WeWork: The leader in shared working space movement

WeWork has emerged as one of the most valuable startups in America by combining the savvy of a real estate developer with the soul of a Kibbutz

Mort Zuckerman, the 77-year-old billionaire chairman of Boston Properties, controls $19.6 billion (market cap) worth of prime office buildings in cities like New York, Washington and San Francisco, and in June 2013, he took a walk through a little real estate business called WeWork that Adam Neumann and his partner Miguel McKelvey were building.

Neumann, then a 34-year-old former Israeli naval officer with a thick mane of black hair, met Zuckerman at the elevator of his second WeWork office in New York’s SoHo neighbourhood. “Surprise, surprise—another upstart wanted in on the office rental game,” Zuckerman remembers thinking to himself. Neumann explained the business model: WeWork takes out a cut-rate lease on a floor or two of an office building, chops it up into smaller parcels and then charges monthly memberships to startups and small companies that want to work cheek-by-jowl with each other.

Neumann led Zuckerman past WeWork’s 38,000-square-foot warren of small, glassed-in offices packed with young creative-economy types, the coffee lounge that converts into a beer-and-wine event space during happy hour, the conference rooms brimming with videoconferencing gear and the office managers smiling and taking care of package deliveries and replenishing the free coffee and laser printers. “We’ve got a waiting list months long,” Neumann told him. And the buzz in the air was going to be repeated across seven cities in a dozen new locations before 2015.

Zuckerman warmed up. Here were dozens of members with needs very different from the tenants who sign leases at Boston Properties buildings on Park Avenue. These startups need each other. They feed off each other. They want to belong to something. “Adam understood in a very serious way that we are in a new culture,” Zuckerman says. “I found it extraordinarily creative and original after being in this business for god knows how many years.” (For the record, it’s 50-odd.)

Zuckerman asked Neumann to lunch. Then another. By their fourth meeting, he made Neumann promise to let him invest personally in WeWork the next time it raised money. And in 2015, almost two years since that first tour, a 200,000-square-foot WeWork will be the anchor tenant of the $300 million redevelopment co-owned by Boston Properties in the Brooklyn Navy Yard. Plans are afoot for another partnership in San Francisco and perhaps Boston down the road.

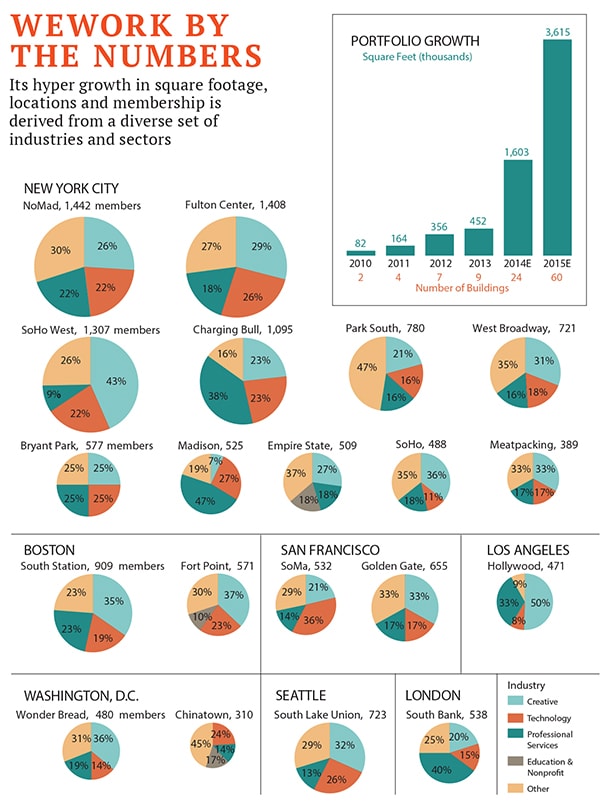

WeWork’s founders have been content to stay quiet about their story until now, swearing investors to secrecy. No longer. Over the next 12 months, the company expects to triple its membership from 14,000 to 46,000 and expand to 60 locations from 21 today and nine just a year ago. WeWork’s first location four years ago was just 3,000 square feet in SoHo with creaky floorboards and walls power-washed by its founders. Now WeWork is the fastest-growing lessee of new office space in New York and next year, will become the fastest-growing lessee of new space in America as it spreads to cities such as Austin and Chicago, not to mention London, Amsterdam and Tel Aviv.

