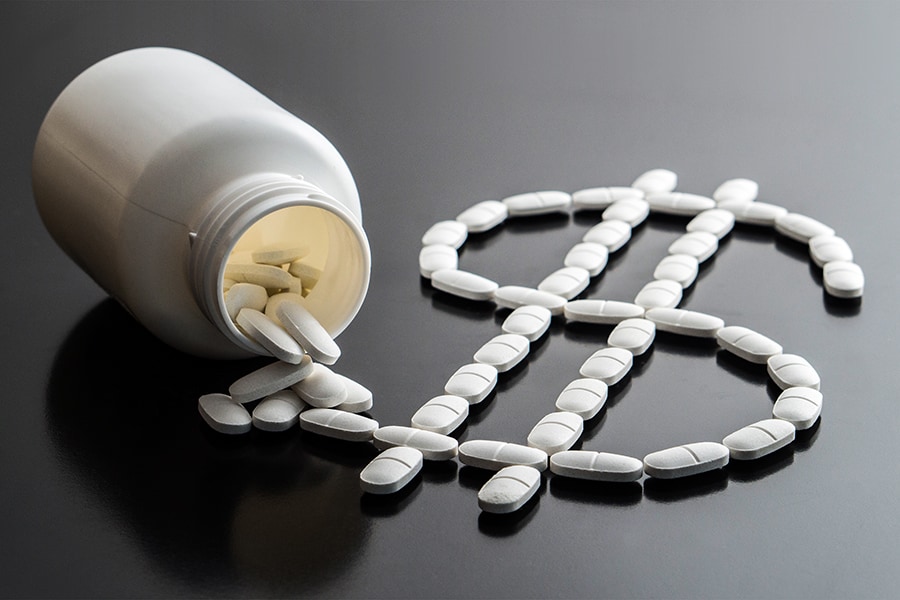

Launch prices for new drugs have doubled since 2005

Analysis suggests Medicare Part B reimbursement encourages high drug prices

Image: Shutterstock

Image: Shutterstock

Launch prices for new drugs have doubled since 2005, according to research from Duke University’s Fuqua School of Business.

The data links the high prices to a 2005 change in the way Medicare reimburses doctors and other providers for Part B medications, which are drugs and treatments delivered in outpatient settings, said David Ridley, a health economist and Fuqua strategy professor who co-authored the research published in The Review of Economics and Statistics.

Currently, Medicare Part B pays health care providers back based on a drug’s past sales prices, plus 4 to 6 percent. When Medicare introduced this formula in 2005, it was an effort to correct flaws in the previous reimbursement policy, which was based on a drug’s average wholesale price, Ridley said.

“Medicare leaders have suspected for many years that we got the fix wrong,” said Ridley, who collaborated on the research with Chung-Ying Lee, a Duke alumnus now at National Taiwan University. “Some have proposed experimenting with different mechanisms. But small experiments won’t work. To move the market you need to implement changes at scale. That’s why we wrote this paper – to highlight flaws in the current system using theory and evidence.”

So long as Medicare reimburses providers based on cost, costs will continue to rise and taxpayer dollars will be wasted, Ridley said. Medicare Part B drug spending is close to $40 billion a year, and the issue extends far beyond Medicare, as most commercial insurers mimic Medicare policy on reimbursements, Ridley said in a live talk about the research he hosted on Fuqua’s LinkedIn page.

[This article has been reproduced with permission from Duke University's Fuqua School of Business. This piece originally appeared on Duke Fuqua Insights]