How successful South Korean brands create value through immersion

South Korean brands — be it K-pop groups, eyewear or fashion — outpace competitors through transformative customer experiences, from discovery to retail

South Korean brands are adding value to the customer experience and furthering their worldwide appeal by creating immersive experiences that engage consumers on a deep, multisensory level.

Image: Shutterstock

South Korean brands are adding value to the customer experience and furthering their worldwide appeal by creating immersive experiences that engage consumers on a deep, multisensory level.

Image: Shutterstock

When American brand Warby Parker entered the eyewear scene in 2010, it was heralded as a game changer for the industry. By championing a direct-to-consumer approach, it cut out the middleman and offered a wide array of affordable, high-quality glasses without the sizeable markup characteristic of traditional retail channels. The brand cleverly leveraged mobile to digitalise part of the eye examination process, while enabling customers to try on up to five pairs of eyewear for free in the comfort of their home before making an online purchase – a best-in-class “phygital” experience.

Style played a pivotal role in helping the brand stand out. Warby Parker’s product lines drew design inspiration from the eyeglasses sported by music luminaries Buddy Holly and Bill Evans, as well as John Lennon’s hallmark round frames. To complement its e-commerce operations, it eventually opened showrooms in locations including New York, San Francisco and Seattle, some of which became among the most profitable retail operations of global city centres.

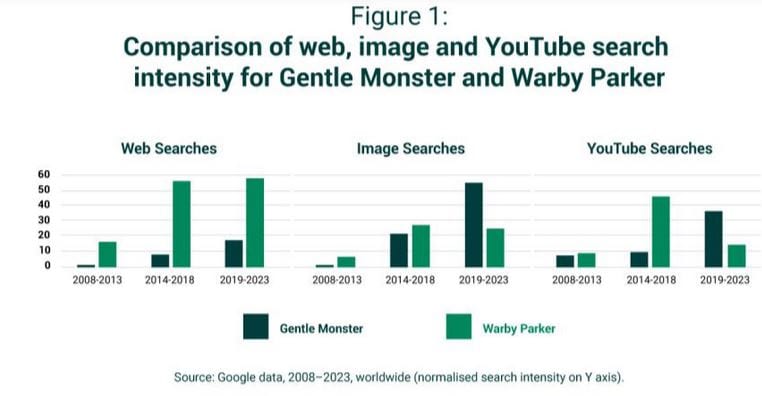

In 2024, Warby Parker is an established eyewear player. Its first-quarter 2024 earnings notched US$200 million and full-year sales are expected to reach US$761 million. But disruption in the eyewear scene looks different today and may have a new epicentre: fast-growing South Korean brand Gentle Monster. It took seven years for Warby Parker to attain an estimated US$250 million in revenue. Within the same time, Gentle Monster’s revenue almost reached twice this amount. What powered such growth?

Gentle Monster: the perfect retail immersion storm

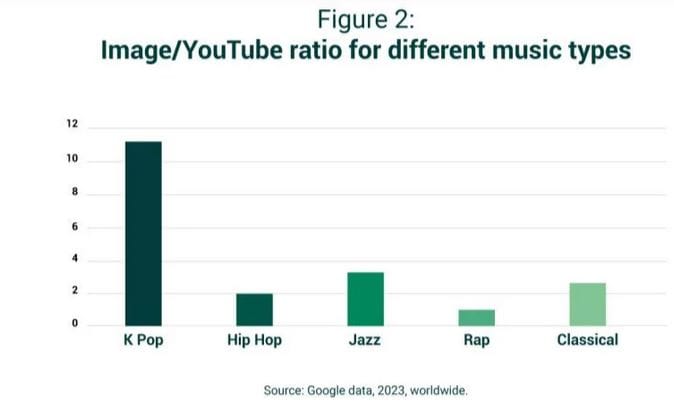

Inspired by its CEO and co-founder Hankook Kim’s conviction that “retail is driven by humans’ curiosity”, Gentle Monster rapidly grew into one of the East Asian region’s leading eyewear brands. Revenue jumped from US$140 million in 2017 to US$440 million in 2024, driven partly by surging global demand from China, Japan and beyond.Besides the brand’s stylish frames, which have been seen on K-pop idols including BLACKPINK’s Jennie and BTS’ J-Hope, it stands out for its commitment to providing immersive experiences, including using concept stores as discovery tools. In fact, Gentle Monster employs more spatial designers than product designers. The brand’s dazzling retail outlets feature art exhibitions and eye-catching, highly Instagrammable installations that make visitors feel as if they’re stepping into an art gallery. These unique, captivating spaces offer powerful differentiators from the brand’s challengers by deepening customers’ relationships through immersion.

[This article is republished courtesy of INSEAD Knowledge, the portal to the latest business insights and views of The Business School of the World. Copyright INSEAD 2024]