WeWork will gross an estimated $150 million this year with operating margins of 30 percent. Current plans will push revenue to more than $400 million next year. In February, JP Morgan led a massive (and secret) $150 million investment in the company along with the Harvard Corp, Zuckerman and Benchmark Capital. The deal valued WeWork at $1.5 billion. The founders suspect they will be out raising another round next year that could easily fetch a valuation north of $6 billion. If that comes to fruition, Neumann and McKelvey, who each own an estimated 20 percent, would be paper billionaires.

WeWork is the leader, by far, in a surging co-working space movement. Some 5,900 shared office operations dot the globe today, compared with 300 five years ago, according to Deskmag.com, a site dedicated to tracking co-working trends. Back then, there were fewer than 10,000 people working in such locations worldwide. Today, that number is closer to 260,000. Niches have begun appearing: Grind caters to repeat founders and veteran professionals. Hera Hub runs three locations in California just for female entre- preneurs. “People want less stodgy offices,” says Julien Smith, CEO of Breather, a startup that takes flexible space to its extreme, offering private office rentals by the hour to members constantly on the go.

WeWork members freely acknowledge the space is scandalously priced per square foot: $350 a month for a desk and $650 per person for 64 square feet per office. But when WeWork opened its latest building in London’s South End, it was 80 percent full at launch and like the rest, will be at near capacity in just a couple of months. That’s because members can save hundreds per month when you factor in included services such as security, reception, broadband, printing—and fewer headaches.

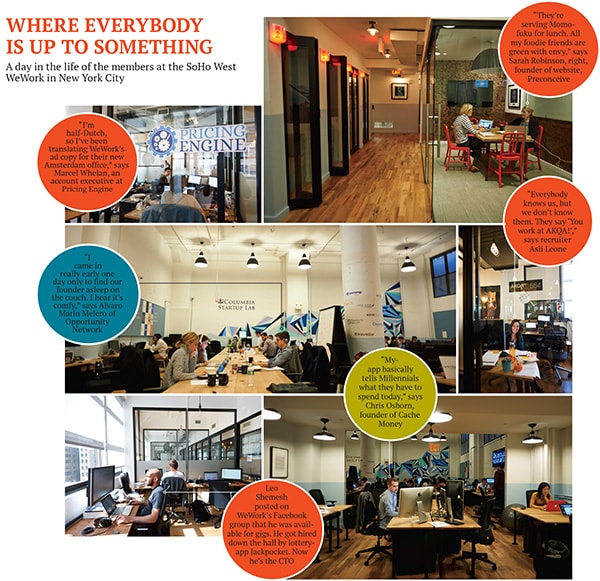

But the real perk is having other people around. WeWorkers network at weekly bagel-and-mimosa parties, where they might find a software de- veloper to produce an app for them.

Members pitch their ideas at informal demo days and get free advice during office hours from willing outside partners like ad agency Wieden+Kennedy. Handshake agreements and job referrals are made over the wagging tails of members’ dogs.

“Other offices are just depressing compared to here,” says Nicole Halmi of Neon, an image-selection platform in the WeWork Tenderloin location in San Francisco. “The old model of office space is dead,” adds startup veteran Gary Mendel, who runs Yopine from a WeWork in the renovated Wonder Bread factory in Washington, DC.

Facebook, Google and other Silicon Valley firms years ago embraced the practice of throwing everyone into a giant room. WeWork lets big companies join the fray. PepsiCo, for example, put a few people in the SoHo WeWork in 2011, with the understanding that these staffers will be available to give advice to smaller member companies. “There has to be a commitment to the bigger picture,” says McKelvey.

