The auto industry bets its future on batteries

Long considered one of the least interesting car components, batteries may now be one of the most exciting parts of the auto industry

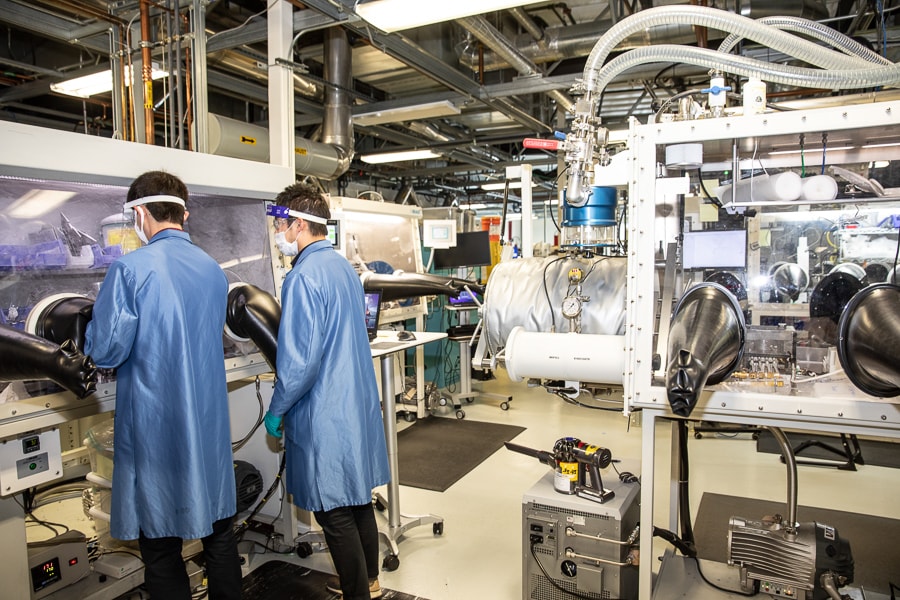

The lab at QuantumScape, a Silicon Valley start-up whose investors include Volkswagen and Bill Gates, in San Jose, Calif., on Feb. 4, 2021. The company is working on a technology that could make car batteries cheaper, more reliable and quicker to recharge.

The lab at QuantumScape, a Silicon Valley start-up whose investors include Volkswagen and Bill Gates, in San Jose, Calif., on Feb. 4, 2021. The company is working on a technology that could make car batteries cheaper, more reliable and quicker to recharge.

Image: Gabriela Hasbun/The New York Times

As automakers like General Motors, Volkswagen and Ford Motor Co. make bold promises about transitioning to an electrified, emission-free future, one thing is becoming obvious: They will need a lot of batteries.

Demand for this indispensable component already outstrips supply, prompting a global gold rush that has investors, established companies and startups racing to develop the technology and build the factories needed to churn out millions of electric cars.

Long considered one of the least interesting car components, batteries may now be one of the most exciting parts of the auto industry. Car manufacturing hasn’t fundamentally changed in 50 years and is barely profitable, but the battery industry is still ripe for innovation. Technology is evolving at a pace that is reminiscent of the early days of personal computers, mobile phones or even automobiles and an influx of capital has the potential to mint the next Steve Jobs or Henry Ford.

Wood Mackenzie, an energy research and consulting firm, estimates that electric vehicles will make up about 18% of new car sales by 2030. That would increase the demand for batteries by about eight times as much as factories can currently produce. And that is a conservative estimate. Some analysts expect electric vehicle sales to grow much faster.

Carmakers are engaged in an intense race to acquire the chemical recipe that will deliver the most energy at the lowest price and in the smallest package. GM’s announcement last month that it would go all electric by 2035 was widely considered a landmark moment by policymakers and environmentalists. But to many people in the battery industry, the company was stating the obvious.

©2019 New York Times News Service