How to file ITR online: Complete step-by-step guide

Say goodbye to tax stress! With our comprehensive guide, learn how to file your Income Tax Return (ITR) online easily and confidently

When managing your finances, filing an Income Tax Return (ITR) is a crucial step. This document allows you to accurately report your income, expenses, tax deductions, investments, and taxes to the government. The Income-tax Act of 1961 requires taxpayers to file an ITR under specific circumstances. However, there are additional reasons to file an ITR, even if you don't have the requisite income. For instance, you may want to:

- Carry forward losses to offset future gains

- Claim an income tax refund

- Secure a visa or loan from banking institutions

- Purchase term insurance

Filing an Income Tax Return (ITR) is a crucial responsibility for individuals and businesses. It is a legal requirement under a country’s tax laws to ensure compliance and maintain financial transparency with the government.

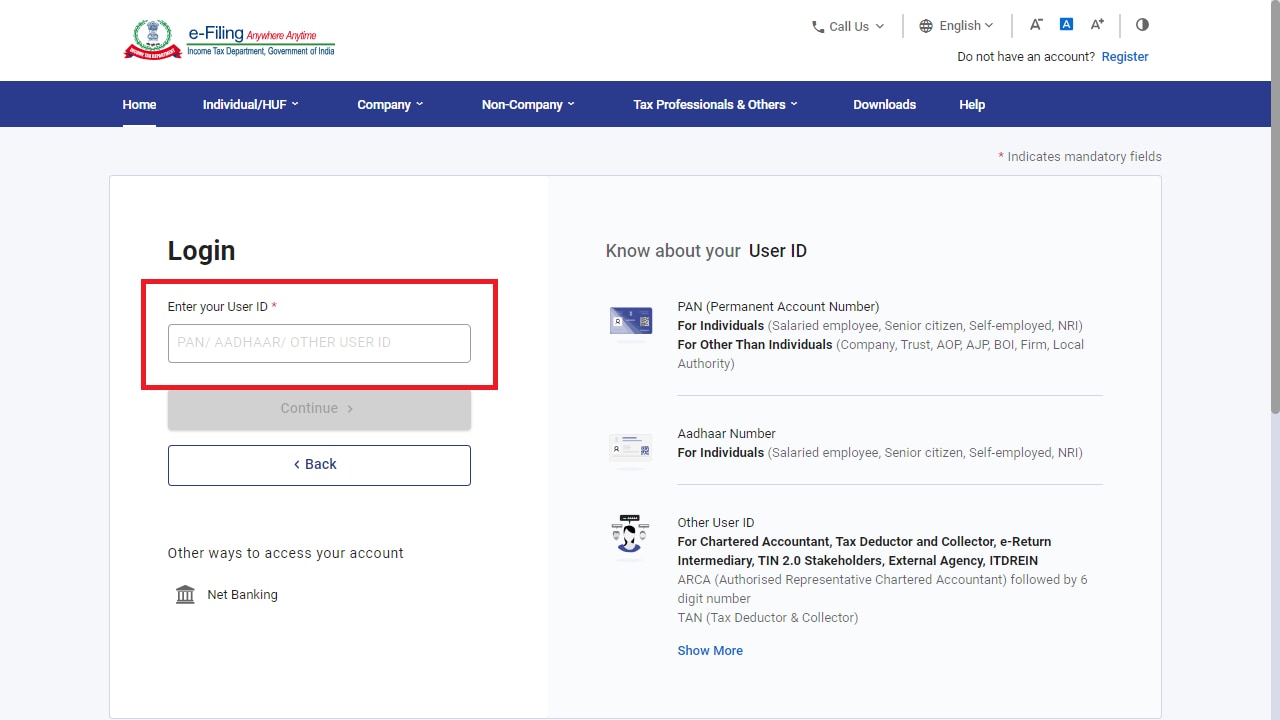

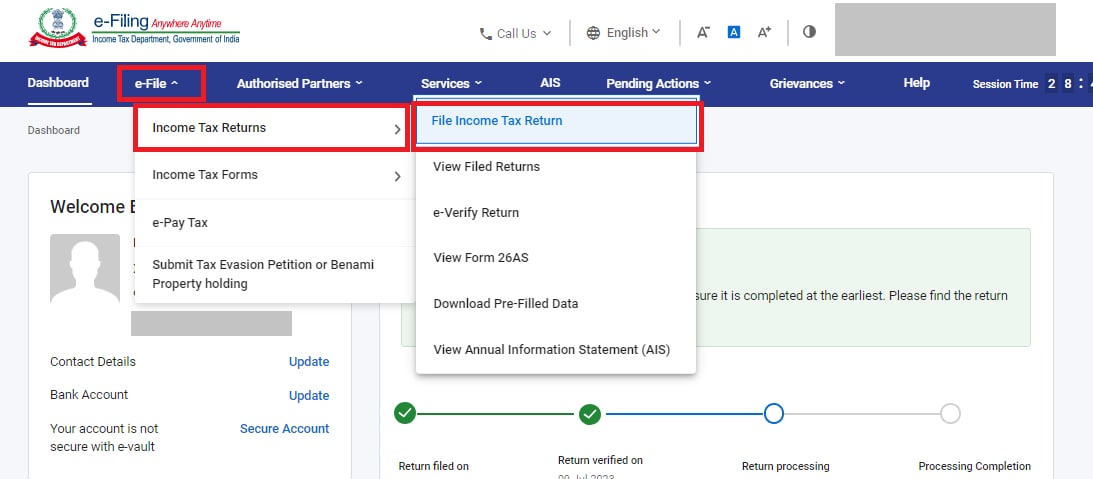

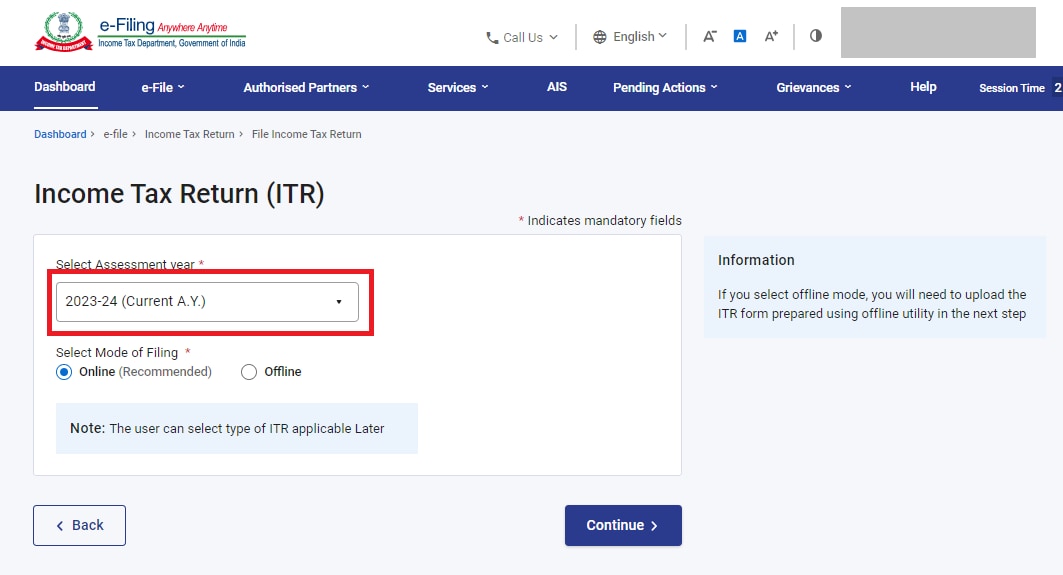

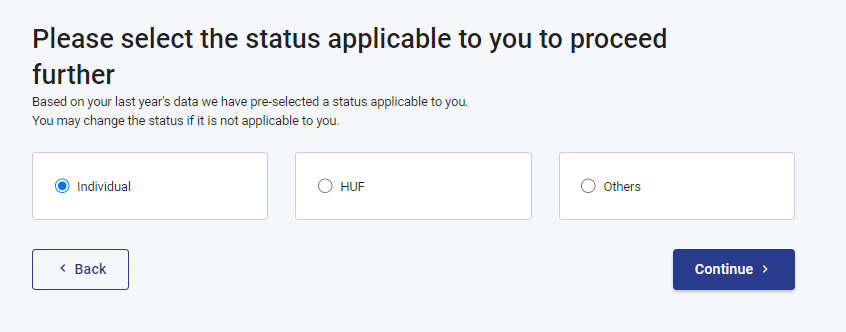

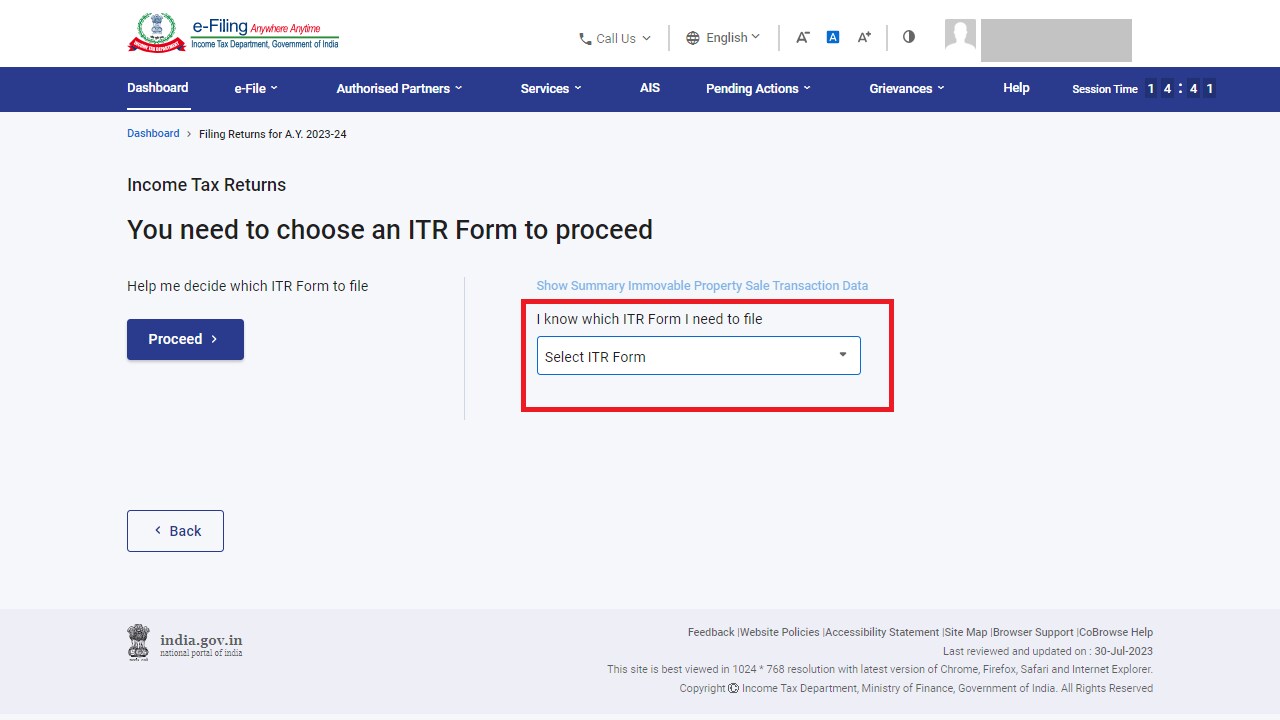

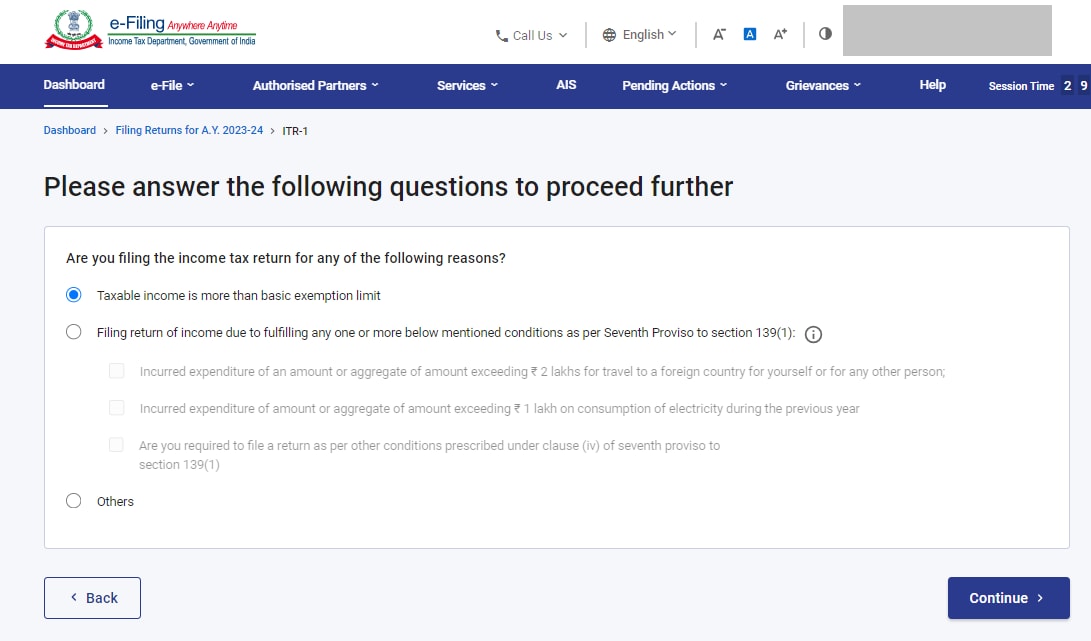

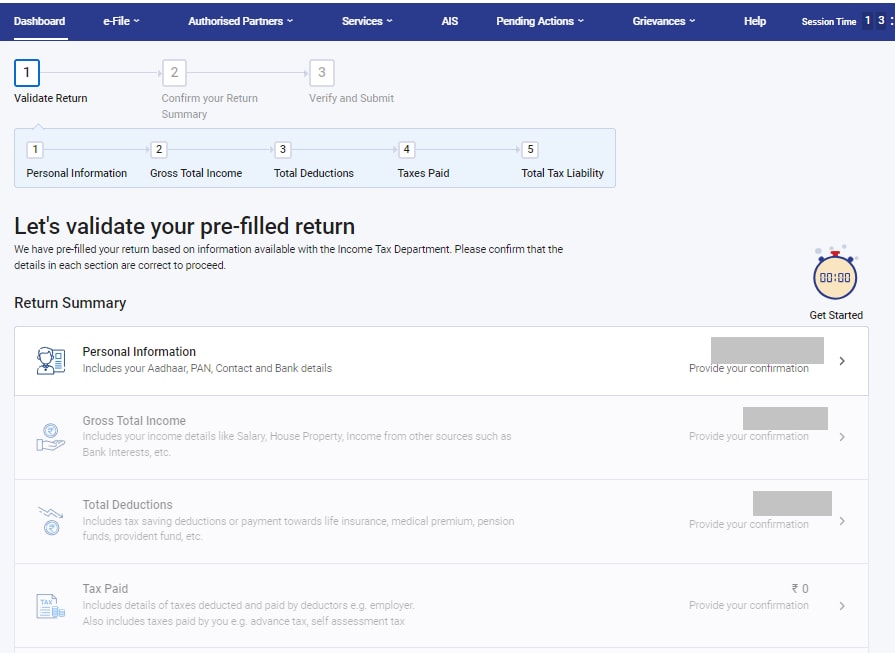

In today's digital age, e-filing ITR has become the go-to method for filing Income Tax Returns (ITRs). This process allows you to learn how to file ITR online.

Documents Required To File ITR Online

Before e-filing your tax return, ensure all required documents and information are ready. The Income Tax Department has made it easy to file your taxes, but preparation is vital for filing ITR online.

Here's a checklist of what you'll need: