The emperor's new coins: The cryptocurrency bubble

We're in the middle of the greatest bubble of the decade: $100 billion worth of cryptocurrency with little intrinsic value. A long-term system will emerge but not before a handful of visionaries, and hucksters, take billions from the greater fools

Olaf Carlson-Wee, the world’s first cryptocurrency native

Olaf Carlson-Wee, the world’s first cryptocurrency native

Image: Ethan Pines for Forbes

On April 24, Martin Köppelmann, 31, Stefan George, 29, and Matt Liston, 25, placed their laptops on a long wooden dining table ringed by high-backed wooden chairs and three-armed candelabra at their Airbnb in Gibraltar. It was an old-fashioned setting for a 21st-century moment. The three were about to launch a Kickstarter-style crowdsale, based on a concept they’d been developing for two years: A user-driven prediction market based on a coming “Cambrian explosion of machine intelligence” called Gnosis.

Their goal: Raise $12.5 million. But instead of dollars, they would accept money only in the form of a new cryptocurrency, Ether, that didn’t exist two years ago. It was a new form of crowdfunding called an ‘initial coin offering’, or ICO. Supporters would not receive a finished product down the road, as in a typical Kickstarter project. Instead, for every Ether (or fraction thereof) sent to Gnosis’s wallet, the ‘smart contract’ would automatically send back a different type of money, a GNO coin, that would give people special access to the platform plus act as equity in the network.

Theoretically, as Gnosis became more popular, demand for GNO coins (also known as tokens) would rise, boosting the shares of existing GNO token holders. The founders had designed their crowdfunding as a Dutch auction, which starts with a price ceiling rather than a floor. Within 11 minutes, Gnosis had raised the $12.5 million, led mostly by programmatic pooled “bidding rings”, and sold only 4.2 percent of its allotted 10 million tokens. The final price, $29.85, gave their project—which had little more underlying it than a 49-page white paper and a few thousand lines of open-source computer code—a valuation of $300 million. In two months, GNO coins were trading at $335 each, and Gnosis was suddenly worth $3 billion, more than the market cap of Revlon, Box or Time Inc. Köppelmann’s stake alone is, in theory, now worth about $1 billion. “It’s problematic,” admits Köppelmann. His best defense for the valuation: There’s a lot out there that’s far worse.

That’s pretty much all you need to know about the great cryptocurrency bubble of 2017. The market capitalisation for these virtual issues has surged 870 percent over the last 12 months, from $12 billion to over $100 billion. (This number is a moving target, though, since a 30 percent daily market plunge or gain isn’t out of the ordinary.) That’s more than six times the rise in stock market capitalisation during the dot-com boom from 1995 to 2000. A lot of this total gain comes from Bitcoin, the original digital asset—created out of an artful blend of cryptography, cloud computing and game theory—which is up 260 percent in 2017 alone. The total value of Bitcoin now exceeds $40 billion, despite years of shady characters, fraud, theft and incompetence (including the Mt. Gox meltdown, which took almost $500 million with it) and despite the fact that it has no intrinsic value—not even the promise of a central government or a precious metal mined from the ground.

