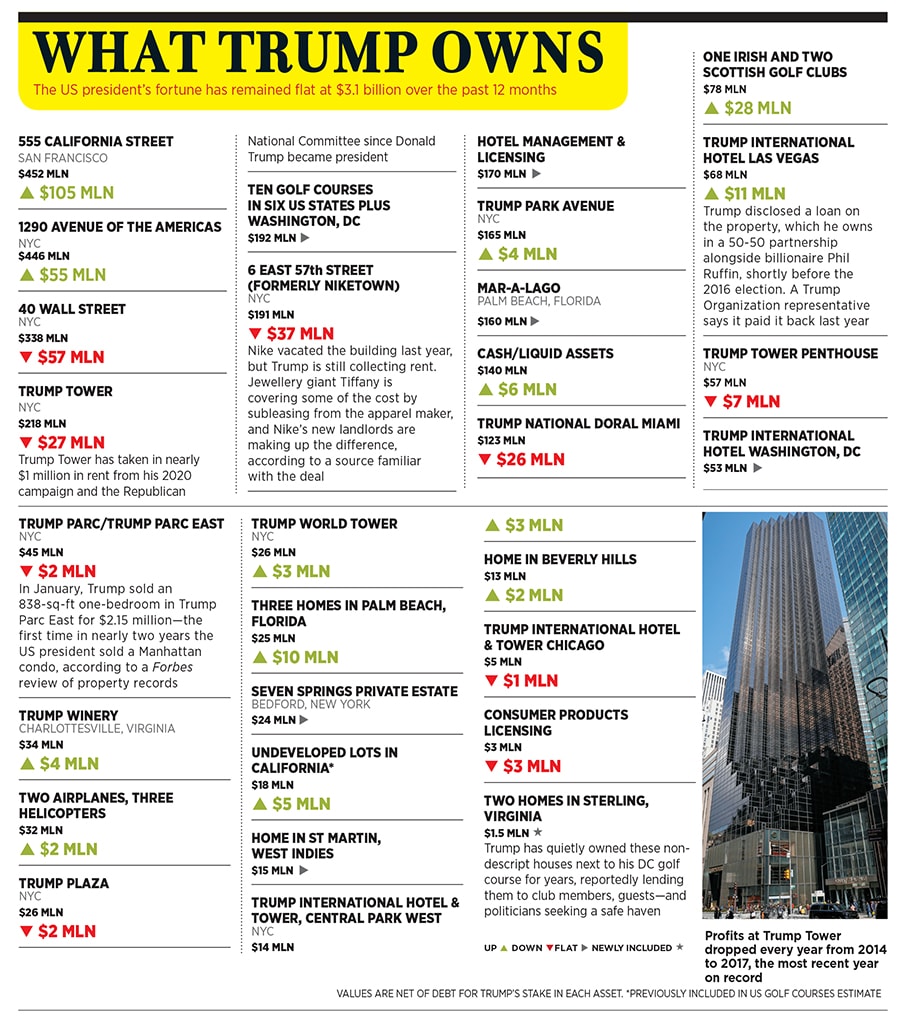

Trump's secret windfall

The US president's largest holding is a $900 million stake in two buildings that don't have his name on them. It's an arrangement that some of his tenants aren't even aware of, and one that he tried his best to torpedo

Largely thanks to a lobby renovation, rents at 1290 Avenue of the Americas have hit new highs

Largely thanks to a lobby renovation, rents at 1290 Avenue of the Americas have hit new highsImage: Chris Kleponis -Pool / Getty Images

Pacing the streets of midtown Manhattan, it’s hard to avoid the president of the United States. Trump Tower, with its bold-faced lettering and battle-armed guards, looms over Fifth Avenue. A couple of blocks away stand Trump Parc and Trump Parc East. There are also Trump International Hotel & Tower, Trump World Tower and Trump Plaza. Hidden among them is another Trump property, 1290 Avenue of the Americas, a hulking skyscraper that doesn’t have the president’s name on it but is worth more than any of the others.

That’s not a coincidence. For years, Donald Trump has touted his own name, at one point telling Forbes it was worth $5 billion alone in goodwill. But what was once an asset—though certainly not a $5 billion one—has become a liability, especially in the cosmopolitan places like New York City where the president built his fortune.

