Frank Slootman, spinning success for others

Frank Slootman doesn't start companies. But no one in business history has a better track record of turning the ideas of others into jackpots. With $80 billion Snowflake, the biggest software IPO ever, he's rewritten the playbook

Frank Slootman

Frank Slootman

Image: Christie Hemm Klok for Forbes

By Labor day, it had become clear that Frank Slootman’s third initial public offering (IPO) would not be like the other two. After a slight summer lull, Covid-19 was resurgent, which meant that rather than a global tour of get-to-know-you lunches and PowerPoints in hotel meeting rooms, his roadshow for data warehousing company Snowflake was going virtual.

Slootman, 62, took over a nondescript conference room on the second floor of Snowflake’s Dublin, California, office, embarking on a series of meetings that now rank with Mark Zuckerberg’s Harvard dorm coding sessions in terms of value per hour. For seven days in mid-September, packing in everything from a series of one-on-one meetings to large presentations, the naturally gruff Slootman met over Zoom with more than 1,000 people, including fund managers and investment bankers, who were on hand to win a piece of his IPO.

Rather than the usual grilling, Slootman was toasted instead. “The issue was not ‘Do I like the company?’ The issue was ‘How many shares do I get?’” he recalls in his Dutch accent. Of the virtual IPO, he says, “I absolutely loved it.”

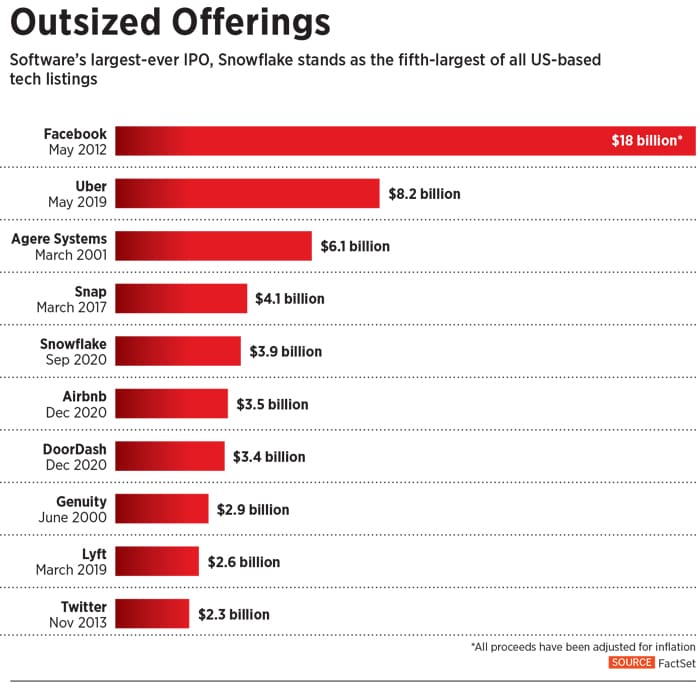

Slootman, who took over Snowflake in April 2019, had been as ruthlessly efficient with the rest of the process. Just six months in, he had lined up his anchor investors, including Dragoneer Investments and Marc Benioff’s Salesforce. Around the same time, he began meeting with research analysts who would wind up setting bullish prices for the IPO. And when Slootman and his team virtually rang the bell of the New York Stock Exchange, a process that looked as awkward as it sounds, raising some $3.4 billion in the process, Salesforce and others were there to support the floor. “These are people we knew from previous rodeos,” Slootman says with a shrug.

During his short-lived retirement, Slootman raced aboard his Pac52 Class 52-foot yacht, Invisible Hand. “The thing I liked about sailing was that if you make a mistake, it’s obvious within minutes.”

During his short-lived retirement, Slootman raced aboard his Pac52 Class 52-foot yacht, Invisible Hand. “The thing I liked about sailing was that if you make a mistake, it’s obvious within minutes.” Co-founders Benoit Dageville (left) and Thierry Cruanes (third from left) are counting on Slootman and his trusted lieutenant, CFO Michael Scarpelli (right), to steer Snowflake through the stock market’s gyrations. Says Dageville: “We have a lot of pressure to deliver on this valuation.”

Co-founders Benoit Dageville (left) and Thierry Cruanes (third from left) are counting on Slootman and his trusted lieutenant, CFO Michael Scarpelli (right), to steer Snowflake through the stock market’s gyrations. Says Dageville: “We have a lot of pressure to deliver on this valuation.”

When Slootman took ServiceNow public in 2012, he rang the NYSE bell in person. Eight years later, with Snowflake, he had to do it over Zoom. “An IPO is a blip on the radar, a mile marker during the marathon,” he says now

When Slootman took ServiceNow public in 2012, he rang the NYSE bell in person. Eight years later, with Snowflake, he had to do it over Zoom. “An IPO is a blip on the radar, a mile marker during the marathon,” he says now