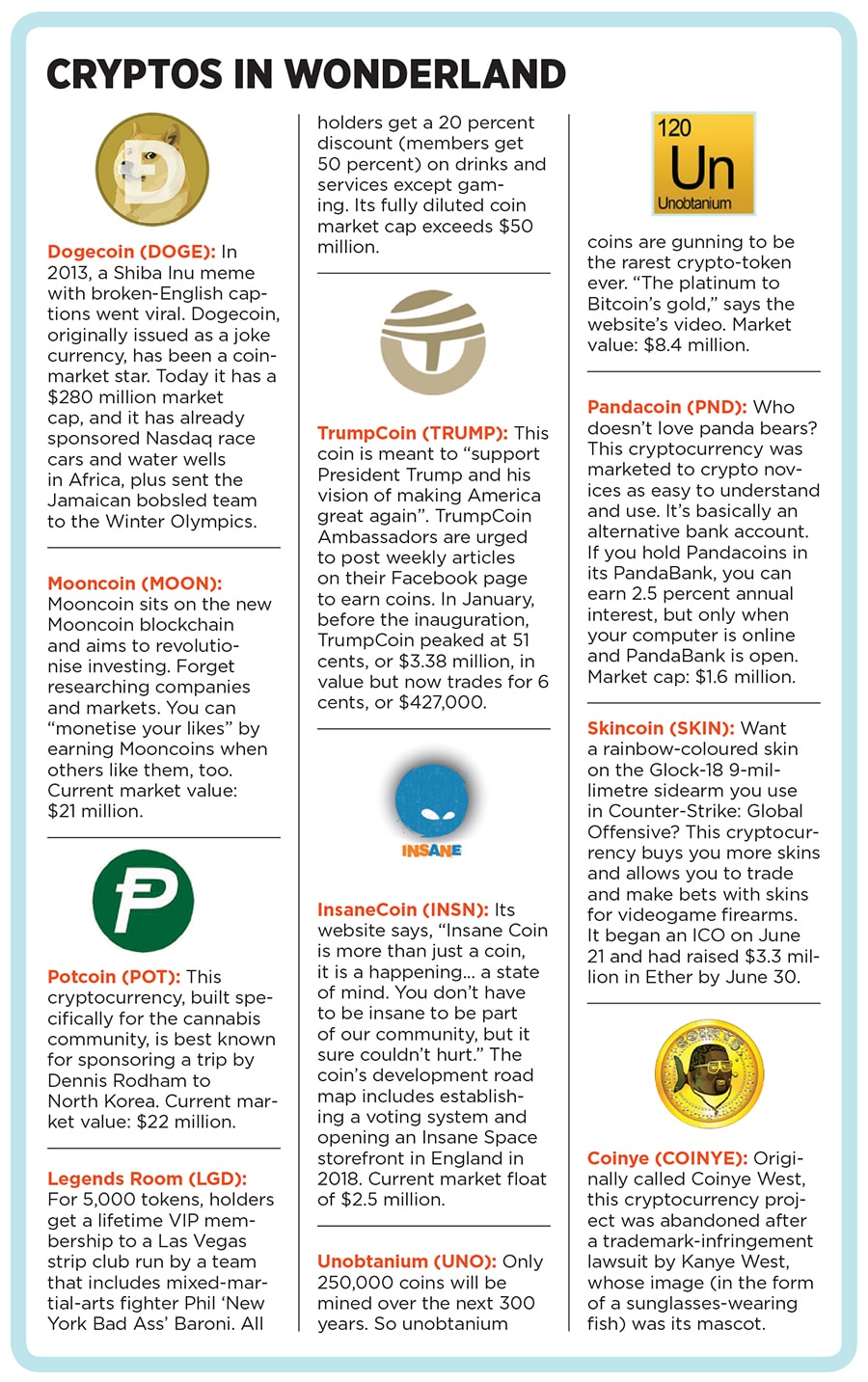

So suddenly anyone with a digital idea can launch a coin to go with it. There are now more than 900 different cryptocurrencies and crypto-assets in the market, with another launching pretty much every day. On June 12, Bancor, which plans to create a new reserve cryptocurrency, offered 50 percent of its total tokens and raised $153 million in under three hours, setting the record for an initial funding amount. The very next day, an entity called IOTA listed a token designed for Internet of Things micropayments and immediately fetched a value of $1.8 billion. A week after that, a messaging platform named Status launched its coin offering, raising $102 million.

In a gold rush, it’s good to be selling the pans. Ethereum’s value has skyrocketed more than 2,700 percent in the last 12 months, to $28 billion, or $300 per token. Of course, on the way there it has flash crashed to 10 cents and hit as high at $415. Bitcoin has been historically just as volatile, trading from $31 to $2 to $1,200 to $177 to its recent $2,500, as armies of day traders try to time something that has all the predictability of a roulette wheel.

