Strand Life Sciences: Bringing Genetic Tests To The Average Customer

By making personalised genetic test services accessible to the average customer, the company is going beyond regular 'business'

When four professors of the Indian Institute of Science (IISc), Bangalore, decided to start Strand Life Sciences in 2000 to aid clinical research through genomic testing using DNA sequencing, the initiative hardly attracted attention. UTI Ventures pumped in $1.3 million a year later and, in 2002, WestBridge Capital Partners invested $1.9 million, but that did not create ripples either. However, things changed dramatically in 2013, when Strand got $10 million from San Francisco-based financial firm Burrill & Co.

It used the capital to roll out personalised genetic test services in collaboration with hospital chains and clinics across India, including Max Hospitals, Mazumdar-Shaw Cancer Center, St. John’s Medical College Hospital, Kidwai Memorial Institute of Oncology and HealthCare Global Enterprises.

Genome testing and predictive genomics-based diagnostics was the cutting edge of life sciences research in the early 1990s. India, however, lagged behind because costs were prohibitive. Strand’s genomics-based diagnostic method now allows millions of cancer patients (undergoing chemotherapy) individualised treatment options that have a higher success rate. The company has also brought down the cost of such tests to Rs 20,000-30,000. Before these tests were indigenised, they would cost in excess of Rs 3 lakh. (Genomic testing for targeted therapy has proved useful for clinical decisions in more than 50 percent of the cases analysed.)

The men behind it

Vijay Chandru (60), Ramesh Hariharan (45), Swaminathan Manohar (54), and Vishwanathan Vinay (50) from the computer science department at IISc got together in 2000 to float Strand—the first company to spin out of an academic institution in India. In fact, IISc even holds a marginal stake in the company.

But getting financial support was difficult initially. “We didn’t start the company with a piece of technology that we wanted to commercialise… it was not a business,” says Hariharan, Strand’s co-founder and chief technology officer, and a PhD from the Courant Institute of Mathematical Science, New York University.

“Medical science was poised to turn into a big data revolution requiring novel algorithms, databases and multi-disciplinary approaches,” says Chandru, co-founder and chairman, whose research career in algorithms and computational mathematics spanned over two decades, including a stint at the US’s Purdue University.

And Vinay, who is the founder-chairman of LimberLink Technologies (a Bangalore-based engineering education startup), serves on the board of Strand.

Why it is a Gem

At present, over 2,000 research laboratories worldwide (about 30 percent of the global market share) are licensees of Strand’s technology products, including the El Camino Hospital (US), Institut Curie (France), Mazumdar-Shaw Medical Foundation (India), TrovaGene, Inc, (US), and Narayana Hrudayalaya (India). With 200 employees, including a strategic team in the US, the Bangalore-based company offers services to over 1,200 life sciences research institutions worldwide. Ninety percent of its sales comes from global markets, including the US (40 percent), Europe (20-30 percent) and Japan (20 percent).

Earlier this year, Strand received a patent in the US for its two-year-old virtual liver product, HepTox. It allows the pharmaceutical industry to trace the side effects of drugs on the liver by cutting down on time, and expenditure associated with animal and human trials.

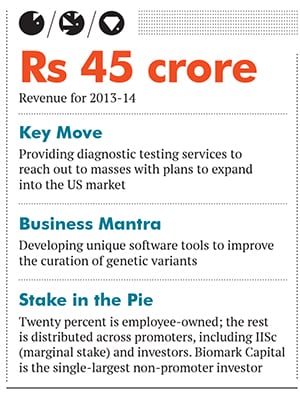

Last year, Burrill & Co transferred the ownership of its Capital Fund IV, which included Strand as a portfolio company, to Biomark Capital. “We were particularly attracted to Strand’s domain expertise, technical talent, global dominance of the research market for bioinformatics, and the unique software tools that it has developed,” says David Wetherell, managing partner, Biomark Capital. The firm bought out early investors WestBridge and UTI Ventures, and is currently the single-largest non-promoter investor in Strand.

Why It Was Hidden

The market for genomics in India is not as evolved as it is in the West. Reports suggest that the global genomics-based diagnostics market is expected to touch $30 billion by 2015, but there are no estimates for the Indian market. “From a business perspective, we were addressing a niche market, but we broke even in 2008,” says Hariharan. In the initial phase, Strand was addressing scientists, a small market, but in the last 2-3 years, it focussed on building the firm into a new generation health care company. Strand now works with over 40 hospitals and several clinics across India and parts of Africa.

Risks and challenges

The biggest challenge in the life sciences sector is the marriage of science and business. “It is not as quick as writing a programme and putting up a web server, and then getting an astronomical valuation because it got a million hits,” says Hariharan.

Experts point out that business in this field must be looked at from a different perspective. While there is no doubt that, over a period of time, the situation in India will evolve, Strand has set its sights on achieving higher growth by targeting more lucrative markets across the globe.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)