City governments are all-in on the benefits that such spaces can bring to the local economy. In San Francisco, Mayor Ed Lee rerouted police pa- trols and opened a precinct outpost in the ragged Tenderloin district to keep the WeWork members there safe. Chicago Mayor Rahm Emanuel insisted on personally showing Neu- mann his unannounced plans for new bike paths and other startup-friendly projects to convince WeWork to move to the West Loop. New Boston Mayor Martin J Walsh chose the new WeWork as the location for one of his first public speeches after taking office. “This is somewhat new to Boston, the innovation economy, but as more and more people see the type of idea of WeWork, more people will get interested in starting companies,” says Walsh.

“WeWork plays both sides of the coin,” says James Lee, the famed investor and JP Morgan Chase vice chairman who has guided the public offerings of Facebook, Alibaba and General Motors. “Institutions have space that young entrepreneurs could use, but they want to start their own business and cut their own trail. WeWork gives them a home and says, ‘We want you here, we will help you and build you’.”

Neumann and McKelvey, who still interview every new employee to make sure they don’t see WeWork as just another real estate play, come by their fanaticism for the power of “we” honestly. The two grew up thousands of miles apart, but in their own types of communes and without fathers around. Neumann grew up as the son of an Israeli single-mother doctor. He spent two early years learning English when his mom was a resident at an Indianapolis hospital. They returned to Israel and moved into the Kibbutz Nirim near the Gaza Strip. All the children lived together in their own dorm, apart from the parents. He and his little sister, Adi, learnt community the hard way, as the tribal kids of Kibbutz shunned Neumann’s family for months. “That was the hardest group I ever had to enter in my life,” he says.

Severely dyslexic and an indifferent student, Neumann found accep- tance as an expert windsurfer and ringleader for unapproved extracur- ricular activities. When it came time for mandatory military service, Neumann says he was among the slowest of the thousands of candidates for the elite naval officers’ school, many of whom had trained for their tryout camp for weeks. When the team-building missions came around, Neumann began to take charge. His was one of the last names to be called when the navy picked its 600-mem- ber class. He finished third and left the navy after five years of service.

McKelvey grew up one of six kids in a five-mother collective in Eugene, Oregon. They were happy and lived simply on gardening and food stamps. Tang, with its forbidden artificial chemicals, was a special Christmas treat. “Looking back, we grew up poor, but living it then we never knew,” says McKelvey’s commune “sister” Chia O’Keefe, an early WeWork’s employee and now head of innovation.

McKelvey was a talented student, but school bored him easily. What he loved was thinking about ways to revive all the empty storefronts and closed buildings in his depressed hometown. His favourite was Lazar’s Bazar, an ugly duckling that stayed open selling a hodgepodge of items as neighbours came and went. McKelvey saved pocket change for weeks to finally buy a $7 silk skinny tie. “It was the 1980s,” he shrugs today.

After playing basketball at the University of Oregon (and earning his architecture degree), he jumped into the 1990s dot-com boom, starting a website that connected Japanese and English pen pals. Eventually he landed a job with an architecture firm in Brooklyn.

Neumann, meanwhile, had fol- lowed his sister, Adi, a Miss Teen Israel, to New York City to pursue her modelling career. He spent the next five years staying at her apart- ment while taking business classes at Baruch College and managing her six-figure income. Neumann tried several ventures, including selling baby overalls with built-in knee pads (a major flop). He found more success with Egg Baby, an online store for high-end baby clothes.

McKelvey and Neumann struck up a friendship at a party. Neumann asked McKelvey to design his new office space. McKelvey persuaded him to move it to Brooklyn’s Dumbo neighbourhood. Their first inkling that they could make money selling shared office space came in January 2008, when Neumann began renting out a corner of his office to someone he found on Craigslist to cut costs. Weeks later, Neumann’s landlord, Joshua Guttman, took him through an empty building he had just bought down the street. He was going to charge $1 per square foot for each 5,000-square-foot floor. Neumann said, “I got a better idea. Let me take over one of the floors. I’ll split it up into 15 offices, charge $1,000 each. We’ll make $15,000 a month on this floor—you can take $7,500, we’ll pay the receptionist $2,500, and I’ll keep whatever profit is left.”