The brand dilution started in Trump Tower, in lockstep with his 2016 campaign launch event, where he denounced Mexican immigrants as “rapists”. Within weeks, partners who had paid him to put his name on mattresses, shirts and ties began distancing themselves. The political backlash eventually spread to other parts of Trump’s business. The value of his residential condos dropped, fewer Northeasterners booked vacations at his Miami resort and commercial tenants pulled out of his properties. News broke in February that two more Trump-branded buildings are removing the president’s name, which had already been scraped off properties in Toronto, Panama and New York. Even the recent effort by his sons Don Jr and Eric to leverage Trump’s relative popularity in red-state America, with a chain of lower-cost hotels, went nowhere.

In any portfolio, it’s good to have some diversification. In Trump’s case, that’s two major buildings without his name on them, 1290 Avenue of the Americas in New York and 555 California Street in San Francisco. The Trump Organization neither brands nor operates them. Instead they are controlled and managed by the publicly traded real estate firm Vornado, which holds a 70 percent stake in both; Trump owns the rest. Given the arm’s-length relationship to the president, tenants don’t seem to be backing away from those buildings—in fact, two said they didn’t even know they were partly paying Trump until Forbes told them.

The other assets that make up Trump’s $3.1 billion fortune are down by $600 million since he became president, by our count, largely because of a slump in retail real estate and an increasingly toxic brand. The two office-heavy skyscrapers without Trump’s name, however, are up by an estimated $230 million, buoying what has otherwise been a lousy two-year run for the Trump Organization.

Largely thanks to a lobby renovation, rents at 1290 Avenue of the Americas have hit new highs

Largely thanks to a lobby renovation, rents at 1290 Avenue of the Americas have hit new highsImage: Getty Images

Today, 1290 Avenue of the Americas and 555 California Street are the two most valuable properties in Trump’s portfolio. Anyone who continues to say the president is not a billionaire needs to focus on these assets, where his stake is worth an estimated $900 million after debt. That’s twice as much as all his golf properties put together, five times as much as his famous branding and management business, six times as much as Mar-a-Lago and 17 times as much as his stake in his DC hotel, which is seen as a place for foreign dignitaries and lobbyists to curry favour with the president. For all the scrutiny of the president’s businesses and foreign misadventures, it’s the two anonymous buildings in America that prove to be the most important—holdings that, ironically, Trump originally wanted no part of.

*****

None of this success is the product of Trump’s business savvy. In the early 1990s, he was drowning in debt and struggling to make payments on a $200 million mortgage tied to a 75-acre plot he owned on Manhattan’s Upper West Side. A group of deep-pocketed Hong Kong investors, including billionaires Henry Cheng and Vincent Lo, offered to bail him out. In a $89 million deal, they bought Trump’s debt in exchange for a 70 percent stake in the property—and full control. Trump was relegated to the passenger seat, with no decision-making authority, his 30 percent stake locked up until 2044.

Trump had a plan to build 16 luxury apartment towers on the site. But in 2005, fearing the market was about to collapse, the Hong Kong investors agreed to sell the partially developed project for $1.76 billion. They intended to plough the proceeds into two presumably safer investments: 1290 Avenue of the Americas and 555 California Street. Trump hated the idea from the start, as he made clear in a note to Cheng: “You can get a much higher price!”

The partners didn’t budge, so Trump took the fight to court, seeking to dissolve the partnership and asking for more than $1 billion in damages. His case rested on the claim that he was smarter than his partners, plus rumblings from a couple of friends who, he said, would surely pay much more for the property. Tom Barrack, who later headed Trump’s inaugural committee, faxed the partners an informal offer for $2.9 billion. Richard LeFrak, who was given a seat on the president’s quickly abandoned infrastructure council, was supposedly willing to pay $3 billion.

It was all typical Trump bluster. Independent appraisers had said the property was worth $1.6 billion, and the partners found offers of up to $1.76 billion. The judge didn’t take Trump any more seriously than his co-investors did, and the courts ultimately tossed the litigation. The deal went through, and Trump’s Hong Kong partners essentially swapped the land parcel for the two office towers, dragging Trump along kicking and screaming.

Lucky for him. The plan he called a “tragic mistake” and fought to block ended up being one of the best deals of his life.

*****

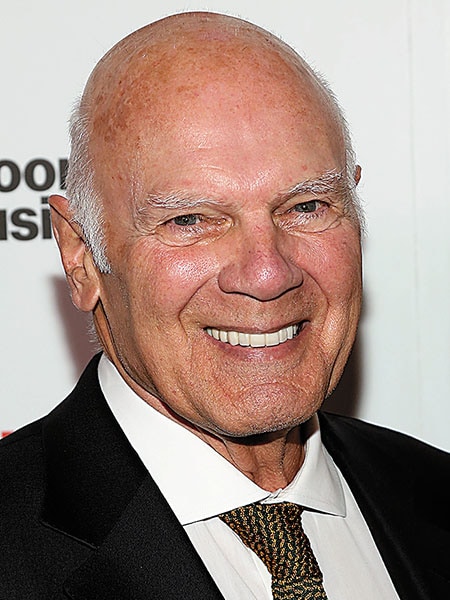

The person really responsible for Trump’s success here is as press-shy as Trump is camera-hungry: Vornado’s billionaire chief executive, Steven Roth. In May 2007, Vornado bought out the Hong Kong investors’ 70 percent stake, making Roth a business partner with the future president.