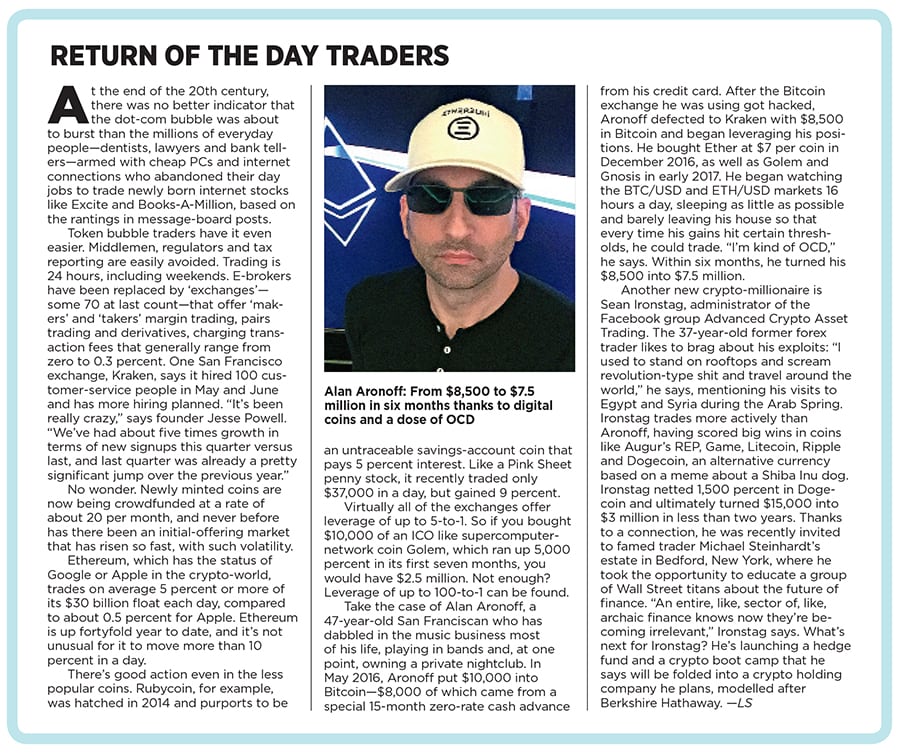

Of course, that hasn’t stopped a slew of websites and Facebook groups from popping up, full of endless bragging of crypto-conquests, including token purchases financed with credit card debt. Or hucksters from trying to get people to put their retirement money in this stuff, via Ether and Bitcoin IRAs. Every new coin offering presents another chance to translate a flaky business into an absurd valuation.

These pioneers have certainly unlocked a better way to raise money and create a network effect. Why grovel before Silicon Valley venture capitalists or deal with federal regulators when you can attach a token to your idea and have speculators throw money at it and then bid it up? These initial coin offerings have raised more than $850 million, from Brave Software’s lofty ‘Basic Attention Token’ (which sucked in $36 million in 24 seconds, at a $180 million valuation, on the promise of using blockchain technology to fix digital advertising’s deep problems) to the more basic Legends Room (a coin that gives users VIP privileges at a Las Vegas strip club).

Still, we’re past the tulip stage. Yes, that first dot-com bubble was ridiculous, but it also gave us enduring companies like Amazon, Google and eBay. And, yes, scores of foolish day traders and IPO junkies got crushed, but lots of smart, early players got very, very rich. That history is repeating right now, too.

To best understand how cryptocurrency works, think about videogames. You have a virtual world, and within this realm, you can often earn virtual currency, which can then be redeemed for rewards within the game—extra armour, more lives, cooler clothes. It’s the same here, except that it’s rooted in blockchain technology and (theoretically) you can either convert the play money into the real thing or deploy it for actual goods and services inside the entity that spawned it.

Many ICO descriptions even read like byzantine videogame rule books. For example, owners of GNO tokens in the $3 billion prediction market Gnosis have the ability to earn a second kind of token, WIZ, valued at $1 each, to pay platform fees. Ingeniously, the coins are earned by voluntarily ‘locking in’ tokens for periods up to a year, which conveniently props up Gnosis’s overall price.

It’s a common model. Since most of these platforms cap the number of tokens, increased usage jacks up the demand for them and should, in turn, boost the price. This network effect, in which a service becomes more valuable as more people use it, mirrors the incentives of Amway-style pyramid schemes. Imagine if Facebook had a token and by merely convincing a friend to join you would improve the network and your “token” net worth.

