Fighting the ecommerce froth

That Indian ecommerce firms are highly-valued is no longer even up for debate. But to call the situation a bubble is not only premature, it is incorrect, say experts

In September this year, veteran investor Vinod Khosla, who had backed Google in its earlier days, said 85 percent of Indian ecommerce firms (including Flipkart and Snapdeal) were over-valued. Harsh as his words may have sounded, they were based on trends he had noticed in the American market. And these have continued to play out. In November, fund manager Fidelity marked down its stake in image-based messaging service Snapchat, a unicorn (loosely defined as a startup that has crossed $1 billion in valuation), by 25 percent to $34.5 million. BlackRock had marked down the value of its investment in file hosting service provider Dropbox, another unicorn, by 24 percent, while Square, a financial and merchant services aggregator and mobile payment company, factored in 33 percent discount in its pre-initial public offering (IPO) price to $11–$13 ($4 billion) from the last private funding valuation of $15.46 ($6 billion).

These three are among the most highly valued tech startups in the US and their devaluations have sent tremors of concern through the industry. India is obviously not untouched by the implications. Consider that almost 90 percent of the investments in the Indian ecommerce story comes from the US.

The sunshine industry seems to have found its clouds.

So much has changed in the last year-and-a-half: From 2014 to early 2015, it was a buoyant period for the ecommerce industry; investors were trying to enter or stay in India’s consumer internet space. It was the party you were willing to buy a very expensive ticket to.

Cut to 2015, and it seems that every one, from veteran investors like Khosla to venture capitalists and hedge fund investors, is beginning to question the business model of ecommerce firms and if they can sustain the high valuations they have garnered so far. It doesn’t help that a few firms saw flat to negligibly higher valuations compared to last year.

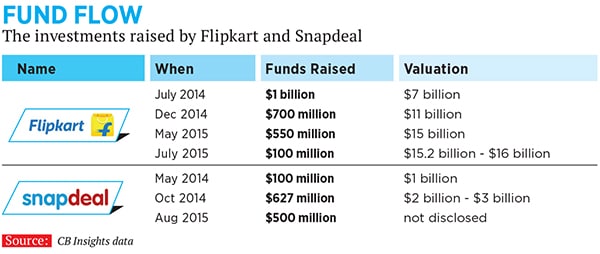

Homegrown ecommerce numero uno Flipkart had a small increase of 1.3-6.7 percent in its valuation in its latest round of funding in July, from $15 billion to $15.2-16 billion. In the round prior to this one, in May, Flipkart’s valuation rose by 36.7 percent. Last year, its valuation saw a 57 percent jump across two rounds, according to CB Insights data. Snapdeal also saw a similar trend. In 2014, its valuation tripled across its two rounds of funding. This year, in its latest round, its valuation remained flat to marginally higher, said sources.

While valuations are a way to gauge a company’s worth, they tend to go through cycles, sometimes swayed heavily by investor sentiment. The appetite for the Indian ecommerce industry was so strong last year that Japan’s telecom giant SoftBank Group Corp invested nearly $1 billion in India in less than 30 days. This, for instance, explains Snapdeal’s spiralling valuation during that time.

It isn’t that money has suddenly dried up. It still needs to be deployed. But what has changed is the filter employed by investors.

“Today, it’s not about growth; it’s about profitable and sustainable growth. The cash burning scenario is gone. Investors want to know if businesses can scale up in a sustainable manner showing a clear path to profitability and exit for them. As a consequence, valuations have taken a hit because multiples have come down,” says Sanjith Kumar, director at advisory firm Ambit Holdings.

Growing Caution

The amount of new capital coming into the ecommerce industry is less than what it was six months ago and is reflected in the dwindling number of Series B and C deals in India. According to estimates by investors, if 75 companies are trying to raise funds in the range of $20 million to $40 million today, only about five will succeed. Also, hedge funds, the deep-pocketed alpha-returns-seeking set of investors world over, are in a difficult spot. According to Bloomberg, 417 hedge funds closed down in the first half of 2015 alone, indicating uncertain markets. And the Indian ecommerce industry has been powered by several hedge funds including Steadview Capital and LionRock Capital, both from Hong Kong.