Roth, 77, has a long history with Trump. In the early 1990s, both developers controlled big stakes in a department store chain called Alexander’s. But around the same time that Trump’s debt load forced him to cede a 70 percent stake in his Upper West Side land, he also had to forfeit his Alexander’s shares to Citibank. Roth ended up buying them three years later at a 20 percent discount from the market price.

Defeated, Trump gained a deep respect for Roth, who is the sort of billionaire the president always portrays himself to be: Brilliant, ruthless, self-made. During the 2016 campaign, Trump tapped Roth to serve on his panel of economic advisors. Once elected, the president put his partner on the short-lived infrastructure council with LeFrak, making Roth one of the many background billionaires (along with Adelson, Ruffin, Perlmutter and Hamm) who has the president’s ear—but no government position.

Their partnership, meanwhile, has remained remarkably amicable. “Steve can be abrasive at times, even with his friends, and Donald is also difficult,” says Douglas Durst, head of the famous New York real estate dynasty. “It’s lasted ten years or so, and I didn’t think it would last two months.”

“The Trump family holds Steven Roth in the highest regard and with the utmost respect,” Amanda Miller, a Trump Organization spokesperson, said in a statement. “He is a great visionary, developer and operator. We are proud to be in partnership with Vornado in two of the most valuable and iconic properties in the world.”

From the start, Roth has been in control. Since Vornado bought into 1290 Avenue of the Americas and 555 California Street, Roth has invested millions in renovations to squeeze out bigger profits long term. In 2012 and 2013, Vornado put $31 million into upgrading the New York office tower, freshening up the storefronts, elevators and lobby. Those changes helped lure new tenants, at higher rates. By 2015, the building’s tenants were paying an average of $82 per square foot, an 18 percent increase over what they had paid four years earlier. Spread across 2.1 million sq ft, that added up to an estimated $32 million in additional rent every year for Vornado and Trump. Not a bad return on investment.

Since Trump took office, no one has been more critical to propping up his fortune than Steven Roth, who is worth $1.1 billion

Since Trump took office, no one has been more critical to propping up his fortune than Steven Roth, who is worth $1.1 billionImage; Getty Images

It wasn’t the only windfall at the property. Many people have speculated about the sources of the president’s cash. It turns out a big pile of it came from this anonymous building. “We just wait every month and—and they sent me a cheque last year for, like, $125 million,” Trump told Forbes in 2015, a previously unreported statement dug up for this story. “We didn’t even know what it was for.”

Rents at 1290 Avenue of the Americas have continued to increase during the past two years, even as the broader midtown market has declined. Forbes estimates the US president’s 30 percent stake is worth $100 million more today than it was when he took office.

His partner is now focusing on the San Francisco property, which includes a 52-storey skyscraper at 555 California Street and two smaller buildings next door. In 2015, Roth told stock analysts that Vornado was busy fixing up one of the shorter buildings, 315 Montgomery Street. Roth’s firm completed the project in 2017, and rents jumped nearly 50 percent. Next up: A $46 million makeover for its neighbour at 345 Montgomery. Before Vornado was even halfway done with the work, it had already signed a 15-year deal to lease the place to co-working company Regus. Net operating income at the three-building complex is up by 19 percent during Trump’s presidency. His stake in this asset, accordingly, has spiked an estimated $130 million.

In typical Roth fashion, he declined to comment. But all this success put him in a celebratory mood. Last November he hosted a blowout party at the San Francisco property to show off the renovations. Local restaurants laid out hors d’oeuvres, and wine flowed freely. More than 100 people showed up, including real estate brokers, analysts—and Jerry Seinfeld, who cracked jokes onstage for an hour. “It felt like a corporate event before the last recession,” says John Kim, a Wall Street analyst who attended. “Everything was first class.”

The person who had the most to celebrate, however, wasn’t at the party. President Donald Trump’s 30% stake makes him the biggest individual beneficiary of all the success. Even though he had pretty much nothing to do with it.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)