future,” says Anis Lahlou, ED, portfolio manager, Dynamic Team, JMAM.

With 2014 being an election year in India, the possibilities of a volatile rupee make a case for investing in an overseas market.

But Europe might still be early. The fund will work well for those who are ready to take higher risks. For others, investing into US funds is a better idea.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)