Mewar Ortho: Taking Quality Health Care to Rural India

Udaipur’s Dr Manish Chhaparwal set out to fund his American dream. Instead, he set up India’s leading orthopaedic health care delivery system

Mewar Orthopaedic Hospital was created almost by chance. Its founder, Dr Manish Chhaparwal, an orthopaedic surgeon, had his sights set on higher education in the US. But while trying to fund further studies in America, Chhaparwal unwittingly laid the foundation for an exemplary business in health care delivery.

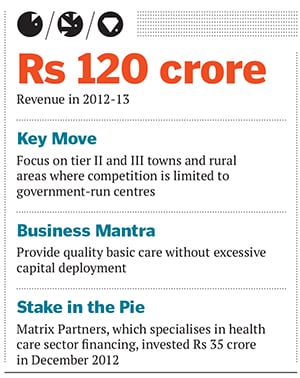

Today, Mewar has 12 branches across Rajasthan, Madhya Pradesh and Gujarat. Apart from the main hospital in Udaipur, almost all the other units are located in rural and semi-urban areas. “I believe there is a big market in the rural areas if you can provide quality service at affordable prices,” says Chhaparwal.

The chief driver of Mewar’s success has been its focus on quality basic care without excessive capital investment. Its business credentials received a huge boost when several VC and PE firms evinced interest in investing. A series of negotiations later, Matrix Partners, which specialises in health care sector financing, invested Rs 35 crore in December 2012. Since then, it has opened eight new centres, adding to the four already existing.

The potential for expansion is massive. According to Chhaparwal, there are around 300 locations in India which have little to no orthopaedic health care facilities.

THE PEOPLE BEHIND IT

In 1998, Chhaparwal arrived in Udaipur, his ancestral town, after completing his masters in surgery (Orthopaedics) and DNB (Diplomate of National Board) in Mumbai. He was looking for a way to make money to fund his American dream.

As it turned out, he started making money very quickly because of the huge suppressed demand for orthopaedic treatment. “The ticket size was big, patient flow was regular and existing services at the ground level were zero,” he says.

By 2004, Chhaparwal and his wife, Devashree (also a doctor and a co-founder), had made enough money to fly Westward but they had begun to realise the huge opportunity that lay at their own doorstep. They invested Rs 60 lakh from their savings and also took some loans to build a 15-bed hospital. By 2006, they had paid back the debt and since then they have been “accumulating money”.

At some point, however, Chhaparwal says money had stopped being the main motivator. His new mission was to provide affordable health care to the under-served. Since 2004, he has been launching new centres almost on a yearly basis. “Each centre pays for itself in about two years,” he says.

WHY IT IS A GEM

There is a huge gap between the demand and supply of health care in India. But in terms of investment options, the most attractive are perhaps those fields of medicine where the mortality rate is not too high and the cosmetic need is manageable. Orthopaedics ranks high on those parameters. Mewar is a clear front-runner since the risks associated with capital deployment are fairly low in its model. In theory, if a centre does not work, there is an easy exit. Moreover, Mewar has a presence in places where the need for treatment is acute and the players are few. The only real competition comes from the government-run centres.

Another reason why Mewar is a gem is because of its leader and promoter. Asish Mohapatra, vice president of Matrix Partners, says Chhaparwal combines all the three skills they look for in a doctor-promoter—clinical, operational and commercial.

WHY IT WAS HIDDEN

If you are a company hoping to provide health care in India, it is likely that you will focus on the south and west, not so much on the north and even less so on the central and eastern regions. The reason for this disparity: Lack of a viable ecosystem given the low purchasing power of the people in the less-served areas. So, health care companies in central India tend to go unnoticed.

Also, as a niche, orthopaedics has not typically boasted successful companies. Mewar is probably the only one which has been able to bring down capital expenditure enough to deliver value.

“Doctor-entrepreneurs tend to over-invest in intensive care setups that cater to that one complication that may come along in a hundred,” says Mohapatra. “And that is the reason why people have not made money in ortho in a capital-efficient way.”

RISKS AND CHALLENGES

The concern is this: Are they growing too fast? Chhaparwal and Mohapatra both agree. Mohapatra says: “The key operational challenge is the availability of non-clinical talent, especially on the corporate side. Though India today has a lot of opportunities in tier II and III destinations, people continue to have reservations about shifting to our hubs in Udaipur and Bhilwara.”

Also, at present, 45 to 50 percent of Mewar’s revenues come from the Udaipur centre—because the services provided there are far more comprehensive than any other Mewar setup. Future growth would require making a similar impact in other big towns like Ahmedabad, Indore or Kota, which would need considerable brand building.

Any plans of going public, then? Chhaparwal doesn’t answer that directly but says that post-2018, “we” won’t be the people running the company.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)