The Chinese EV company that made battery swapping work

Automotive company Nio's battery-swapping technology offers a viable alternative to charging stations

The recent rise of Chinese EV company Nio challenges the conventional approach with an interesting alternative – battery swapping Image: Shutterstock

The recent rise of Chinese EV company Nio challenges the conventional approach with an interesting alternative – battery swapping Image: Shutterstock

Range anxiety has been a significant barrier to electric vehicle (EV) adoption among consumers. For instance, if I were to drive a Tesla Model 3 from Paris to the famous Mont Saint-Michel, I would need to carefully plan my 360-kilometere route and charge the vehicle near Paris before heading east, as there are no other Tesla Supercharger stops along the way.

Despite Tesla’s popularity, its charging networks simply cannot match the number of petrol stations for internal combustion engine (ICE) vehicles. How can EV companies fuel sales by better addressing consumers’ range anxiety and providing a better travel experience?

One solution is battery technology, including faster charging and longer driving range. As of 2023, long-range batteries can push north of 560 kilometres on a single charge, and fast charging can add more than 160 kilometres to a battery within 15 minutes. However, improving battery technology is both expensive and slow.

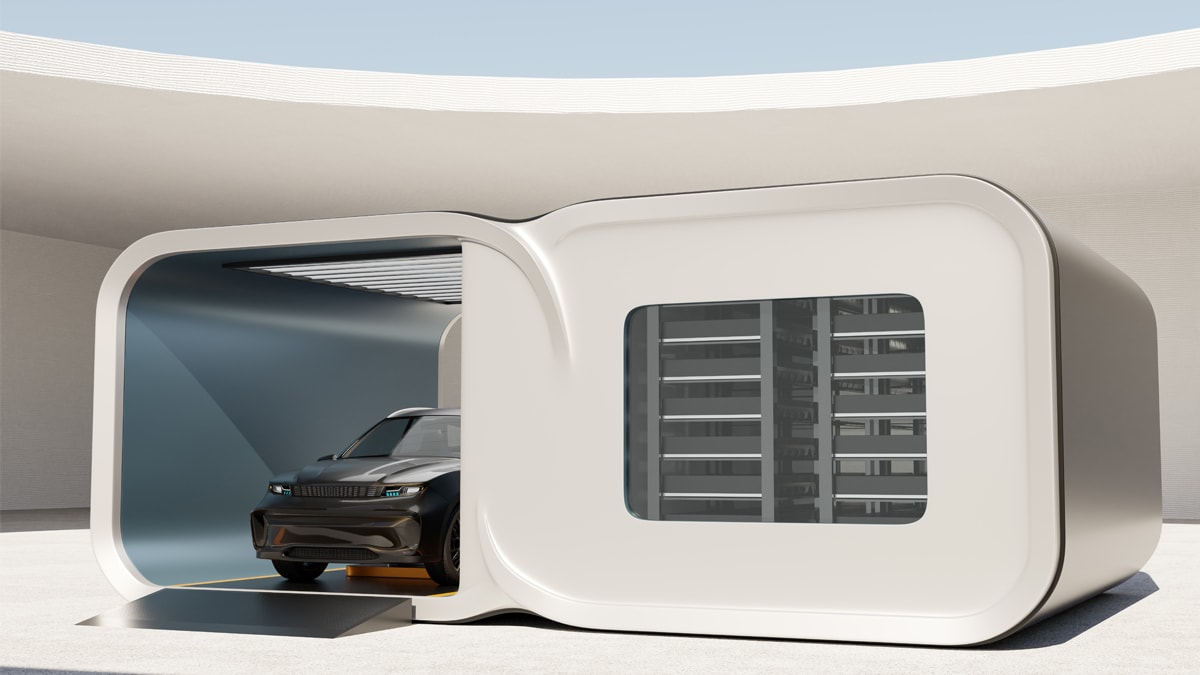

The recent rise of Chinese EV company Nio challenges the conventional approach with an interesting alternative – battery swapping. Could this technology address range anxiety and increase EV uptake? This piece examines the key success factors for battery swapping and explains how Nio makes the technology work in China.

Making battery swapping work

In 2014, automotive veteran William Li established Nio as a Chinese domestic brand to challenge Tesla in the higher-end sports car segment. Tesla debuted a battery swap station at Harris Ranch in California, United States, in 2015, starting its exploration in battery swapping. But this demonstration site saw little to no demand and was eventually shuttered in 2016.[This article is republished courtesy of INSEAD Knowledge, the portal to the latest business insights and views of The Business School of the World. Copyright INSEAD 2024]