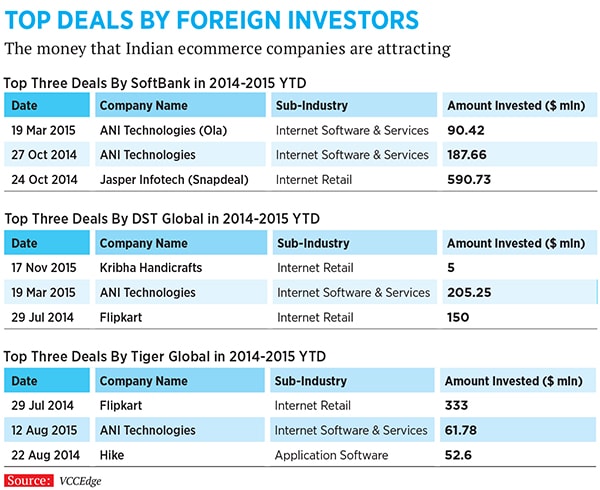

The capital flow from those who were once very bullish on India is also slowing down. SoftBank invested nearly $1 billion across three deals in India last year. This year so far, it has invested $150.2 million across five transactions here. While Tiger Global’s number of transactions are on a rise, according to VCCEdge’s estimates, its investment value has gone down this year. It has invested in 37 deals worth $229.3 million so far this year compared to 17 deals worth $512.4 million last year.

The fast-growing Indian ecommerce industry, probably for the first time, is seeing questions being raised about its sustainability. Not surprising, also considering that it has seen several deaths. Firms like online merchandise portal BlueGape, eshopping platform KoolKart, online toy store Wopshop and electronics etailer Timtara have shut shop. The mortality is, however, neither at the scale nor with the attributes of the dotcom bust of 2000.

But there are several worrisome similarities. When the dotcom boom started in the 1990s, those companies, much like the ecommerce firms in the country today, were riding high on the enthusiasm of being the ‘new economy’, and investors backed them with millions of dollars, often over-valuing them.

A majority of those internet companies did not have very clear revenues models and never made much money. For example, in 1998, Pets.com started as an enterprise selling pet supplies to retail customers. Its advertisements struck a chord with customers and brought it massive orders but the company lacked a workable business plan and lost money on nearly every sale. It was offering huge discounts to lure customers, selling merchandise for nearly one-third of their cost price. It went public and was liquated in 268 days. On the day of liquidation, its stock price had tanked to $0.19 per share from an IPO price of $11 per share.

The dotcom bubble bust started in 2000, triggered by overvaluation and several other factors like corporate corruption, resulting in a loss of almost $8 trillion of wealth.

But Indian ecommerce companies are unlisted (for now). The industry has been created with the customers’ approval, making these businesses more viable. Experts say a shake-up, if at all, would impact investors, promoters and employees to a much greater extent than the market at large as these are private companies.

The overall economy wouldn’t be decimated, certainly not like what the internet bust did to the US. Also, unlike the internet companies of the 1990s, ecommerce companies today possess a definite value and service through their sale of products and services. There is a transactional element that offers a practical value to the user. The firms are also constantly using analytical and intelligence tools that offer insights to gauge customer behaviour and improve services. Further, one of the major causes of the last dotcom bubble was that companies didn’t utilise comprehensive business plans or implement revenue structures. The focus in India right now is to improve unit economics and increase margins—and, ultimately, a listing for the top players.

“You can call it froth, not a bubble. A bubble is what bursts and nothing remains. Here you will still find something. This market has got growth, it doesn’t have profit pools yet,” says Niren Shah, managing director, NVP India, an investment firm that has invested in ventures like Pepperfry.com and Fashionandyou.com.

While valuations are making these companies hit headlines, the good news is that they are no longer overlooking the path to profitability now.

