Cisco's India Solution

The tech giant had to adapt its India strategy. En route it may have found its global flightplan

Three years ago, John T. Chambers, chairman and chief executive of Cisco, was on one of his annual trips to India. He happened to meet K.V. Kamath who was nearing the end of his tenure as CEO and managing director of ICICI Bank. Chambers wanted to understand the biggest business challenges that banks were facing. Kamath touched upon the theme of financial inclusion and said banks needed solutions to serve the 600 million plus people who don’t have access to banks.

Chambers and Cisco India president Naresh Wadhwa took that advice very seriously. Kamath did not realise it, but his observation helped shape Cisco India’s strategy and later dovetail into Cisco’s global strategy.

Globally, Cisco has been talking about being involved in building smart communities or smart cities for some time. In India that approach would have worked wonders had many new cities come up. That hasn’t happened. Much of India’s urbanisation is taking place in existing cities. (Lavasa, near Pune in Maharashtra, was an example of a new city but its development has run into problems.)

When Cisco came to India 15 years ago, it was another multinational company viewing the country from its US-anchored leadership prism. By 2004-05, recalls Wadhwa, the company realised it needed to create the market it wished to serve. Engagement with large enterprises and governments began in earnest, followed by strengthening of a partner network that today is 1,200-strong. It also switched from geographical expansion to vertical focus — every time it went to a new location, it hunkered down to fill gaps in the local market.

“It’s all about timing; I think by now we know the art,” says Wadhwa. Like the “significant deal” Cisco is closing with one of the largest cable operators in India for supplying set top boxes that convert analog signals to digital. The company spotted this need while engaging with local customers in Kerala and spent six months modifying the box developed by one of its Chinese acquisitions.

Tweaking India

In the developed markets, Cisco is driving convergence of Internet, TV and video-conferencing in homes and in offices. In India, it believes in offering tailor-made solutions to the customer. In 2009, it signed an agreement with Ashok Leyland to build the so-called ‘vehicle-to-infrastructure’ communication. Ashok Leyland buses can be modified to deliver mobile services for emergency medical response, transport management, security and surveillance in defence and government sectors.

Cisco built on this idea to start a Bank-on-Wheels for banking in remote rural areas. The Bank-on-Wheels simulates the functionality of an entire bank branch in a bus.

“We have the prototype, the proof-of-concept, as well as the business case,” says Anil Bhasin, senior vice president — Cisco India & SAARC (BFSI and Enterprise), who is talking to a few banks in India to run pilot projects. He wouldn’t disclose their names. The mobile bank can do all that a branch does, even provide expert advice, enabled by Cisco’s compressed video technology that requires less bandwidth.

Bhasin thinks the cost-effectiveness of this solution will appeal to the banks which have been driven by RBI directives to rapidly reach out to the villages, as only 50,000 of India’s 600,000 villages have organised bank branches. At Rs. 25 lakh to Rs. 30 lakh, this bus, equipped with all the three layers of Cisco technologies that allow voice, video and data transmission, could serve 10-12 villages. “That works out to about Rs. 2.5 lakh per village and if the amortisation [rate of recovery] is poor, a bank is free to move the van to another village,” says Bhasin.

Infographic: Hemal Sheth

Rajiv Kaul, chief executive of CMS Infosystems, which also manages infrastructure for banks, cautions that operational expense may not come down. “Moreover, moving cash in a van is a risky proposition. How will the banks manage security?”

Bhasin says such scenarios will come up as “something like this hasn’t been tried before anywhere; we’ll learn along the way.” In reality, Cisco may have to increase its service offering. Bank-on-Wheels is a novel concept for villagers, no doubt, says V. Vaidyanathan, vice chairman and managing director, Future Capital Holdings (he was formerly with the ICICI Group). “But Cisco could explore other services to add on to the same connectivity pipe, like healthcare or entertainment, that will add to viability and also cause stickiness of customer behaviour.”

Need for Speed

But Cisco’s system highlights the solution-oriented approach it is taking in India. It needs to do this because while in the US market Cisco earns more than a fifth of its revenues from services, in other markets it makes just 15-16 percent as service revenues. A company like IBM has shown that service revenues are long-lasting and can create a ‘trusted advisor’ perception; while someone like a Cisco may be seen as just a box seller.

And IBM is a path breaker here. Its usage of India as an outsourcing base and healthy service revenues have pleased the markets. Over the last 12 months IBM has outperformed the Dow Jones Industrial Average and the S&P 500 Index by a wide margin. Cisco has underperformed both the benchmark indices.

It isn’t as if Cisco hasn’t been making money in India. In 2007 when the Globalisation Centre East (GCE) was set up in Bangalore, Cisco had a three-year plan to build teams and innovate, says Chief Globalisation Officer Wim Elfrink. While the parent company is growing at around 11-12 percent a year, Cisco India, with Rs. 5,400 crore revenues in 2010, is clocking 50-60 percent growth. Two key areas, set top boxes and government businesses, may be on decline in the US, but not in India. In November, the weak guidance for the next quarter coming out of its Silicon Valley headquarters stunned Wall Street, but India holds steady, says Wadhwa.

