100 years of Forbes: Hits and flops

When you are the drama critic of business, sometimes you get it right and sometimes you don't. Here are some of the highlights and low points of the magazine's coverage

April 1927: BC Forbes takes on automobile pioneer Henry Ford, praising his manufacturing successes, but railing against his virulent anti-Semitism. Ford issues an apology.

May 1929: A BC Forbes column warns “Stocks too high” five months before the market begins a slide that will take it down by 85 percent.

December 1929: Though Forbes declares the worst is over for stocks, the market remains down for the next three years.

June 1932: A little-known Columbia University lecturer named Benjamin Graham writes an article saying crash had been way overdone, saying stocks are cheap. With the Dow at 45, it was nearly the bottom.

July 1956: Forbes is the first magazine to launch an Annual Report on mutual funds, including performance grades in Up and Down markets. The survey is widely followed and copied.

July 1963: A Forbes cover story examines the evidence that tobacco causes cancer and concludes, “The US tobacco industry is headed for trouble of a kind no other industry has ever seen.”

September 1972: “The New Super Money Men” cover is the first to identify the rise of professional athletes and their managers as business-focussed enterprises.

December 1972: A cover story predicts Mazda’s rotary engine will take over Detroit. Its popularity stalls soon after.

November 1974: In the depths of a bear market, Warren Buffett tells Forbes that stocks are cheap. “I feel like an oversexed man in a whorehouse. This is the time to start investing.” Stocks soon rise.

August 1980: Chrysler is near bankruptcy and written off by the media. Forbes accurately predicts a comeback under auto veteran Lee Iacocca’s leadership.

November 1984: A Forbes investigative team is the first to shine a light on Drexel Burnham’s Michael Milken and his junk bond money machine.

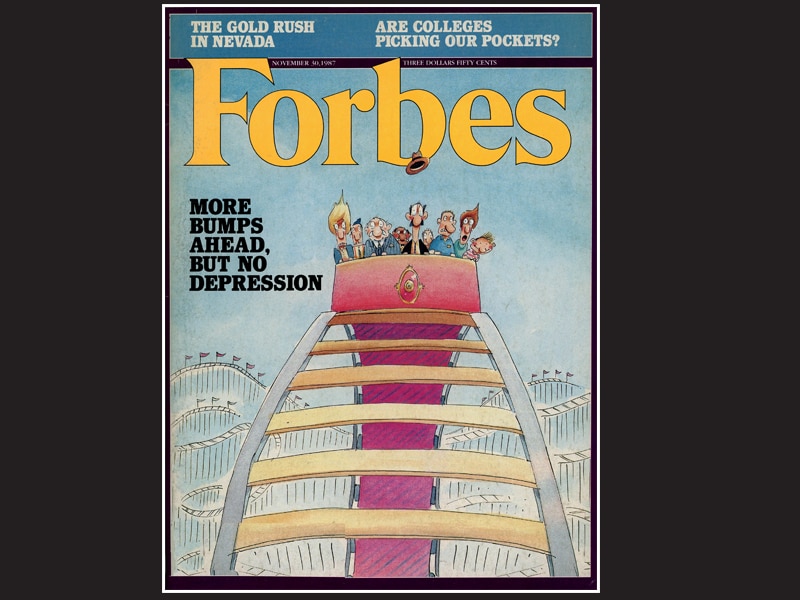

November 1987: Despite dire predictions, a Forbes cover story assures readers that there would be no serious economic downturn as a result of the October 1987 crash. The market ends the year with a gain.

May 1990: “How Rich Is Donald?” A cover story digs deep into Trump’s finances, exposing a liquidity crunch and revealing a net worth of only $500 million versus the $4 billion he claimed.

April 1992: The magazine puts a tulip bulb on the cover and advises our readers not to put any new money into the stock market. The bull market rages on, almost without interruption, for eight more years.

March 1993: George Gilder’s cover story “Telecosm”, in Forbes ASAP, predicts the coming wireless web and computers the size of a wallet that would store your life—smartphones.

April 1994: Midway through Bill Clinton’s first term as president, a cover exclaimed: “Why Bill Clinton Looks Like a One-Termer.”

December 1996: In “Gilbert Amelio’s Grand Scheme to Save Apple” Forbes predicts that a new OS will save Apple, which would squash Microsoft. Amelio is ousted within seven months—by Steve Jobs.

December 1996: In “Is He the Godfather of the Kremlin?” Forbes reveals how Russia’s Boris Berezovsky is the real muscle behind President Yeltsin. The oligarch will factor heavily in the selection of Vladimir Putin.

December 1998: A cover story on “Tax Shelter Hustlers” reveals a myriad of income tax avoidance manoeuvres by leading accounting firms and their corporate clients and prompts alarm at Treasury and in Congress.January 1999: “Amateur Hour on Wall Street” warns that a growing mob of novices, armed with cheap, fast PCs and e-brokerage accounts, is fuelling a dangerous speculative tech stock bubble. Fourteen months later—pop!

April 2008: A cover story, “No Thain, No Gain,” gushes over Merrill Lynch and its ill-fated CEO, John Thain. Within a year, Merrill Lynch is bailed out by Bank of America and Thain is ousted amid scandal.

November 2008: With the financial crisis in full bloom, Steve Forbes’s cover story, “How Capitalism Will Save Us”, extols the underlying strengths of the US economy and accurately predicts a resumption of the global boom.

October 2011: Magazine calls Chesapeake Energy’s CEO Aubrey McClendon, “America’s Most Reckless Billionaire.” Two years later, he’s out as CEO. Within five years, he dies in a car mishap after being indicted for bid-rigging.

February 2013: A cover story on Airbnb identifies the share-economy as a new disruptive threat in a myriad of industries from hotels to car rentals.

September 2015: In “Money’s New Operating System” Forbes predicts that the blockchain will become the “dial tone for the 21st-century global economy”.

June 2016: Forbes exposes billionaire Peter Thiel as the hidden money behind Hulk Hogan’s $140 million libel case against Gawker.

December 2016: Magazine chronicles how billionaire Kenneth Feld keeps Ringling Brothers circus alive. Within six months, the 146-year-old entertainment business is shuttered.

March 2017: A cover package called “In Trump They Trust” exposes the vast web of global business partners—from Indonesia to Panama—cashing in on the 45th president.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)