Neumann told McKelvey about the idea that afternoon. A night owl, McKelvey came back the next morning with a name, a logo and a working website. The space would be called Green Desk, and it would be eco-friendly with free-trade coffee and cleaning detergent from Seventh Generation. “It seemed so obvious to us,” McKelvey says. “What was out there for office space was not good—it sucked.” Guttman finally agreed, with one condition: They save even more on operations by repeating the model on every floor.

Neumann kept operating Egg Baby as Green Desk took shape. McKelvey quit his job to renovate the building with help from Neumann’s filmmaker wife, Rebekah Paltrow Neumann (she’s a cousin of the actress). He spent his weekends driving to Ikea to fill up his Zipcar with butcher blocks to create office tables. As the deadline for their first move-in neared in 2008, the economy crashed. Guttman told them the jig was up. “He said, ‘I’m not mad at you guys, but this business is going to fail. In a down economy, people don’t rent’,” says Neumann.

Just the opposite happened. They filled Green Desk with a mere seven Craigslist ads and word of mouth, with tenants ranging from a private equity shop to blogging website Goth- amist. But Green Desk was much closer to an executive suite rental company like $2 billion (market cap) Regus than WeWork would become.

It didn’t have the communal open spaces or room for programming that the founders would have liked. “We had aspirations for a global brand,” Neumann says. That would mean designing different layouts for each location and spending much more capital on events and amenities. According to Neumann, Guttman preferred to replicate the model that had already worked in more locations in Brooklyn—and it would, with seven locations today. Just not with Neumann and McKelvey on board.

The founders sold to Guttman at a $3 million valuation that netted them $300,000 in initial cash and the rest in gradual payments they’d live off of for the next two years. The lump sum went straight into a deposit for a new location in SoHo built on their community model, along with what- ever they could scrounge from credit cards and friends. Israeli friends of Adam’s received free plane tickets to spend two weeks at his apartment and ended up slinging drywall and lumber. “They thought they were coming for fun, and they worked seven days a week,” says Neumann. By February 2010, just one month after launch, WeWork turned its first profit and has never stopped.

An early investor, developer Jack Schreiber, identified their second location, a cheap space across from the Empire State Building owned by three Persian brothers. But the place needed $1 million in work, money that WeWork didn’t have. Schreiber told Neumann that the brothers could be swayed if he won over the one who lived in New York before his relatives outside the country could find out.

“We sat down in the lounge at the SoHo WeWork, and he was very excited,” Neumann remembers. The Israeli and Iranian talked for hours and polished off half a bottle of whiskey, Neumann says. The brother left with a signed contract and a hazy memory. Neumann knew he would come back the next day, saying his family wasn’t comfortable, and he did. “So I said, ‘I understood that Persians were men of their word’.” That was mostly all it took. WeWork finished preparing their first floor in the building in just 29 days.

Three more locations went up in 2012, by which time WeWork had caught the attention of Benchmark Capital, the media-shy venture firm that had backed eBay, Twitter and Uber. Benchmark had never backed a real estate play, so a founding partner, Bruce Dunlevie, flew out to New York to see why these spaces were so different. “It reminded me a lot of eBay when I met them in 1997,” the investor says. “There was something going on at both that you couldn’t quite put your finger on.” Benchmark’s round valued the company at about $100 million, a figure that would shoot up to $450 million in 2013 when investment bank Jefferies came onboard, says Neumann. JP Morgan passed, but it would change its tune.

It’s possible to out-perk WeWork. A high-end competitor in New York, NeueHouse, co-owned by Joshua Abram and Alan Murray, has a small broadcast studio for members and a café in its New York location, with plans to open a full-service restaurant in its upcoming Los Angeles building. But NeueHouse is growing more slowly and deliberately, with plans for 20 locations by 2020. WeWork, meanwhile, is moving fast, going big and trying to learn from each building and each deal. Neumann can come across as grandiose in his pitch meetings and probably turned off a lot of developers in the early days.

