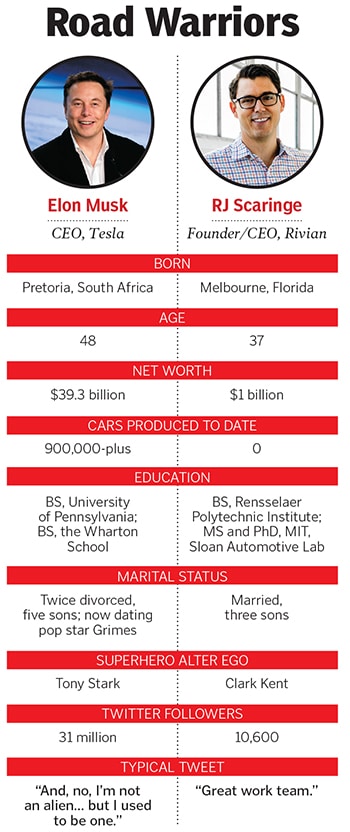

Elon's new nemesis

Check your rearview mirror, Tesla. Rivian has a $3 billion war chest from Amazon, Ford and the Saudis, and is revving up production on its electric SUVs and trucks. Now all the secretive automaker has to do is start building cars and avoid the roadblocks that almost caused Tesla to crash. A rare interview with its 37-year-old founder, RJ Scaringe

RJ Scaringe, Rivian’s CEO, introduces his company’s R1T all-electric pickup and all-electric R1S SUV at the Los Angeles Auto Show in California

RJ Scaringe, Rivian’s CEO, introduces his company’s R1T all-electric pickup and all-electric R1S SUV at the Los Angeles Auto Show in CaliforniaImage: Mike Blake / Reuters

It’s 8 o’clock on a January morning, and the temperature in Normal, Illinois, just a few hours south of Chicago, is well below freezing. The small pond in front of Rivian Automotive’s assembly plant has turned to ice, the grass is covered with frost and there is snow in the forecast. It’s not much warmer inside the plant. Nearly the entire 2.6 million-square-foot facility is a construction zone, undergoing a massive $750 million renovation to prepare for the end of the year, when it expects to start rolling out battery-powered trucks, vans and SUVs. So minor details like heat are not exactly a top priority.

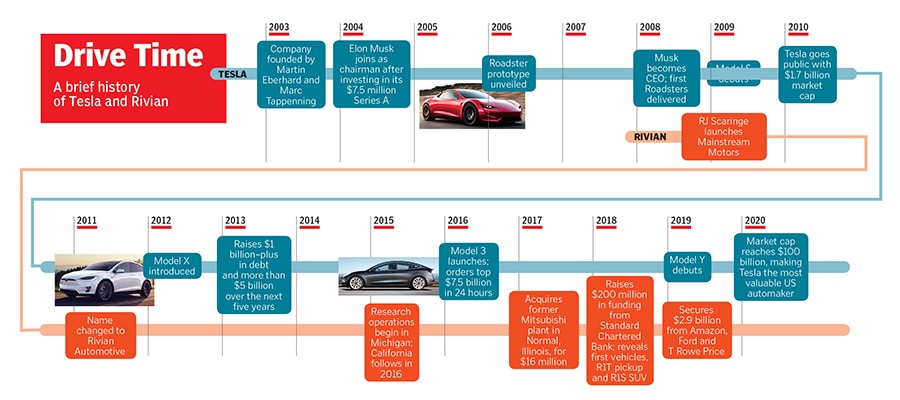

The only finished area—a second floor at the front of the building that overlooks the factory—is where the plant’s previous owner, Mitsubishi, had its executive offices. Back then, access to this floor was restricted to the suits. Now it’s a giant open workspace, accessible to all, with a cafeteria, polished concrete floors and lots of natural light, just like the floor plan at Rivian’s research and design centre in Plymouth, Michigan. The concept for both offices was to merge industrial and outdoor aesthetics that mirror the company’s brand—an automaker that builds sustainable vehicles usable in off-road settings. Rivian, which was founded in 2009 but is finally releasing its first vehicle this year, also has operations in San Jose and Irvine, California, where it develops its technology and batteries.

“When we’re done cleaning, painting and installing the equipment,” says Rivian’s 37-year-old founder and CEO, Robert Joseph Scaringe (better known as just RJ), “we will eventually be able to produce 250,000 vehicles per year by mid-decade.”

Starting an independent car company is not easy. Among the roadkill in automotive history are Preston Tucker, who challenged Detroit in the late 1940s, and John DeLorean, who failed to take the Motor City back to the future in the early 1980s. Producing a line of mass-market vehicles in the 21st century is even more difficult than it was for Tucker and DeLorean, and considerably more perilous in the EV (electric vehicles) category.

With the emergence of Rivian, the electric vehicle market is no longer a one horseless carriage race. Indeed, the 2020s are gearing up to be the decade of the EV. According to research at Oppenheimer, EVs and plug-in electric hybrids accounted for a mere 2.2 percent of all US vehicles sold in the last quarter of 2019. And only a third of those were purely electric. But that is changing rapidly. While only 5.1 million electric cars were sold worldwide in 2018, that figure is expected to surge throughout the decade—21 million units are projected to be sold in 2020, 98 million in 2025 and 253 million in 2030.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)

Rivian’s adventure SUV can accommodate seven people, but the company has also filed for a patent to adapt a seat for first responders

Rivian’s adventure SUV can accommodate seven people, but the company has also filed for a patent to adapt a seat for first responders