How do you beat Amazon at retail?

Sell cheap. Be opportunistic. Micromanage the stores. And stay off the internet. Lessons from Ollie's, perhaps the only American company whose brick-and-mortar stores are not just surviving, but thriving

Mark Butler at the Ollie’s in Harrisburg, Pennsylvania. Corporate headquarters is directly behind the store

Mark Butler at the Ollie’s in Harrisburg, Pennsylvania. Corporate headquarters is directly behind the storeImage: Harry Fellows For Forbes

The sheriff’s deputy arrives early, assuming his position before 9 am. He stands silently, in a dark uniform beneath a bulletproof vest, and waits, sipping a small cup of thin coffee. As time rolls on, it becomes apparent he isn’t much needed here, stationed in a big, glassy store alongside a highway in Sterling, Virginia, by Washington’s Dulles International Airport.

Sometimes when an Ollie’s Bargain Outlet opens, the crowd can get large—particularly if Ollie’s arranges for a Nascar star or MLB player to visit—and law enforcement is needed to help manage the situation. By contrast, everyone on this wintery March day is well behaved, not a race-car driver or slugger in sight, leaving the deputy to contemplate the gigantic bin of plush, chicken-size Peeps (price: 99 cents), shelves of Farberware cookware sets ($39.99) and pallet of four-quart bags of Earthgro potting soil (also 99 cents).

The CEO, chairman, president and co-founder of Ollie’s is Mark Butler, a slightly built man with a big moustache and graying hair silvering over to white. When he walks in around 10, he is almost indistinguishable from his customers. Butler, 60, has attended every one of Ollie’s first 104 openings, but it’s harder to get to them these days with Ollie’s rolling out almost 40 a year. “Looks good,” he says, a group of lieutenants gathering around him. “Parking lot is very, very full.” Something is off, though. “Turn the music down a bit.” The Kinks can be heard, clearly, through the store’s public-address system. “What station do we have on?” Soon the tunes get softer and more modern. (“Something like the radio bothers the daylights out of me,” he admits.)

Moving through the store, Butler notes what’s selling. “This is hot,” he says, examining a dwindling supply of Chefman air fryers. The display of Hatchimals—Furby-like creatures in an egg, the hit toy of Christmas 2016—earns similar praise: “Hot.” And he is pleased with the weighted blankets (a super-heavy comforter meant to keep sleepers from rolling around) near the front door. “This is hot—with three Ts.” Hottt. “We can’t keep it in stock. They’ll be gone in a few hours.”

But where is—“Joy Mangano?” he asks. No, the QVC queen (and titular entrepreneur of the 2015 film Joy, starring Jennifer Lawrence) is not supposed to be at Ollie’s. The store should, however, have a full supply of Mangano-branded clothing hangers. They should be in later that week, he’s told. Butler suspects they’ll sell quite well. “The hangers—hot.”

*****

Ollie’s is possibly the only company in America whose brick-and-mortar stores are not just surviving but thriving. Butler focuses exclusively on traditional retailing, selling not a thing online. Read that again: Nothing sold online. Nonetheless, Ollie’s sales have doubled in four years. It moves more than $1 billion a year of low-priced goods from its large (30,000 square feet or so), no-frills stores like the one in Sterling. Profits are at a high, nearly $130 million.

Most other retailers seem headed in the other direction. The internet now accounts for 10 percent of American shopping—up from below 4 percent less than a decade ago—and e-commerce topped $130 billion in the fourth quarter of 2018, a 12 percent increase from a year ago. Meanwhile, companies announced 3,400 store closures last year, with plans to shutter a record 155 million square feet of shops. Those numbers will skyrocket in 2019: Retailers announced 4,300 store closures in just the first nine weeks of the year.

From left: An Ollie’s in Lancaster, Pennsylvania, inside a former children’s store; Ollie Rosenberg and a customer

