StarAgri: Building Storage Capacities, and Much More

It may hold commodities worth Rs 1,500 crore in its warehouses, but this company’s services extend way beyond storage

A few years ago, four former ICICI associates spent a month in each other’s homes to ensure that they shared the right philosophy about their business model. The result was StarAgri, a bridge between farmers and buyers of agri-commodities.

The Mumbai-based company operates in 183 locations across seven states and has seven lakh tonnes of storage. It holds commodities worth Rs 1,500 crore in 110 collateral management locations. It has also tied up with 26 banks that provide credit to farmers, with commodities in the warehouse acting as collateral.

While a bulk of its revenues—about 65 percent—inevitably comes from warehousing, StarAgri also provides post-harvest management services like procurement, collateral management, lab testing and logistics for various commodities. For the sake of efficiency, these five aspects of their business have been divided into different arms of the company.

The people Behind It

In commodity circles, StarAgri is referred to as the company promoted by one Suresh and three Amits. Amit Mundawala is responsible for operations and is considered a pioneer in creating rural finance networks. Amith Agarwal looks after finance and HR while Amit Khandelwal handles business development. Suresh Goyal is the chairman and managing director.

All of them were previously associates at ICICI Bank in Rajasthan. The bank would have regular meetings with its rural business franchises that financed farmers and the four often came across each other at these events.

By 2006, they started meeting other banks and were able to put together the initial concept for StarAgri. It was around this time that ICICI went through a rough patch in the derivatives business.

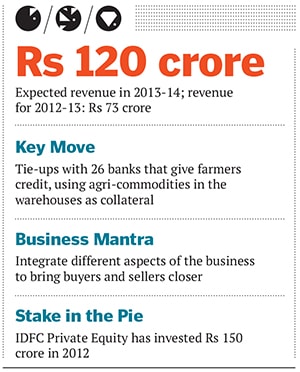

In 2011, Girish Nadkarni, a partner at IDFC Alternatives (Private Equity), came across the company and was impressed with the idea. Within a few months, the firm invested Rs 150 crore in StarAgri.

Why it is a gem

StarAgri currently has a direct relationship with more than 50,000 farmers; its vision is to reach 25 lakh. The company procures agri-commodities from them and helps with transport to the mandis. But, more significantly, farmers often get credit from banks because the grains in StarAgri’s warehouse serve as collateral. Banks benefit too. They have been able to disburse rural credit of about Rs 30,000 crore over the last five years through StarAgri. But the promoters feel that this is a small number, as annual agri-production is over Rs 8 lakh crore.

The company’s in-depth understanding of the commodity business puts it in a unique position to link the centres of production to the centres of consumption, says Nadkarni.

Since the latest RBI guidelines force banks to focus on rural credit, this is an opportunity for StarAgri to build on its relationships with farmers as well as banks for a tidy fee. “New banking licences are going to open up big opportunities for StarAgri to help more banks reach the farmers and channelise their priority sector lending,” says Nadkarni.

StarAgri also serves as a one-stop shop since it has created five lines of businesses which integrate to provide a complete solution. Its customers, therefore, range from banks to bulk buyers of commodities like Cargill and commodity exchanges like NCDEX. Over time, the company plans to spin off its agri-finance division into an NBFC.

It intends to create 50 private mandis licensed by the Agricultural Produce Marketing Committee. These will provide infrastructure to farmers in terms of logistics, warehousing and lab testing, which are tough to find at regular mandis. StarAgri wants to expand its warehouses, which have a capacity of 10 lakh tonnes, by creating silos that will have additional capacity of 250,000 tonnes.

The multiple sources of revenues emerging from catering to rural areas hold the promise of high growth. For 2012-13, StarAgri had a turnover of around Rs 73 crore, and a net profit of Rs 24 crore. It expects to close 2013-14 at around Rs 120 crore.

Why it was hidden

Agriculture in India is still unorganised and is virtually untapped by the corporate sector. StarAgri is one of a new breed of companies trying to introduce efficiency by bringing big farmers closer to corporate buyers. Consequently, the company does not deal with the retail market at either end, which keeps it in the background.

Risks and challenges

Natural disasters play a huge role in commodity prices and this can affect the fortunes of the company. StarAgri also operates in a highly unregulated and unorganised business environment where market efficiency is not easy to achieve.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)