Bright Lights, Big Profits: LED technology taking the world by storm

Street lights everywhere are going digital, cleaning up the night skies, saving billions in wasted energy—and offering major windfalls for those who embrace the gold rush

Ed Ebrahimian loves to stare out of the plane window on night flights home to Los Angeles. Next time you fly into LA late, take a good look and see why. Five years ago, a bright orange blanket of light used to saturate the city and stain the air above. Today, it’s a metropolis aglow with tens of thousands of cool silvery pinpoint lights. The grid is clearer. The skies are blacker.

“The lights look like candles now and they aren’t glaring at all,” Ebrahimian gushes. “The sky glow is the most amazing thing I’ve seen in my life.”

Ebrahimian has good reason to be enthused. As director of LA’s Bureau of Street Lighting, he’s overseeing one of the largest relighting projects in the world, spending $57 million to retrofit the city’s 215,000 lights, which come in more than 400 styles. The money has gotten him only to lamp post number 155,000 after five years. Replacing the remaining 60,000 will cost $50 million more.

Los Angeles is a dramatic front in an important and overlooked battle facing the rapidly urbanising world: The struggle between light and dark. Cities and businesses want more light everywhere for commercial and safety reasons, but our decades-long saturation bombing of the darkness is blowing holes in electricity budgets, confusing and killing wildlife, and completely erasing our view of the stars, the inspiration for millennia of scientists, poets and explorers. “What was once a most common human experience has become most rare,” writes Paul Bogard, author of The End of Night, a book that assails the world’s unchecked light pollution.

The technology at the centre of the shift is the LED, or light-emitting diode. LEDs are a break from the history of illumination. As solid-state semiconductors, they’re more akin to the processor in your smartphone than the lamp overhead. Los Angeles, New York, Chicago, Shanghai, Copenhagen and scores of other cities around the world are deploying LEDs to solve most, if not all, of the problems created by inefficient traditional lamps.

LEDs cost three to four times more than traditional high-pressure street lamps, but they last three to four times longer and produce two to three times more light per watt, delivering anywhere from 30-70 percent in annual electricity savings. Because they are digital chips, they will only get cheaper as the efficiencies of Moore’s Law roll on. And as electronic components, they’re also far more programmable and connect more efficiently with radio and sensor chips to create citywide wireless networks to monitor crime, power outages and water main breaks and coordinate disaster relief.

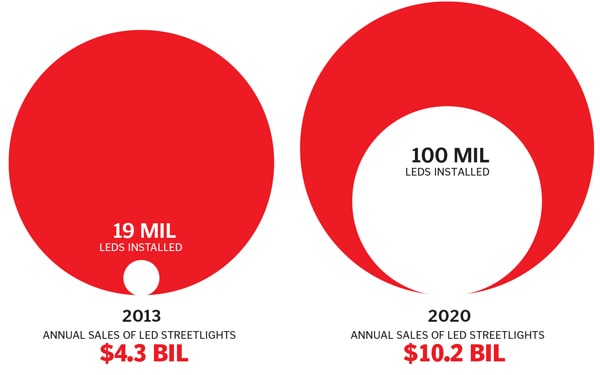

The business opportunity in the great LED retrofit is enormous. Of the 140 million street lights installed worldwide last year, only 19 million were LEDs, according to IHS Tech- nology. By 2020, LEDs are expected to account for 100 million of the installed base of 155 million street lights. Annual sales of LED street lights will jump from $4.3 billion to $10.2 billion in the same time period. Boston, Seattle and New York City are all undertaking big retrofits. New York’s $76 million project will be the largest in the US: Replacing 250,000 lights by 2017. City officials expect to reap $14 million in energy and maintenance spending per year.

The biggest players in street lighting—Osram, Royal Philips, Acuity Brands and Panasonic—are racing to implement new business models. Manufacturers used to count on selling replacement bulbs and components every four years, but LED lights come with a 10-year warranty, though many will last 15 to 20 years. Several manufacturers are focusing on selling software to control and monitor LED networks from a central command centre or smartphones. Philips launched its CityTouch management software in 2011 to monitor the energy consumption of each light, spot failed lights and dim or brighten each. The company now collects an undisclosed amount of annual service fees from 260 lighting-project owners in 31 countries. Manufacturers and utilities are introducing financing schemes in which they assume the upfront installation costs and take a long-term share of the energy savings from the city.