“It took us a little bit to get on the same page. My first impression was they had very big ambition, but I wanted to make sure there was enough substance behind it,” says Jared Kushner, the scion of a big New York real estate family and an advisor to many startups in his brother Josh’s venture portfolio. Kushner has heard plenty of bluster. But then he sat down with McKelvey, who spent 30 minutes arguing about which coffee shop would be right for Kushner’s new $375 million complex in Brooklyn’s Dumbo district. WeWork won a prize spot as one of the project’s two anchor tenants, along with online crafts market Etsy, taking an entire building for itself. “They’ve built a good mousetrap to capture this market trend,” Kushner says. “I capitulated.”

WeWork prefers to work with new developments or in gentrify- ing or distressed neighbourhoods, where WeWork can get space at a standard anchor-tenant discount of about 10 percent. Even if WeWork drives a hard bargain, its presence raises values of adjacent floors and buildings in the neighbourhood. “They’re not stepping on our toes,” says Bill Rudin, whose Rudin Management is also in on the Navy Yard project and one other WeWork location on Wall Street.

WeWork’s biggest risk, found- ers and investors agree, is in over- extending itself. It’s at a manageable enough size that it can tend to its brand and maintain high levels of customer service. Hire the wrong community managers or automate too much and broken elevators or other snafus won’t be forgiven with free doughnuts. The former CEO of Coach is now a full-time advisor, helping the founders maintain their culture in the midst of rapid growth. New CFO Michael Gross, the former CEO of Morgans Hotel Group, brings experience at creating a hip and hospitable vibe while staying asset-light and within budget. But even they don’t know if WeWork will go over in smaller towns like Cincinnati or Bruges once it reaches the top 25 cities in the US and top dozen in Europe.

Some Silicon Valley investors are sceptical that its economics can survive the inevitable real estate slump. WeWork is charging high per-square-foot prices but is also locking itself into long-term leases at today’s record rents. One investor who passed on the company was concerned not by its high valuation but by the prospect of a tenant exodus amid a recession or cheaper competition.

Neumann has heard that one before. His experience with Green Desk proved that co-working spaces are in even hotter demand when budgets tighten. WeWork’s own rental agreements with property managers can survive in a city like New York, he argues, unless rents hit unprecedented lows, and even then WeWork has millions in equity and operating cash flow that can help it weather a down cycle (and that’s without jacking up member rates).

WeWork’s member base is quite stable, and 28 percent of its revenue comes from smaller members who upgrade as bigger members graduate to their own spaces or move into larger, newer WeWorks. “I get so much business from being here that they could double my rent and I would still come out ahead,” says Jonathan Smalley, CEO of Brilliant Collaborations, a creative agency and a member at the Wonder Bread WeWork.

Neumann and McKelvey see new revenue streams from playing matchmaker with services to members: Health care, accounting, legal and cloud computing. WeWork helps members save $200 a month on health insurance plans through TriNet. Amazon Web Services offers $5,000 of the first year of web hosting. These are offered with no middleman fees for now, but that could change. A big fundraising round seems inevitable in the coming year, and McKelvey, who grew up on food stamps, has given the prospect of a life-changing IPO some thought. He’s asked rich people he’s met how they spend their money, and so far he’s unimpressed. Should his large paper fortune turn into real cash in the future, McKelvey’s dream would be to open non-profit WeWork locations in developing countries like Haiti to spur economic growth.

But McKelvey can’t top Neumann when it comes to future schemes. Neumann says he got the chance once to speak with Elon Musk, the force behind Tesla electric cars and SpaceX rockets. They met for only a moment, but if they meet again Neumann will show him his proposal for a WeWork in space. “When he gets everybody to Mars, we’re going to build a community like there’s never been,” Neumann says. “It’ll be awesome, and if he can just get us there, then we can do it. No question.”

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)