The Myntra-Jabong clout in India's online fashion market

The Jabong buyout can bring Flipkart-owned Myntra big gains in the growing online fashion market

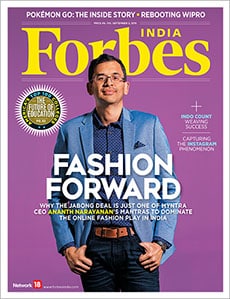

When online fashion retail brand Myntra acquired competitor Jabong in July, the deal marked another major milestone in the storied world of Indian ecommerce. It’s an all-star cast yet again: Flipkart owns Myntra, and with this acquisition, India’s homegrown etail giant has once more made its growth intentions clear. Myntra aside, Jabong, which of late is battling its own set of challenges, has been an attractive choice for investors and online shoppers alike and the $70 million deal ensures that the Flipkart-Myntra-Jabong combine will now dominate the growing online fashion market (online fashion and lifestyle is set to be a $40 billion market in India by 2020). Though some observers say there’s a degree of overlap between the two entities in terms of customers, for Myntra, the deal appears to make eminent sense. Taken together, Flipkart, Myntra and Jabong have nearly two-thirds of the online branded clothing market and the Myntra-Jabong combine has 15 million active users a month. Besides, Jabong was Myntra’s closest rival anyway, and the deal ensures Myntra won’t have to worry about competition for a while.

We also bring you a detailed look at how Wipro’s new CEO Abidali Neemuchwala is seeking to re-engineer the company, bringing in a startup culture to regain lost ground. Neemuchwala’s strategy is critical, given that TCS and Cognizant now dominate the pecking order in the Indian IT space, and Infosys is also undergoing a significant makeover.

This issue also contains the definitive Forbes list of America’s Top 100 Colleges. The ranking, topped by Stanford University, is based on some key metrics—student debt, graduation rates, post-grad salaries etc, as well as financial health and a Grateful Grads Index. Read on to know more.

Best,

Sourav Majumdar

Editor, Forbes India

Email:sourav.majumdar@network18publishing.com

Twitter id:@TheSouravM

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)