“The light industry is changing, so we are looking at what our next step is,” says Martin Oerder, head of Global Outdoor Systems at Philips Lighting in the Netherlands.

The social and economic gains from illuminating the night have been incalculable. Electric street lights first began appearing in European capitals in the mid-1800s. Parisians and Londoners marvelled at the light, even if it was so blinding that the lights had to be installed in high towers. America pierced the darkness in April 1879, when the first electric lamp went up in Cleveland. Ever since, it’s been an all-out race to illuminate every road, gas station, warehouse and corner of the country.

Today in the US, there are some 60 million of those cobrahead street lamps blazing pink-peach all night long, heedless of inactivity below and absurdly lighting the sky above. Forty percent of the average city’s electric bill goes to street lighting, and close to half of that is wasted. Excessive outdoor lighting, including exterior fixtures on office and industrial buildings, wastes about $3.5 billion in energy per year, according to the International Dark-Sky Association, a not-for-profit body that works to reduce light pollution.

The number of truly dark places on earth is shrinking rapidly. Upward light emissions have been growing at least six percent per year across North America, according to satellite images and computer modelling done by researchers at the National Park Service and research institutions in Italy and the US. Two-thirds of the world’s population, including 99 percent of those in the continental US and Europe, no longer experience starry nights. LEDs are not going to rid the world of wasted energy and light. Many of the current LED models are brighter than old-style sodium or mercury lamps, and many emit at the blue wavelength that does the most damage to melatonin production, which according to the American Medical Association, has been linked in limited epidemio- logical studies to an increase in cancer, especially breast cancer.

The key will be to use less light overall by connecting the new LED street lights to motion sensors to eliminate unneeded glare. Some cities such as Phoenix and Flagstaff have ordinances to curb excess outdoor illumination, but most places are not (like Arizona) home to several important space observatories, which need dark skies. Ebrahimian says dimming the lights would be a big headache should people start blaming dark streets for their fender benders.

“One thing that’s been true throughout history is that as lighting tech gets cheaper, we use more of it,” says Scott Kardel, acting executive director of the International Dark-Sky Association. “Most cities don’t think about how we use lights at night.”

Los Angeles began looking at LEDs 10 years ago, as a way to cut its electric bill. LA has the second-most street lights in the US after New York. Back then, LED technology was good enough for traffic signals, but the early models of street lamps burnt out quickly or emitted an overly bright blue-white or uneven light that was too blinding or created shadows. It wasn’t until 2008 that Ebrahimian felt the technology was ready enough to propose the re-lighting plan. Even at $400 per fixture, more than twice what they cost now, LEDs made economic sense because they would cut the city’s $16 million annual electricity bill by 40 percent. Two other things were working in his favour: then Mayor Antonio Villaraigosa’s desire to reduce the city’s carbon footprint and the fact that LA happens to run its own utility, which financed the first phase of the programme with a $40 million loan and $17 million in electricity rebates.

The first phase has been a huge success. Energy use from street lights fell from 190 million kilowatt-hours to 110 million kilowatt-hours. With improved efficiency, the projected savings have since jumped to 63 percent per year. The city expects to save $8.8 million on its electric bill this year and another $3 million or so in maintenance costs. A software system now measures each light’s energy use and checks to see if it’s working properly. (Conventional street lights require manual inspection.) All these savings will stay with the city once it begins paying off the loan next year.

LA can dim or brighten any individual pole, controlling the lighting network like a digital army, something that isn’t technically feasible for old-style lamps. The city likes the idea of using flashing light paths to guide its police and firefighters toward and away from emergencies, and it may put that practice in place later. The city of Chattanooga, Tennessee, also ran a pilot project in 2011 that gave the police the ability to dim and blast its LED street lights from their patrol cars. The city used the technology to reduce crime at a park by selectively shining bright lights to disperse people. Even without making the light dance, LA has seen a reduction in crime. Offences such as burglaries and vandalism have fallen by 10 percent between 7 pm and 7 am since 2008. “I’m amazed that this new technology isn’t deployed more throughout the country,” Ebrahimian says.

