He warned Apple about the risks in China. Then they became reality

In recent years, China shut down Marriott's website after it listed Tibet and Taiwan as separate countries in a customer survey while it also suspended sign-ups to LinkedIn after the site failed to censor enough political content

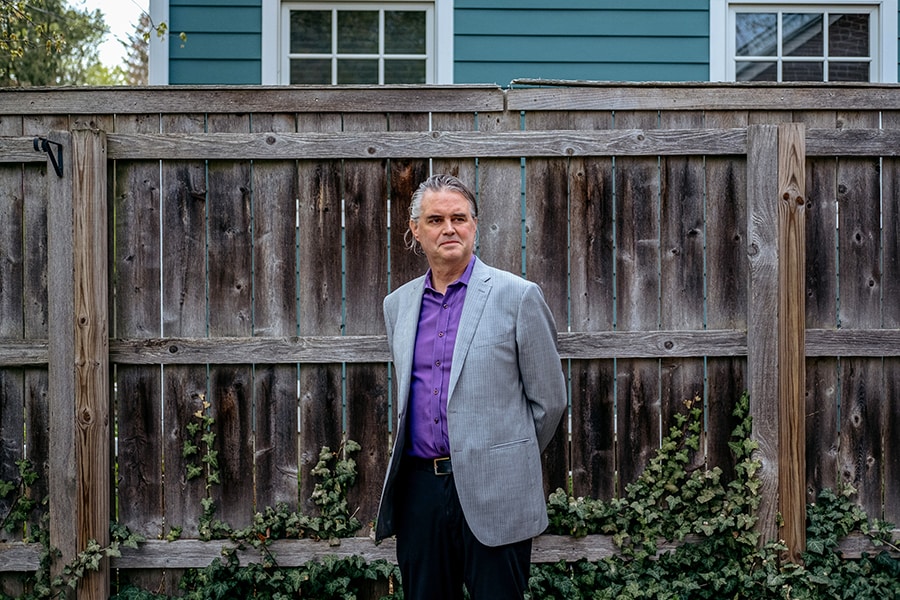

Doug Guthrie outside his home in Ann Arbor, Mich., on April 26, 2021. Guthrie, once one of America’s leading China bulls, rang the alarm on doing business there.

Doug Guthrie outside his home in Ann Arbor, Mich., on April 26, 2021. Guthrie, once one of America’s leading China bulls, rang the alarm on doing business there.

Image: Erin Kirkland/The New York Times

Doug Guthrie spent 1994 riding a single-speed bicycle between factories in Shanghai for a dissertation on Chinese industry. Within years, he was one of America’s leading experts on China’s turn toward capitalism and was helping companies venture East.

Two decades later, in 2014, Apple hired him to help navigate perhaps its most important market. By then, he was worried about China’s new direction.

China’s new leader, Xi Jinping, was leaning on Western companies to strengthen his grip on the country. Guthrie realized that few companies were bigger targets, or more vulnerable, than Apple. It assembled nearly every Apple device in China and had made the region its No. 2 sales market.

So Guthrie began touring the company with a slide show and lecture to ring the alarm. Apple, he said, had no Plan B.

“I was going around to business leaders, and I’m like: ‘Do you guys understand who Xi Jinping is? Are you listening to what’s going on here?’” Guthrie said in an interview. “That was my big calling card.”

©2019 New York Times News Service