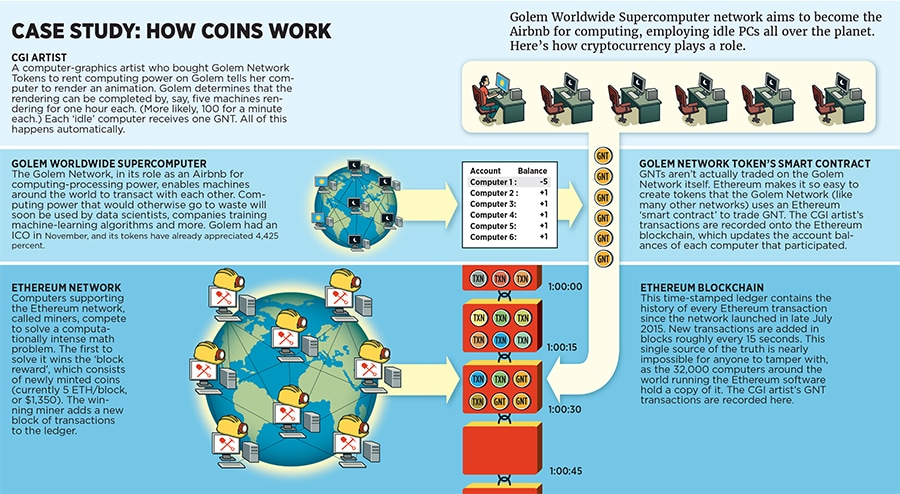

“We are crowdfunding a new decentralised digital economy,” says Chris Burniske, who recently left New York City’s ARK Investment Management, the first public fund manager to invest in Bitcoin. Burniske classifies the emerging assets into three categories. First, cryptocurrencies like Bitcoin and untraceable digital cash like Monero and Zcash. Second, crypto-commodities, the putative building blocks of a decentralised digital infrastructure. Golem Network Tokens, for example, harness a network of computers that rent or lease computing power—so while you sleep, your computer could be used by an entrepreneur who needs to train her machine-learning algorithm, earning you coins in the process. An especially hot type of crypto-commodity: Decentralised data-storage tokens, such as Filecoin, Sia or Storj, which compete with Amazon Simple Storage Service. The third category (and farthest off), crypto-tokens, promises to power consumer-facing, decentralised networks. Think Uber without Uber—a peer-to-peer network of riders and drivers (or driverless cars), earning and paying one another in the crypto-tokens needed to transact on that network.

The entities raising money in these coin offerings are not always startups. Sometimes they’re merely developers collaborating on a project and don’t form a legal entity. And even when the group is really a corporation, such as the messaging app Kik, which is launching the Kin token, the organisers will claim that the crowdsale is not actually offering a share in the company, conveniently sidestepping securities regulations.

And the people backing this technology aren’t naive idealists. Venture capital stalwart Tim Draper has backed two crypto-assets. Brendan Eich, of Basic Attention Token fame, previously created JavaScript and co-founded Mozilla. Tiger Management alum Dan Morehead founded Pantera Capital to specialise in these assets.

They’re chasing firms like Blockchain Capital, founded by former child actor and videogame virtual-currency entrepreneur Brock Pierce. He went as far as to finance the firm’s latest fund with its own crypto-coin offering, BCAP, ostensibly freeing its would-be limited partners from the usual regulations, including lock-ups.He raised $10 million in six hours in April. Pierce avoided regulatory scrutiny by limiting his coin crowdsale to 99 accredited investors in the US and 901 investors overseas, where rules are more relaxed. Once it launched, though, anyone could buy in. And they did; the fund’s valuation has spiked, to a recent $17.5 million.

“My phone has been ringing off the hook,” Pierce says. “I have so many people coming to me asking, ‘Can I do this in my industry?’”

Olaf Carlson-Wee is a 27-year-old son of Lutheran pastors. He can barely write computer code, has no formal training in financial analysis and has never managed money before. This, of course, qualifies him as the poster child for the cryptocurrency bubble of 2017. Carlson-Wee’s Polychain Capital, based in San Francisco, has seen its assets swell from $4 million to $200 million in less than ten months, mostly because of a series of deft manoeuvres based on his innate understanding of crypto-assets.

For Carlson-Wee, it all started on a Minnesota lake during his summer vacation from Vassar College in 2011, as he stared at $20,000 in student-loan debt and $700 in savings in the bank. Carlson-Wee was obsessed with math, games and imaginary worlds from a young age. And after reading about the underground drug marketplace Silk Road and how it was enabled by Bitcoin, he conjured a world coursing with cryptocurrency and eventually sank in almost all of that $700 into Bitcoin, at prices as high as $16, only to see it drop to $2.

