Sutures India: Growing In Stature with Wound-Care Products

Manufacturing relatively unobtrusive medical items, the company had stayed unnoticed for a while. But its consistent innovation and growth has finally caught the eye of the investor

Change is coming to a little-known company in Bangalore which manufactures healthcare consumables such as sutures, gloves and mesh that form the backbone of surgeries. For 20 years since its inception, Sutures India has been making wound-care products and steadily expanding its distribution network. Given the unobtrusive medical items it manufactures—most people are ignorant of the life-saving role of sutures—the company would have probably gone unnoticed despite exporting to 95 countries and supplying to 12,000 hospitals in India.

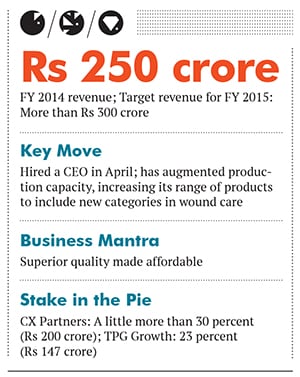

But then it attracted the attention of two private equity firms in two years. First, CX Partners invested about Rs 200 crore in the company in 2012. Next year, in September, TPG Growth—the mid-market and growth equity platform of the global private investment firm, TPG Capital—invested Rs 147 crore.

Expansion and acquisition are on TPG’s mind. In the immediate months after it came on board, it evaluated more than 15 acquisition targets. “We are in discussions with three or four of them for a possible buyout or acquisition. We are evaluating joint ventures with other companies in healthcare that have cutting-edge products,” says Vish Narain, country head of TPG Growth.

A 2014 PwC report values the Indian health care market at $79 billion as of 2012, and predicts a compounded annual growth rate of 12 percent in three to five years. Narain estimates that the Indian wound-care market is about $2 billion, and sutures, or stitches as they are commonly called, have a 15-20 percent share in this space. In 10 years, hospital beds are likely to increase by nearly four million. More beds mean more surgeries and Sutures India is ready to scale up operations.

The Men Behind it

In 1992, Chairman LG Chandrasekhar and Managing Director S Subramanian launched Sutures India with an investment of just a few lakhs. To start with, they manufactured and sold catgut sutures, a type of stitches prepared from animal intestine.

The company’s growth arc mirrors the evolution of sutures in India. Fifteen years ago, most sutures were made from natural materials such as silk and catgut. Over the years, the Indian market became more diverse and moved to stitches made from synthetic materials; Sutures India’s Truglyde is one such example. (The names of almost all its branded products are prefixed with ‘Tru’.)

Sutures India was launched with the mission of producing indigenous but superior surgical products at affordable rates. It achieved success early on in its journey, logging operating profits the very year it was launched. The profits were marginal, but is significant given the crucial, yet understated products it made—stitches that held the body tissues together after a laceration or surgery. Even the most talented of surgeons will find themselves handicapped without sutures, but even the fussiest of patients wouldn’t insist on a particular brand. Sutures were essential, yet invisible.

Over the next two decades, Sutures India expanded its product range: Apart from producing absorbable and non-absorbable sutures, it now manufactures surgical meshes, catheters, tape, gloves, skin staplers and bone wax.

Why it is a Gem

Sutures India is primed to grow in a market that’s only expanding. In the last fiscal, its revenues increased 20-25 percent. YS Prabhakar, who joined as CEO in April, says the immediate goal is to introduce new products, multiple kinds of sutures, and be the final port of call for end consumers. “Portfolio expansion is our immediate challenge. We will have a complete range of products even for niche markets,” says Prabhakar. Research and development is also on the agenda.

TPG will invest heavily in human capital as Sutures India expands to new categories. Prabhakar’s recent appointment as CEO is a sign of things to come. He has 15 years of experience in the healthcare and medical devices arena.

In June, The Times of India reported that the private equity firm plans to increase its stake in Sutures India from its existing 23 percent by buying out CX Partners, which holds approximately 30 percent stake. Narain did not comment on this. Prabhakar says the board has no knowledge of any takeover.

Why it was hidden

Wound-care materials of the kind Sutures India manufactures have little brand awareness among end consumers. It would be a rare patient who’d insist that a surgeon use monofilament polypropylene sutures or recommend a specific type of hernia mesh, which Sutures India began manufacturing in 2005.

The company is strongest in north and south India, but is ready to take up the challenge of increasing its reach elsewhere. To keep up with its growth plan, it has doubled the capacity of two of its Bangalore factories.

Risks and challenges

Sutures India caters primarily to tier-II and tier-III cities, but the new CEO wants to enter the tier-I segment. For that, he has to break the stranglehold that Johnson & Johnson’s Ethicon has on the Indian market. Sutures India is the second-largest company, but it is second to a giant, which commands more than 50 percent of the market share.

Sutures are often one of the more inexpensive medical consumables, so doctors don’t switch brands easily. The pay-offs are low, which is why hospitals, too, rarely change suppliers.

The challenges, though, are offset by the growth in the sector, which has both investors and management bullish about the future.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)