Why agriculture is India's silver lining

With government initiatives and newer business models, the sector is poised to grow further

Farmer and CEO of Vidhi Seeds, Praveen Kumar, has been storing his produce in agritech and fintech startup Arya's warehouses closer to his farm and saving nearly 20-25 percent

Farmer and CEO of Vidhi Seeds, Praveen Kumar, has been storing his produce in agritech and fintech startup Arya's warehouses closer to his farm and saving nearly 20-25 percent

Image: Madhu Kapparath

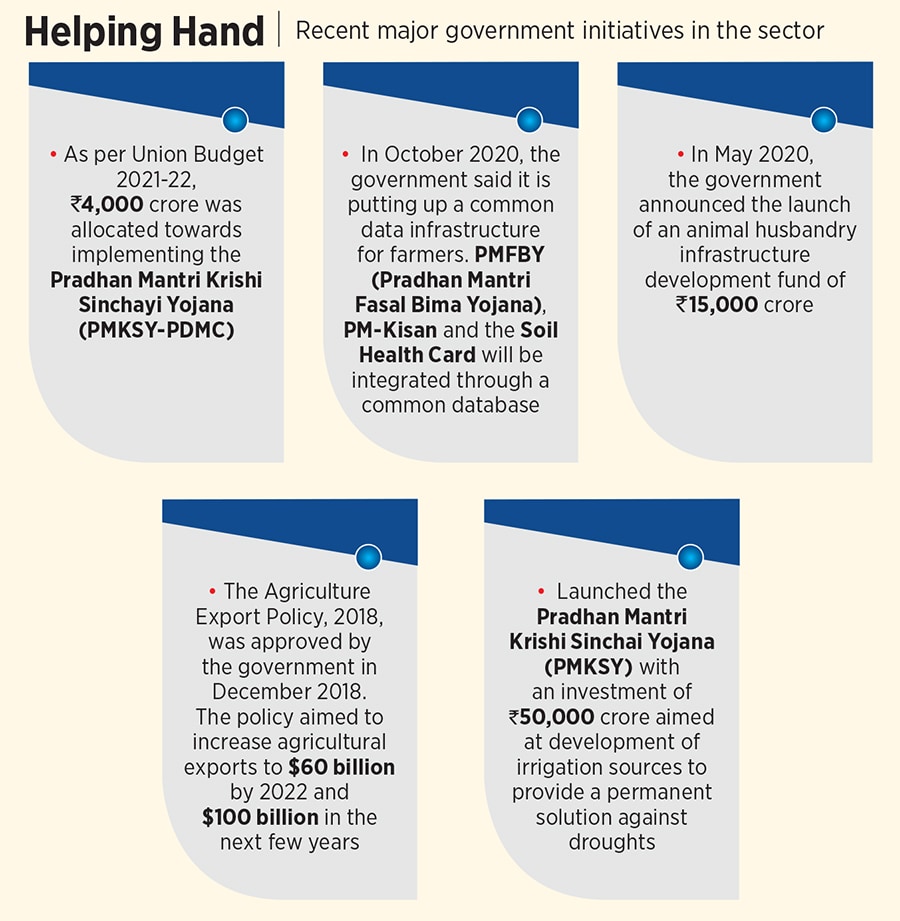

The year 2020-21 has seen India’s economy suffer terribly, with its largest ever contraction in GDP of 7.3 percent. However, it has grown by 20.1 percent during the April-June quarter of this financial year. Agriculture, which has been a silver lining for the Indian economy since the pandemic struck, has continued to grow as the latest GDP figures show. The sector's gross value added (GVA) has grown 4.5 percent in Apr-Jun FY22 when compared to FY21, when the sector had reported a growth of 3.5 percent on-year.

According to the Economic Survey of India 2020-21, in FY20, the total foodgrain production in the country was recorded at 296.65 million tonnes—up by 11.44 million tonnes compared to 285.21 million tonnes in FY19. Exports of only agricultural products (excluding marine and plantation products) increased by 28.36 percent to $29.81 billion in 2020-21 as compared to $23.23 billion in 2019-20. India is also seeing growth in the export of cereals, non-basmati rice, wheat, millets, maize, and other coarse grains (see box).

According to reports, the sector grew at 3.63 percent, which though lower than the 4.31 percent growth in 2019-20, was still a significant cushion for the overall economy. Other sectors like contact-based services, manufacturing and construction, that were hit the hardest, have been recovering steadily.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)