Undeterred, Carlson-Wee persuaded his sociology professors to accept a senior thesis on Bitcoin and graduated from Vassar with a degree in sociology. After a stint as a lumberjack, he emailed his thesis to Coinbase, the cryptocurrency wallet and exchange, in 2012, and became its first employee, charged with managing customer service. Carlson-Wee requested that his salary of $50,000 be paid in Bitcoin, likely becoming the first person in the world to both earn and spend almost exclusively in cryptocurrency.

He later helped automate many of Coinbase’s routine customer-service responses and even created a sort of Bitcoin SAT, which he used to screen applicants for positions, eventually hiring eight, all of them paid in Bitcoin. He then got promoted to head of risk, lowering Coinbase’s fraud rate by 75 percent via artificial-intelligence algorithms.

By last September, he had quit and launched his crypto-only Polychain Capital with $4 million in funding from investors like Jack Herrick, founder of Wikihow, and Garry Tan, a former Y Combinator partner.Since most venture capital and hedge funds are precluded from investing directly in highly speculative assets like cryptocurrencies, Carlson-Wee worked instead with the likes of Andreessen Horowitz, Union Square Ventures, Sequoia Capital, Founders Fund and Pantera Capital, as his three-plus years at Coinbase made him something of a sage in this space.

Accordingly, while the crypto-asset movement espouses a democratisation of nearly every aspect of business, life and wealth accumulation, most of Carlson-Wee’s 13 investments to date have been made before the ICO, at a significant discount.

His investments include emerging industry-standard Ethereum and the decentralised supercomputer scheme Golem, as well as Augur, a prediction-market coin that Carlson-Wee prefers to Gnosis; 0x, a cryptocurrency exchange protocol that will allow for decentralised coin trading; and Tezos, an Ethereum competitor. “With Tezos, you can formally verify contracts, proving it does what it’s intended to do,” he says.

He’s taking a longer-term venture approach rather than wantonly trading coins, but in a market frenzy advanced knowledge and preferential treatment translate into big gains.

So where do we go from here? Carlson-Wee believes that base-layer protocols and infrastructure such as data storage and computing-power services will be built first. “I could see a future where computers, instead of having their own internal memory, their own bandwidth, their own internet connection—all of that could be outsourced on a per-use payment basis using tokens,” he says. “You could pay for every packet of internet you want and every piece of storage you want in real time, instead of those things being on everyone’s device and unused most of the time.” In other words, cloud computing meets the sharing economy meets the Fed.

Maybe. But before that happens, a lot of folks get hurt. Technically speaking, at least in the US these ‘equity’ coins aren’t securities so long as they are partly utilitarian and are not dependent on any particular party to succeed. It’s sort of like taxi medallions or golf-club memberships. Some token developers have attempted to sidestep the issue of whether their coins are actually securities by basing operations in places that have low taxes and looser regulations, like Singapore, Gibraltar and Zug, Switzerland.

Unsurprisingly, insider trading and dirty deals are flagrant. One coin-offering creator told Metastable Capital’s Naval Ravikant, the CEO and co-founder of AngelList: “If you agree to buy tokens at the ICO and support the price, then 30 days later, we’ll secretly sell you any leftover tokens at a lower, pre-agreed price,” recalls Ravikant. That’s a felony on Wall Street. In the cryptocurrency Wild West? “These are the kinds of deals being cut left and right.”

The SEC has said that it expects this industry to protect its investors, but given its Keystone Kop track record before and after the subprime meltdown, it’s hard to see it effectively regulating a world of functional currency. “The scams are very subtle and very sophisticated unless you’re willing to read the source code,” Ravikant adds.

And even if regulators did read the code? “If my bank account [in the US] gets shut down, I can’t just open up a Russian bank account and start using my bank credit card to go about my day buying Starbucks,” Carlson-Wee says. “But if my Bitcoin wallet provider gets shut down, I can shoot that bitcoin overseas so fast—literally in one minute—it’s like, ‘Okay, now that Bitcoin is in Russia, and now I’m going to participate in this crowdsale from the Russian exchange and store these tokens on a Russian wallet.... So on a global scale, trying to regulate these things is like Whac-a-Mole.” Ditto trying to collect taxes.

So buckle up for more blowups, more Mt. Gox-type fiascoes and tens of billions in losses for the people who are gambling in an area where there is precious little to protect them. The smart money, meanwhile, should do fine, vulnerable only to its own hubris. “Everyone’s like, token sales are complete madness right now,” Carlson-Wee says. “I don’t think we’ve seen anything relative to how big this could be.”

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)