China's bullying is becoming a danger to the world and itself

Everything Xi Jinping is doing today is eroding trust among Chinese and foreign entrepreneurs about what the rules of business are now inside China

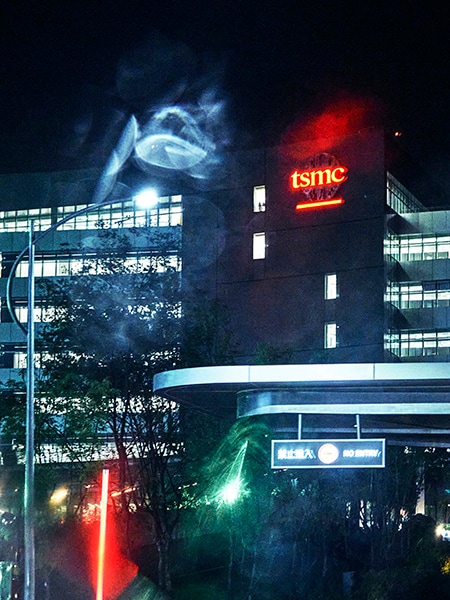

A Taiwan Semiconductor Manufacturing Company plant in Tainan, Taiwan, on Sept. 18, 2020. Image: An Rong Xu/The New York Times

A Taiwan Semiconductor Manufacturing Company plant in Tainan, Taiwan, on Sept. 18, 2020. Image: An Rong Xu/The New York Times

Ever since Deng Xiaoping opened China to the world in the late 1970s, many in the West wanted to see the country succeed, because we thought China — despite its brutal authoritarian political structure — was on a path to a more open economy and society. Alas, President Xi Jinping has reversed steps in that direction in ways that could pose a real danger to China’s future development and a real danger to the rest of the world.

Everything Xi is doing today is eroding trust among Chinese and foreign entrepreneurs about what the rules of business are now inside China, while at the same time eroding trust abroad that China — having swallowed Hong Kong — won’t soon move on Taiwan, which could trigger a direct conflict with the U.S.

While I don’t want Xi’s hard-line strategy to succeed — that would pose a danger to every free country and economy in the Pacific — I also don’t want China to fail or fracture. We’re talking about a country of 1.4 billion people whose destabilization would affect everything from the air you breathe to the cost of your shoes to the interest rate for the mortgage on your house. It’s a real dilemma. Alas, though, I don’t think Xi realizes just how much uncertainty his recent behavior has injected — inside and outside China.

For those of you who have not been keeping score at home, let me explain by starting with a question: What would you have thought if you’d looked at this newspaper in 2008, a year after the Apple iPhone was released, and the front-page headline said that Steve Jobs had disappeared? There would be millions of searches on Google: “Where is Steve Jobs?”

Well, if China has a Steve Jobs equivalent it’s Jack Ma, the co-founder of the e-retail giant Alibaba. Has anyone seen Ma lately? I guarantee you that more than a few people have asked Google this year, “Where is Jack Ma?”

©2019 New York Times News Service