UPI 2.0, BHIM and the new shape of payments

UPI's success is proof that India is moving mountains to usher in a less-cash economy. But the scope of BHIM must be widened

Illustration: Chaitanya Dinesh Surpur

Illustration: Chaitanya Dinesh Surpur When former governor of Reserve Bank of India Raghuram Rajan, in April 2016, launched the Unified Payments Interface (UPI)—which allows instant, seamless fund transfer between bank accounts using a smartphone—there were many sceptics. New-age, technology-led government programmes had rarely worked before and a mass behavioural shift from cash to cashless was unheard of.

Over two years hence, the sceptics stand corrected. Statistics suggest that UPI has been a game-changer. Official data from the National Payments Corporation of India (NPCI)—the umbrella organisation for all retail payments in India that also operates the UPI platform—reveals a massive jump in usage and volumes.

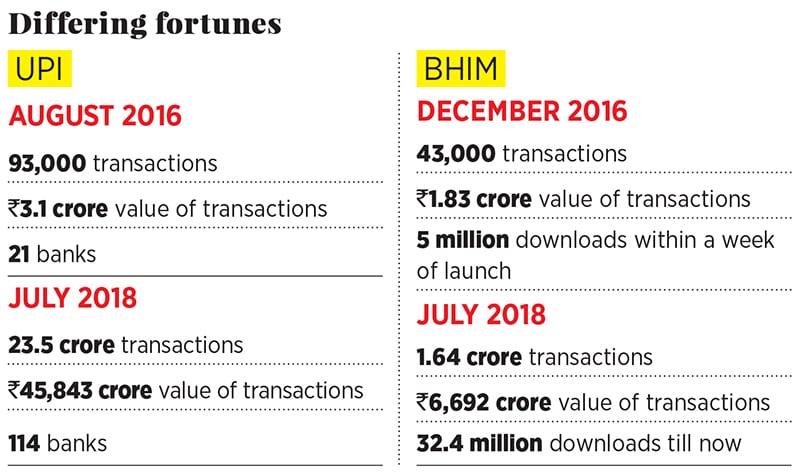

In August 2016, around 93,000 UPI transactions (cumulatively valued at ₹3.1 crore) took place through 21 banks. This, in July 2018, multiplied manifold to 23.5 crore transactions (valued at ₹45,843 crore) through 114 banks. The shift towards UPI gathered pace post-demonetisation, when there was a scarcity of cash in the market.

“UPI set out to make payments safer and quicker, which it has done. Prior to this, though there were organised payment interfaces such as NEFT and RTGS and the debit card-based RuPay, India was not solving the problem of enabling real-time, 24X7 payments for the masses, for individuals and merchants,” says Ramaswamy Venkatachalam, managing director (India/South Asia) at FIS, a global provider of financial services technology.

A newer version of UPI—in August, UPI 2.0 was launched—might fare even better. Currently, 11 banks including State Bank of India, HDFC Bank, ICICI Bank and Kotak Mahindra Bank use UPI 2.0.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)