The macroeconomic pointers are favourable too. From 2000, the number of people using the internet has grown considerably. India is expected to have over 500 million internet users by 2017, up from over 350 million users as of June 2015, according to a new report by the Internet and Mobile Association of India (IAMAI) and consultancy firm KPMG, released in August.

The high-speed 4G launch is also expected to further boost the online shopping experience by improving user experience in terms of downloads, payments and visuals.

The ecommerce market is likely to grow tenfold in the next five years to $100 billion on the back of increasing internet penetration, smartphones and the spread of the digital network in rural areas, according to a report titled ‘Direct selling: Mapping the industry across Indian states’, released by industry body Ficci and KPMG.

PATH TO PROFITABILITY

Ecommerce companies in India have generally focussed on maximising GMV (gross merchandise value) in their bid to rake up valuations. They have been burning cash on customer acquisition, strengthening the backend and infrastructure, technology and people. Access to capital from venture capitalists, private equity and deep-pocketed hedge fund investors meant that these companies could scale fast and offer heavy discounts in their bid to keep the customer hooked.

Over the last few months, most investors and companies have started talking about profitability. Ventures like Myntra, Pepperfry, Flipkart, Snapdeal, BigBasket and Paytm want to be profitable in the next two to three years. “At the peak of the current technology bull-run, investors were focussed on traffic, market share and transaction volumes, with the belief that the economic model would work itself out at scale. Large investors were pumping in money and companies continued to focus on growth, with enough in cash balances to take care of rising expenses. Now, with momentum withering, there is a pullback on capital across the chain,” says Mayank Singhal, who led Temasek’s investment in Snapdeal early last year. “Early investors are concerned about follow-on funding and more measured in their early bets.”

The concern is leading internet companies to create a culture of thinking about profitability to bring more discipline into their approach and potentially take them to a space where public market investors may start looking at them with interest, says a Morgan Stanley report called ‘India Technology: India Internet: Path to Profitability’, released on November 3.

For instance, NVP India’s meetings with its portfolio company Pepperfry are increasingly about improving margins and unit economics. NVP and Pepperfry are aligned in their belief that rapid growth has to be accompanied with a route to profitability over the next 12 to 18 months. “Most people are aware that, at current levels, companies won’t make profits,” says Shah of NVP India, adding that the investment firm is not seeking an immediate profitability but an effort to better unit economics. “Ecommerce is bigger than the industrial revolution. The market is resetting from growth to unit economics. When the market feels good, people will go for growth. No one wants profits overnight. It’s a game of owning a customer’s mindshare.”

The emphasis on better margins and unit economics seems to be working well for Pepperfry, for instance. Co-founder Ashish Shah says they never lose money on their products and don’t discount below cost price. Pepperfry is operationally profitable, including shipping, he adds. “In bad times, one does not spend a rupee on marketing; all those levers are in my hand. There is a path to everything. One cannot say that today I will grow and tomorrow I will make money. Both growth and making money have to happen simultaneously,” he says. Pepperfry’s overall margins grew significantly last year—10 percent more than a year ago. Shah asserts that in 18 months they will be completely profitable.

India’s largest online fashion retailer Myntra says it should be completely Ebidta-positive in the next 12 to 18 months. This year (till March 31, 2016), the Bengaluru-based fashion portal expects to grow 70 percent year-on-year. “Our unit economics are way better than anybody else’s, and we are able to sell more premium products and at lower discounts than anybody else in the industry. Our logistics and operational costs are in much better control. All of these efforts are contributing to the profitability roadmap that we have for ourselves. We are well on track for that,” Prasad Kompalli, head, ecommerce platform, Myntra, told Forbes India in an unrelated interview.

Firms are adopting multiple steps to achieve profitability. Economies of scale are expected to bring tonnes of benefits for large marketplaces like Flipkart and Snapdeal, through lower warehousing and logistics costs. Several Indian ecommerce startups spend as much as 30 percent of their net sales on logistics, according to retail consultancy firm Technopak, which is much higher than the 11.7 percent Amazon.com spends in the US. In China, Alibaba doesn’t bear any shipping costs. Also, the average size of an online sale in India is around $20, compared with the global average of around $100.

Diversifying into new, profitable categories could help generate better returns. In August, Flipkart launched its furniture range, a category that can offer margins as high as 40 percent and is already seeing a growth of 60 percent month-on-month.

Several startups are also rationalising their employee strength. For example, Zomato fired 300 employees, with an email by its founder Deepinder Goyal explaining that “the fact of the matter is that our sales team is not firing on all cylinders”, indicating results are most crucial for sustenance in a startup. TinyOwl and Housing.com fired over 160 and 600 employees respectively, to remain lean.

Another significant move being cautiously taken is to rationalise discounts. The arrival of large conglomerates like the Aditya Birla Group and the Tata Group into ecommerce will, in any case, change how companies lure customers. In October, the Aditya Birla Group launched its online fashion store called Abof.com. The Tata Group is also close to starting its ecommerce business. “It is not a ‘winner takes it all’ market. Their presence would not fundamentally change the business; there is enough room for all to grow. Online startups have a different DNA which may not be easy to replicate. Going forward, existing players will not offer as many discounts. The focus will be on innovation to augment customer experience,” says Kumar of Ambit Holdings.

According to the Morgan Stanley report, several companies are leveraging big data to intelligently direct discounts to consumers who are sensitive to them. They believe this will potentially help bring down the overall discounting practice at the company level and/or repurpose it to draw new consumers into its net. Some companies have also increased the minimum transaction value for free shipping.

One of the biggest expenses for ecommerce companies right now is marketing and advertising.

“You can curb these expenses,” says Mayank Singhal, adding that such initiatives can show an almost immediate curb on cash burn, by as much as 40 percent. But these are steps that will yield results in the future. And achieving higher margins and better unit economics is not as easy as it seems. Better margins impede growth, and investors don’t want that. After all, it is growth that has driven valuations.

RIDING THE TOUGH TIMES

India hasn’t offered any great exits in ecommerce investments and this fact is not helping the industry. With no profits or cash flow to show, public offerings also seem to be a while away, for at least two to three years. Early investors in companies such as Flipkart, like Accel Partners, are sitting on alpha returns which are not yet realised. “The time is coming up where they [investors in VCs] want to see the flow coming back. Their allocation for India is still very small, but they all know that the day the money starts coming back, India will attract a lot more funds,” says Shekhar Kirani, partner, Accel Partners, one of India’s most active investors.

The good news is people know that money can be made in ecommerce. American investment firm Kleiner, Perkins Caufield & Byers, an early stage investor, scored returns of over 55,000 percent in Amazon in 1999 at the peak of that stock. SoftBank made exceptional returns on Alibaba: In 2000, it started with a $20 million bet on Alibaba and its returns were estimated to be worth about $58 billion last year.

That said, the ecommerce market structure in India is significantly different from that in China and the US.

Competitiveness—be it the number of players (Amazon, Flipkart, Snapdeal) or investors from early stage VCs to PEs to hedge funds—in India is significantly higher. A large country like China has two big ecommerce players—Alibaba and JD.com. Amazon dominates the US market.

“Returns in India will be divided among many more players than in the US or China. In India, the value will be divided amongst four or more players. There are multiple hands in that pie. You may put more money but less returns will come,” says Mukul Singhal of SAIF Partners, which has invested in firms like Urban Ladder, Firstcry.com, Just Dial, UrbanClap and Paytm.

Singhal says the pool of investors for India has to be broadbased. This will bring stability to the sector. Indian ecommerce firms in the growth stage are often backed by investors from Russia, Japan, Hong Kong and the US. Large private equity firms like KKR, Warburg Pincus and Apax Partners, with offices in India and substantial offline investments, have stayed clear from betting on them. “Indian private equity will do ecommerce, we will see some exits. Globally, value investors are shifting from offline to online. They will do the same in India. It’s a question of time, maybe two to three years,” says Singhal.

Ecommerce is a battlefield in India. Lured by the possibility of high returns, more investors may come in and offer ammunition to promoters to win the game. But financial firepower will not be enough. Not if the lessons from the West are any indication.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)