“India presents this unique opportunity to Cisco and therefore we focus on developing newer solutions which can be exported back to the developed world,” says Wadhwa.

Even globally, Cisco’s conscious effort is to move from an “enterprise-relevant company to a broad-appeal company”. This is the story of most hardware companies as they realise customers today look for complete solutions and a deeper level of consulting rather than buying products and technologies piecemeal.

This is one chance for Cisco to completely change brand perception in India and be known as a solutions company, says Navi Radjou, executive director at Centre for India & Global Business, Judge School of Business at Cambridge University, UK. “This might become the beachhead in its global brand transformation.” However, this may not come easy as Cisco has no track record in this business, he cautions. But Cisco can learn from the playbook of IBM, GE or GM. GE’s latest portable ECG machine, MAC 400, which now sells globally, was designed and manufactured in India.

The notable change here, accelerated to some extent by GCE, is that Cisco is no longer just about technology architecture, it is about solution architecture. This is causing many customers to double up as partners. Neurosynaptics and GE, Apollo Hospitals and Everon Education were first customers and are partners now, says Susheela Venkataraman, managing director, Internet Business Solutions Group, Cisco India.

The company will need high-end consulting services in this transformation, reckons Radjou, adding mischievously that the company should poach top professionals in traditional consultancies. “I am also eager to see how IBM or Accenture will react to Cisco’s move,” he adds.

But a formidable challenge lies in developing business models so that with these solutions people actually make money. “If you use technology to run a small executive management training programme, you can make money but for other small businesses, in agriculture or healthcare, it has to be scalable,” says Venkataraman, who is grappling with this issue as she partners with small enterprises in India.

Still, the solutions surge that Cisco is driving out of India seems to challenge the popular idea propounded by Vijay Govindarajan of Tuck School of Business that innovation has to come from outside the performance engine of a company. Says Radjou, “In the US, customers are not expecting innovation so companies are not innovating. In India, customers are asking for it.” Bhasin nods in agreement: “Earlier we were plumbers, residing on the shop floor; now we are at the top floor, driving business cases because our customers are asking for it.”

Next Steps

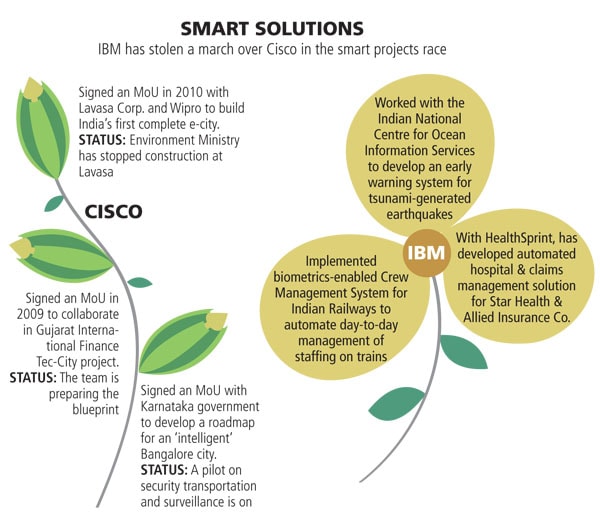

In the last two years, Cisco has signed three MoUs in India for smart cities or civic bodies, though analysts remain sceptical on the execution front. Jennifer Belissent, a senior analyst with Forrester Research, says IBM is ahead of Cisco in this market and has a larger market share. Wadhwa’s defense is that large government projects in India take long to execute. The Lavasa e-city project is stalled as the environment ministry is examining the encroachments. It is one of the 35 MoUs worldwide for Cisco but is also watched closely for its business model innovation as it has for the first time invested in MyCity Technologies to build this e-city.

For now, believes Elfrink, the sustainable communities initiative — Project Samudaya in Raichur district in Karnataka — a $10 million corporate social responsibility initiative for Cisco, provides a good reference.

Cisco believes government business is going to be a major growth driver in India. There is traction already. During the Commonwealth Games, a huge amount of uncompressed video (400 Gbps) was beamed on Cisco’s network. In September, Air Force Network (AFNET) went live, demonstrating to the nation an automated air command control system for air defence operations controlled by ground-based and airborne sensors.

Forrester’s Belissent is confident of Cisco’s ability to replicate business models. What it has done with the textile and clothing sector in Turkey — adopting a virtual clustering and collaboration strategy to bring geographically dispersed small and medium partners closer — it could do for Tirupur in Tamil Nadu, a textile cluster that accounts for 90 percent of India’s cotton knitwear exports. Venkataraman says Cisco is evaluating Tirupur.

But Cisco will have to unify all these efforts quickly into its earnings very much the way GE or IBM have done. A lot of its stakeholders will be watching how it manages to use emerging markets to power its growth and profitability.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)