For all of LEDs’ energy savings and anti-light-pollution potential, their real promise may be in hasten- ing the arrival of the smart grid. Forward-thinking cities are using retrofit programmes to turn lamp housings into intelligent hubs with microprocessors, cameras, sensors and wireless radios. Street lights can feed the system with information about traffic, weather, air quality, sudden noises and unexpected crowds.

Denmark, a leader in municipal LED lighting with 25-30 percent of its 1 million lights converted, is about to switch on a high-tech test bed in Albertslund, Copenhagen. The first phase of the Danish Outdoor Lighting Lab (DOLL) has a three-year, $10 million budget. A control room with a huge screen will show the amount and colour of light each light emits and its status in carrying out functions such as dimming or lighting up with the approach of pedestrians and cars. Data from sensors installed in the sewer or water pipes will be beamed to light poles and then on to the city’s public works department. “Companies gain a unique showroom by having an opportunity to showcase their products,” says Flemming Madsen, who heads the DOLL initiative. “We can do the matchmaking with researchers, cities and technology manufacturers.”

The money for the great LED rollout is coming from taxpayers, but the payback is promising enough to attract private funders too. Philips won a 10-year deal last year with the Washington (DC) Metropolitan Area Transit Authority to convert 13,000 light fixtures at 25 parking garages. The agency expects to pay Philips with the $2 million savings in electricity and maintenance. Pacific Gas & Electric in California offers to manage LED lighting conversions for cities, from choosing suppliers to securing government incentives to installing the lights, and promises to do the job cheaper than the city’s work crews. Oakland and Walnut Creek, two cities near San Francisco, are customers.

Another new concept for lining up funding involves renting out the real estate on light poles to mobile or cable service providers. Philips and Ericsson launched a programme earlier this year, which offers cities a lamp post with a combination of low-power LEDs from Philips and a wireless base station from Ericsson. The venture is yet to announce any customers.

Ebrahimian eagerly awaits the final rollout of LA’s LED programme. “We are in the middle of a lighting revolution in the world. Lamps have been around since Edison, and in the past few years, LED has changed the whole picture. The rules of the game have changed.”

Four Ways To Play The LED Boom

Investors looking to get rich off the growth in LED cities don’t have a lot of ideal options (and may need an offshore broker to buy relevant stocks). Global conglomerates such as Philips, GE and Samsung are conservative, indirect players, but some of the pure players have had bumpy rides of late because of rapidly falling component prices and competition from China, where most LED chips are made. Some ideas:

Osram does it all, from chips to fixtures to services. The 100-year-old German firm is independent once again, having spun off last year from Siemens. Its LED business was up close to 70 percent in the third quarter, offset by a 14 percent sales drop in the classic-lamps business.

Latest-12-month price/earnings ratio: 22

Price-to-book value: 1.5

Operating margin: 4.6 percent

Philips, which pioneered conventional street lighting technology, is now a leader in the LED transformation. The company is selling hardware, software and services to help cities monitor and control the lights. LED sales grew by 43 percent in the second quarter and are now 36 percent of its total lighting revenue. It is looking for a buyer for its Lumileds components and automotive LED businesses to focus on other

commercial markets.

P/E: 19.5

Price/book: 2

Operating margin: 8.6 percent

Cree, an LED pioneer and the biggest US manufacturer, has great technology and solid growth prospects. Revenue was up 19 percent in the latest fiscal year, and profit was up 43 percent. But shares are down 29 percent year-to-date due to increased competition from China. Some analysts say it’s oversold.

P/E: 44

Price/book: 1.8

Operating margin: 8.5 percent

Acuity Brands sells both conventional and LED street lighting. It has been investing in LED lighting-control technology both to keep pace with competitors and to anticipate moves by cities to replace their conventional lamps with LEDs. Sales for the nine months ending May 31 rose by 14 percent, with net income up by 47 percent. The company’s LED light sales doubled in the third quarter from a year ago and now represent 33 percent of sales.

P/E: 32

Price/book: 4.7

Operating margin: 12 percent

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)