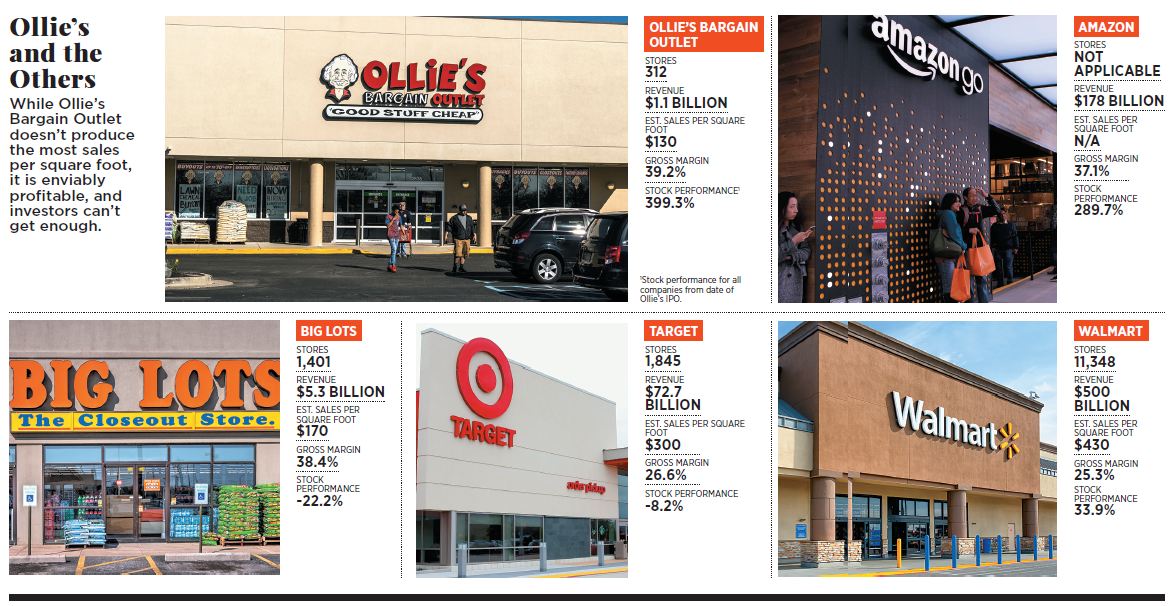

From left: An Ollie’s in Lancaster, Pennsylvania, inside a former children’s store; Ollie Rosenberg and a customerOllie’s is the exception to the rule. Not only is it opening new locations, its stock is on a tear. Even after a recent sell-off, shares in Ollie’s have quintupled since its IPO in 2015. This handily beats the performance from the rest of retail (the SPDR S&P Retail ETF has actually lost 12 percent), the broader stock market (the S&P 500 has gained 34 percent) and even high-flying Amazon (up nearly 290 percent). Ollie’s shares now trade at 34 times earnings. No one has benefited more from the run-up in Ollie’s stock than Butler himself, who has an estimated $1 billion fortune, nearly all from his approximate 15 percent stake in the company. “A lot of the incoming calls [from clients] this year have been, ‘How did I miss Ollie’s?’ ” says Judah Frommer, an analyst at Credit Suisse.

Talk about success will have to wait, though, because right now Butler needs to take a call about flooring. “Sorry, one of my merchants needs me,” he says, seating himself at a patio-furniture set. Ollie’s purchases most of its products as closeouts, meaning a manufacturer has excess inventory of something that a traditional retailer, like Target or Walmart, doesn’t want any longer, and it will sell it to Ollie’s cheap.

Ollie’s targets a 40 percent gross margin, and as long as it can turn a profit, it’s not too fussy about what it sells. Now one of Butler’s merchants has a line on a new supply of floor tiles. “Glue or grout?” Butler asks. His eyebrows go up. The tiles are hard to install, meant more for professional contractors or Home Depot shoppers than for the Ollie’s customer, who tends to be lower-middle class or poorer and likely doesn’t have the time or money to become a home-remodelling enthusiast. Moreover, Butler is not sure what he’d price the tiles at. He gives his merchant the name of someone he met “at a dinner in Hong Kong”, who may have advice on whether they should take the tiles.

Thirty-six years ago, Butler skipped college to start the company in Harrisburg, Pennsylvania, with three much-older co-founders, including the eponymous Ollie Rosenberg. Yet Butler, the only living founder, has lost none of his enthusiasm for managing even the smallest details of his business.

A customer pulls up to the register with a shopping cart loaded with toys. Butler strolls over. The haul includes several Call of Duty-branded sets from Mega Construx, a Lego competitor. “Now that I know I’ve got a hot item, I’ll call my merchant.” He dials and issues a clear instruction: “See if we can get some more.”

*****

A few months from now, Ollie’s will open another store farther north, in Olean, New York, a small town positioned on the eastern edge of the Rust Belt. Olean is an ideal spot for Ollie’s. It is over an hour drive from the nearest metro, Buffalo. The median income is about $40,000, 34 percent less than the national average. There is one public high school and one middle school; the mayor is an ex-police officer. The new Ollie’s will be in a former Kmart, a five-minute drive from a still-operating Walmart and across the parking lot from Aldi, a discount grocer. Most important, “everybody knows the road that it’s on”, Butler says. True enough, West State Street is probably the community’s busiest thoroughfare. “We’re selling a product for a price people will travel to get to.”

