Turbulence at Tata

The Ratan Tata-Cyrus Mistry battle is about much more than the chairmanship of the business house

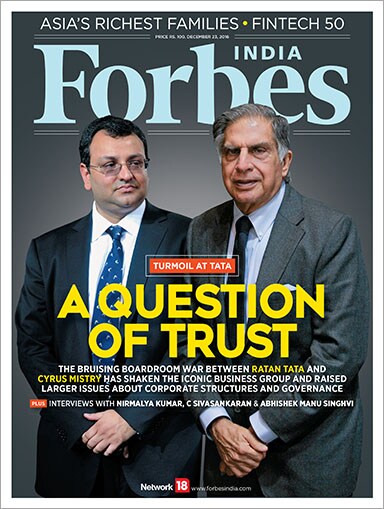

When Cyrus Pallonji Mistry was named chairman of Tata Sons, the holding company of the House of Tata, in 2011, and a full year given to him to understand the intricacies of the job before he took charge, few would have imagined that four years into his tenure, he would be locked in a bitter—and very public—face off with none other than his predecessor Ratan Tata. But the developments at Bombay House, the sombre headquarters of the $103-billion conglomerate which is in many ways a proxy for India Inc, since October 24, the day Mistry was unceremoniously replaced as Tata Sons chairman and Ratan Tata called back to take over as interim chief, has sent shock waves through Corporate India.

That something as important as the chairmanship of the 148-year-old group could become the focus of a public war of words was quite unimaginable for most who know the group as a symbol of good corporate governance, philanthropy and excellence. But as events unfolded, it was clear that this was turning out to be a bruising battle between the Tata Sons and Cyrus Mistry camps, with neither side willing to back down.

That something as important as the chairmanship of the 148-year-old group could become the focus of a public war of words was quite unimaginable for most who know the group as a symbol of good corporate governance, philanthropy and excellence. But as events unfolded, it was clear that this was turning out to be a bruising battle between the Tata Sons and Cyrus Mistry camps, with neither side willing to back down. As we delve deep into one of the biggest corporate battles in recent memory, it is clear that there’s much more at stake here than the chairmanship of the Tata group. The Tata-Mistry battle has at its core a number of vital issues for corporate India—among them shareholder democracy, corporate governance, the role of independent directors and the extent of power which the promoter group should wield. What makes this face-off even more riveting is that the Tata group is not a typical family-owned business house. Tata Sons is controlled by a clutch of philanthropic trusts, together known as the Tata Trusts with Ratan Tata as chairman, which have also become important players in this ongoing drama. Our cover story goes into the various facets of this discord and seeks to examine its implications for the group and for the Indian corporate sector.

The result of detailed reporting and our conversations with several experts: A telling account of two divergent views on how a group of companies ought to be run and of a serious deficit of trust. As this issue is being put together, the battle continues to rage on (despite some murmurs of a possible rapprochement) and the two sides are also bracing for extraordinary general meetings of shareholders where the next phase of the tussle will be played out.

Elsewhere in this issue, we bring you the Forbes list of Asia’s 50 Richest Families, where as many as 17 of the 50 families are from India. Many of these are celebrated names in the world of Indian enterprise and their presence is evidence of the growing influence of Indian business in the region. We also bring you the second annual Forbes Fintech 50 list, exciting startups which are disrupting the traditional financial services industry like never before. Of course, no talk of financial services can be complete these days without a debate on demonetisation, as India grapples with this momentous change and its after-effects.

Best,

Sourav Majumdar

Editor, Forbes India

Email:sourav.majumdar@network18publishing.com

Twitter id:@TheSouravM

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)