Why Wall Street cheers China, despite growing business unease

Xi Jinping, China's top leader, is ushering the country into an uncertain era and the party's rule is tighter and more authoritarian than before

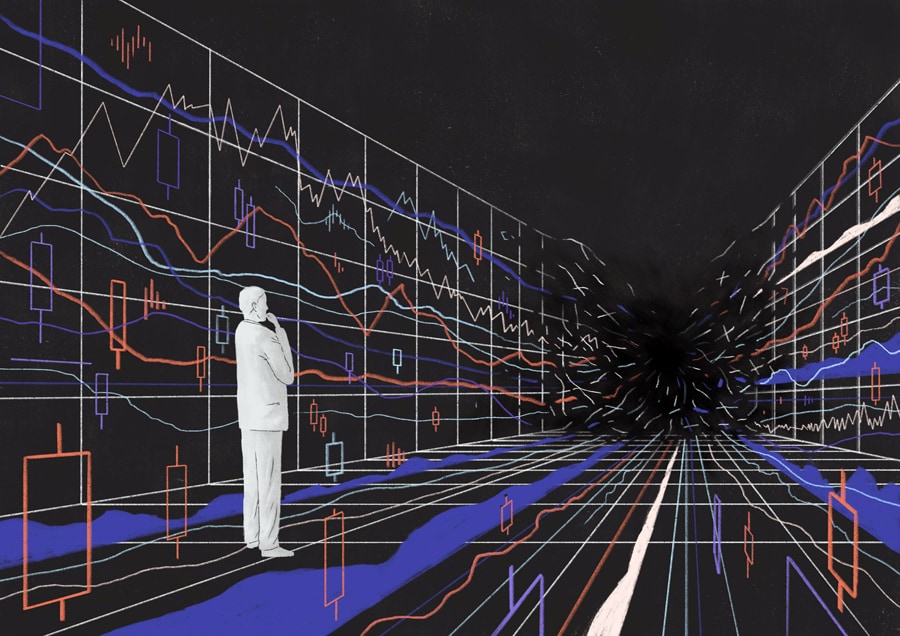

Beijing is opening its financial system to foreign banks — and they have maintained their traditional openness to the Communist Party’s rule. (Jialun Deng/The New York Times)

Beijing is opening its financial system to foreign banks — and they have maintained their traditional openness to the Communist Party’s rule. (Jialun Deng/The New York Times)

This year has been unsettling for Chinese business. The ruling Communist Party has gone after the private sector industry by industry. The stock markets have taken a huge hit. The country’s biggest property developer is on the verge of collapse.

But for some of the biggest names on Wall Street, China’s economic prospects look rosier than ever.

BlackRock, the world’s biggest asset manager, urged investors to increase their exposure to China by as much as three times.

“Is China investable?” asked JPMorgan, before answering, “We think so.” Goldman Sachs says yes, too.

Their bullishness in the face of growing uncertainty has puzzled China experts and drawn criticism from a wide political spectrum, from George Soros, the progressive investor, to congressional Republicans. Soros has called BlackRock’s stance a “tragic mistake” that is “likely to lose money” for its clients and would “damage the national security interests of the U.S. and other democracies.”

©2019 New York Times News Service