As the pandemic forced layoffs, CEOs gave up little

Chief executives of companies such as Walt Disney and Marriott International decided to show solidarity by foregoing some of their pay, but a study found that their reductions were equivalent to 10% or less, even as the companies saw large layoffs

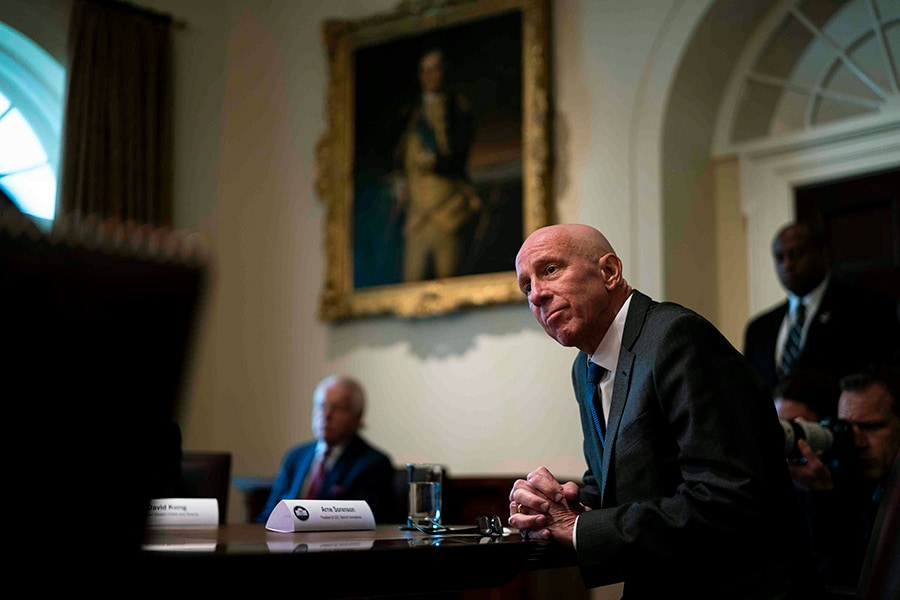

Arne Sorenson, chief executive of Marriott International, during a meeting with President Donald Trump and other travel industry executives at the White House in Washington on March 17, 2020. The pandemic prompted companies to furlough or lay off thousands of employees and some chief executives decided to show solidarity by forgoing some of their pay, but it turns out that their sacrifice was minimal.

Arne Sorenson, chief executive of Marriott International, during a meeting with President Donald Trump and other travel industry executives at the White House in Washington on March 17, 2020. The pandemic prompted companies to furlough or lay off thousands of employees and some chief executives decided to show solidarity by forgoing some of their pay, but it turns out that their sacrifice was minimal.

Image: Doug Mills/The New York Times

When the pandemic prompted companies to furlough or lay off thousands of employees, some chief executives decided to show solidarity by forgoing some of their pay.

But it turns out that their sacrifice was minimal.

A survey of some 3,000 public companies shows that the cuts — which, so far, have come in the form of salary reductions — were tiny compared with their total pay last year. Total pay includes things like bonuses and stock awards that typically make up the bulk of what corporate bosses take home.

Only a small percentage of the companies cut salaries for their senior executives at all, which is surprising given that the pandemic has crushed profits and sales for many companies, forcing large layoffs. But even among businesses that did cut the boss’s pay, two-thirds of the chief executives took reductions that were equivalent to only 10% or less of their 2019 compensation, according to an analysis by CGLytics, a compensation analysis firm.

Companies in this group include The Walt Disney Co., Delta Air Lines, United Airlines and Marriott International. All of those businesses have laid off or furloughed employees or pressed workers to take pay cuts.

©2019 New York Times News Service