Game, tech, match! Indian sports teams are going high-tech

As sports leagues and their fans grow in volume in India, companies are using technology to enhance player performance and fan engagement

Tech companies provide solutions for the sports industry and help players analyse their performance using pitch sensors and videos

Tech companies provide solutions for the sports industry and help players analyse their performance using pitch sensors and videosImage: Luke Macgregor/Bloomberg Via Getty Images

Days before the 2019 ICC Cricket World Cup began in May, media reports said the Indian cricket team had signed a deal with StatSports, a Northern Ireland-based performance tracking and analysis company. It produces a small device that sits between the shoulder blades on an athlete’s back, worn in a vest under the jersey. The device measures metrics such as distance covered, speed, acceleration, deceleration, and dynamic stress load. It allows the coach and support staff to analyse and record data about the players’ movements and manage their workload.

Team India was the first high-profile client from the world of cricket for StatSports, whose clientele includes the United States women’s football team, which recently won the Fifa Women’s World Cup, English football clubs Liverpool (UEFA Champions League winners), Manchester United, and Arsenal, and the Irish rugby team.

StatSports had been in conversation with the Board of Control for Cricket in India (BCCI) for about a year before the deal was signed, says Sean O’Connor, its co-founder and COO. “We have a couple of guys on the ground in India, which is a growing base for us and we are looking to ramp things up there quite substantially.” During this time, the company gave the Indian team a demo of the product, and invited India’s under-19 coach Rahul Dravid to visit Arsenal Football Club’s academy to meet the staff and understand how the technology can best be utilised.

The BCCI-StatSports partnership is one of the many new deals being struck in India’s growing sports technology space. Not only are athletes, teams and organisations turning towards technology to improve themselves, but tech companies are also providing solutions for the sports industry, both domestic and international.

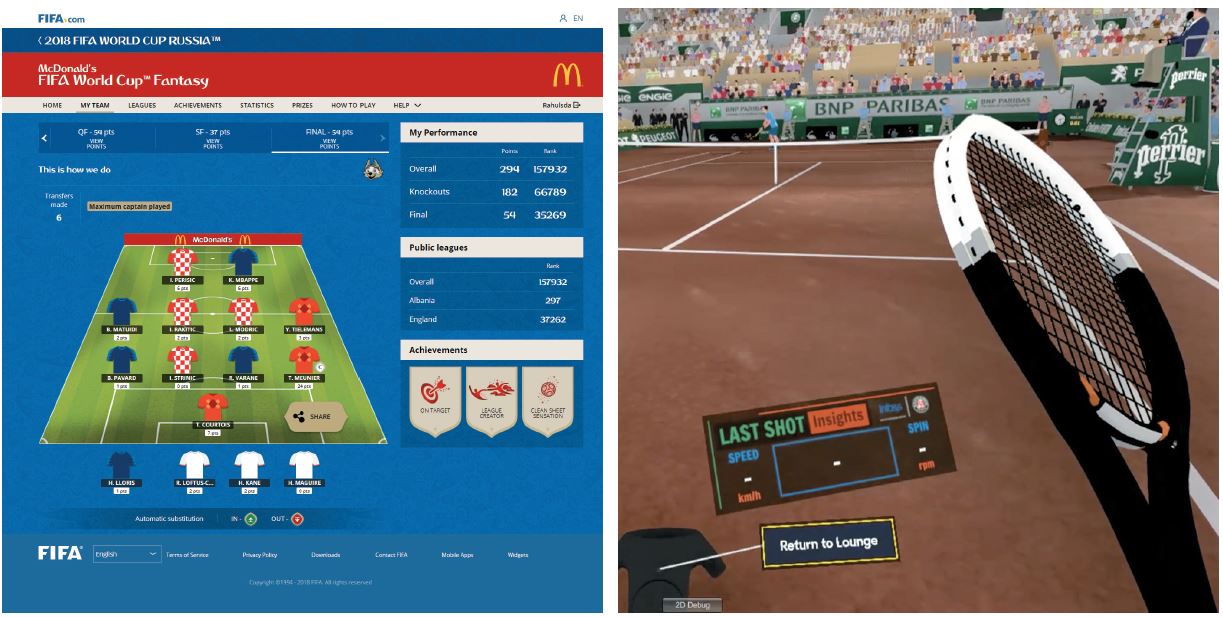

Indian IT majors such as Infosys, HCL and Wipro are being hired by global sports giants for data analytics and tech solutions. Last August, HCL had revamped the website and mobile app of English football giant Manchester United, while this June it became Cricket Australia’s official digital technology partner. Infosys is big in the world of tennis, having partnered with the Association of Tennis Professionals (ATP) in 2015, the Australian Open in 2018, and the French Open in 2019.

Sports technology is predicted to be a $10 billion market globally by 2024, according to industry estimates. Although it is in its infancy in India, significant strides have been made over the last three to four years. According to industry tracker SportsTechX, more than 63 percent of the 360 operational sports tech companies in India were founded since 2015.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)

World No 1 Novak Djokovic. Infosys has partnered with ATP, the Australian Open and French Open for fan engagement and player stats

World No 1 Novak Djokovic. Infosys has partnered with ATP, the Australian Open and French Open for fan engagement and player stats StatSports, a Northern Ireland-based performance tracking and analysis company, signed a deal with BCCI in 2019

StatSports, a Northern Ireland-based performance tracking and analysis company, signed a deal with BCCI in 2019 The number of operators in fantasy sports in India has increased from around 10 in 2016 to over 70 now

The number of operators in fantasy sports in India has increased from around 10 in 2016 to over 70 now