Ollie’s says its prices are “up to 70 percent off” what customers can pay elsewhere. Or, as Butler puts it, an “extreme value”. Brad Thomas, a KeyBanc analyst, recently put those claims to a test, comparing the prices of 32 items from Ollie’s with their prices on Amazon. He found that one, The Beloved Christmas Quilt, a paperback, was more than 70 percent less. Eight were 60 percent to 67 percent off, and Ollie’s on average was 42 percent cheaper. In another shopping trip, Thomas took his four-year-old son to Ollie’s, promising the boy any item he wanted if he behaved himself while Thomas conducted research at the store. They walked out with a Star Wars children’s suitcase with Stormtroopers and the “Darth Vader-ish looking character” from the latest movies on it. “It was a bargain. I think the suitcase cost $12,” Thomas says. “He loves that suitcase still.”

Ollie’s couldn’t exist without big brands like Star Wars. Or Clorox, Hefty, Wrangler, Fruit of the Loom, Philips, Farberware, Bissell and Yankee Candle, to name a few from a recent Ollie’s circular. (It still advertises almost entirely through newspaper flyers, distributing 30 million of them 21 times a year.) Ollie’s would attract far fewer customers if it sold poorly made products from little-known companies. “Brands at drastically reduced prices—that’s what we live for,” Butler says.

Every Ollie’s generally features the same types of things: Household supplies like soap, furniture, food, books, toys and electronics. Beyond that it’s a total guess as to precisely what each Ollie’s will have. “We might have a deal on a Garth Brooks five-CD anthology set one week, Scotts lawn fertiliser the next. It’s whatever we can get our hands on.” Shopping there has always been, well, “a bargain hunt. A treasure hunt,” Butler says. “This is the insulating factor that I tell all the investors: It’s virtually impossible to duplicate my shopping experience online.” Besides that, manufacturers have never been keen to sell their closeouts on the web. “A lot of vendors,” Thomas says, “would prefer that it’s not advertised all over the internet,” drawing customers away from the full-priced stuff.

An average Ollie’s does about $130 in sales per square foot, lower than Target (roughly $300), Walmart ($430) and even dollar-store levels ($200). These numbers support the idea that Ollie’s is, indeed, less expensive. Yet Ollie’s is more profitable. Its operating margin exceeds 13 percent, beating out Walmart (4.1 percent), Target (6 percent) and Dollar General (8.6 percent). Those retailers want to keep the same items in stock, accepting slimmer margins as a tradeoff for consistency. Ollie’s, on the other hand, embraces inconsistency—and the higher margins that accompany it. It passes on lower-margin goods because its customers know better than to expect the same Colgate toothpaste every time or that Ollie’s will bend to seasonality as much as a Walmart.

That’s why a few days before Valentine’s Day, Butler, dressed comfortably in a too-big cardigan and white button-down shirt, is passing through rows of Halloween candy as he winds through his Harrisburg location. “Fully in date, nothing wrong with it,” he says, looking over the bags of chocolate. “Maybe it has ghouls and whatever.” The cartoon M&M characters on the packages stare back with mock Jamie Lee Curtis screams. The ghouls “don’t bother me”, he says, adding a simple explanation. “Good gross margin.”

*****

Thirty minutes from Harrisburg is a small strip of land in the middle of the Susquehanna River. It is roughly 470 acres, a diminutive place with a disproportionate amount of infamy.

Around 4 am on March 28, 1979, a relief valve at the nuclear power plant there on Three Mile Island malfunctioned, causing a partial meltdown. Authorities eventually contained the catastrophe without any health consequences for the public or the plant’s workers, but the incident terrified America and ended the country’s love affair with nuclear power.

Ollie’s operating margin is more than 13%, beating Walmart (4.1%), Target (6%) and Dollar General (8.6 %)

It also put a chill on real estate projects in the area—bad news for a young Mark Butler, who was a manager at a small chain of lumber stores owned by a local man named Mort Bernstein. No one wanted to build “next to a nuclear reactor that almost blew up”, Butler recalls. The broader US economy didn’t help. In the early ’80s, the country was in its worst economic downturn since the Great Depression. Around 1981, Bernstein closed the stores.

While working for Bernstein, Butler had met Harry Coverman, whose building-supplies company had collapsed, too. Maybe the trio could go into business together? Bernstein, a Boston native, knew about a successful closeout retailer in Massachusetts called Building #19. The three figured they could swipe the model—down to the warehouse-style stores—and replicate it in central Pennsylvania. One problem: None of them had any money.

Bernstein suggested bringing in Ollie Rosenberg, a local commercial real estate investor. In the end, Rosenberg would contribute several things. He arranged a $300,000 loan (about $780,000 in today’s terms) from the local Cumberland County National Bank and would also lend his name and appearance to their new business. He looked a lot like Albert Einstein, and a caricature of Rosenberg became the company logo. On July 29, 1982, the first Ollie’s opened in Mechanicsburg, just across the Susquehanna from Harrisburg. A second one followed in October in Harrisburg and a third in York three years later.

Around the time that Ollie’s was creeping out of Pennsylvania into Maryland, Coverman and Rosenberg died, in 1993 at age 74 and in 1996 at 75, respectively. Bernstein, then in his late 60s, was the one setting the tempo at Ollie’s, and having already experienced his share of business failures, saw no reason to risk a lot on overexpansion. “He wanted to make sure he was growing properly and slowly,” Butler says. More bluntly, “he wasn’t at a point in his life when he wanted to take a chance”.

But Butler wanted to. And he got his opportunity when Bernstein, ill with heart disease and cancer, turned over the CEO role to him in 2003 and looked for a way to cash out. That year Dollar Tree and SKM, a small private equity firm in Stamford, Connecticut, acquired 70 percent of Ollie’s, valuing it at roughly $65 million. “We were trying to find situations where we thought we could triple our money,” says David Oddi, then a SKM partner. “We felt like with 27 stores across several states that Mark had already demonstrated that the concept resonated with consumers across multiple markets.”

Butler would do better than triple SKM’s money. To expand Ollie’s, he hired a chief operating officer and a chief financial officer. “It used to be just him and Mort doing everything,” says John Swygert, who was that initial CFO and is now COO. “They did every piece of the puzzle.”

Cash flow wasn’t a worry. Every Ollie’s store has been profitable within a year of opening. Under Bernstein, who died in 2004, the cash was largely taken out of the company as compensation for him and Butler rather than reinvested into the business. Butler reversed that and soon was increasing the store count by 15 percent or so a year, keeping at it through the Great Recession. (“Mark has a saying that ‘Everyone loves a bargain,’ ” Swygert says. “But during the recession, everyone needed a bargain.”) When SKM sold its stake to another PE company, New York-based CCMP, in 2012, the deal valued Ollie’s at around $700 million. Three years later, with almost 200 stores and $640 million in revenue, Ollie’s went public. It ended its first week of trading with a market capitalisation of $1.2 billion. In a little more than ten years, it had risen in value about 18-fold.

Partly because of his duties as CEO of a public company, Butler increasingly finds himself in New York. He likes to take the Amtrak train from Harrisburg to Philadelphia to Penn Station in Manhattan and from there prefers to ride the subway. “I just take the C [line] or the E down” to SoHo, where he keeps an apartment.

Butler enjoys the theatre and has invested in Broadway shows, including The Addams Family musical. Not long ago, he watched and enjoyed King Kong. (“It’s a tragedy. It’s a love story.”) He also recently saw The Boys in the Band (“Great first half but slows down in the second”), a revival of a play that was remarkable when it debuted in 1968 for its honest portrayal of gay men, and Dear Evan Hansen (“A little dark for me”), a hit musical that examines teenage anxiety and suicide.

But Butler’s chief interest outside of Ollie’s is sports. He golfs to a 16 handicap. (“I’m better at drinking beer.”) He chairs the foundation started by baseball Hall of Famer Cal Ripken, which builds sports facilities for children in impoverished areas. He and Ripken are friends. “If you need an answer, you just look to Mark and say, ‘Mark, what is that over there?’ ‘What’s that cost?’ And he knows it,” Ripken says. Since 2015, Butler has also been the majority owner of the Double-A Harrisburg Senators baseball team, an affiliate of the Washington Nationals.

The Senators serve a useful dual function. “It’s been great for my business,” Butler says. “If I’m arguing with a guy over a quarter, once he finds out I own the team he just wants to talk about baseball.” (Some of the Nationals’ biggest stars have appeared in the Senators’ lineup in recent years. “Bryce Harper played for me. Stephen Strasburg played for me.”) When the conversation turns to sports, “he stops fighting me over a quarter”.

Butler’s mind is never off Ollie’s, and he wants to make that point clear. “Let me tell you how my personality works,” he says, his voice dropping to a sharp tone. “I don’t need my picture in Forbes … I’m not doing this so that I get personal recognition. I’m doing this in hopes that a manufacturer is going to be reading this and wants to sell me a deal. I’m hoping you don’t print that, but I’m being honest with you. I don’t need the recognition. I know it’s a great story, but I need to be able to turn it into something in business.”

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)