Do You Need a Family Office?

For some, it is a problem of plenty

You don’t need to read this article if you don’t have at least Rs. 10 crore to invest. If you have a disposable wealth Rs. 50 crore or more, you are quite welcome to the second paragraph.

Thank you. You can stop reading now if you think you have the time and ability to manage your considerable wealth on your own and a very straight line of succession to leave it to before you go.

Those who are still reading, why don’t you guys check out the family office concept? After all, your wealth structure is complex, you have too many assets to maintain and you want to apportion all that moolah among the members of your large family.

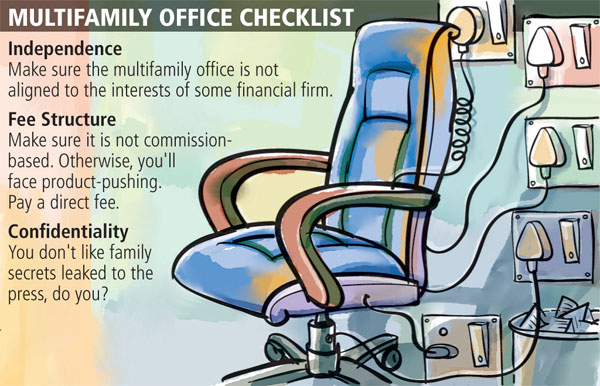

Illustration: Malay Karmakar

Family offices help the stinking rich like you perpetuate and efficiently manage your fortunes. Staffed by teams of money managers, lawyers and accountants, the offices help family members reach consensus on big investment decisions, rein in spendthrift grandchildren and make sure the gardener, butler and chauffeur are all paid on time. At least 4,000 families around the world have them.

In India, over Rs. 6 lakh crore worth of wealth is on the brink of being transferred from one generation to the next, among entrepreneurs that started out in the 1970s and 1980s. “Not many people are aware that this transition is in process right now. It is time promoters start educating themselves,” says Hrishikesh Parandekar, chief executive officer of Karvy Private Wealth.

If you are a member of Forbes India Rich List 2009, or have inside information that you might figure in the 2010 List, go for what is called the single-family offices. One of our members, Azim Premji, did exactly that when he hired a private wealth manager, IIM grad Prakash Parthasarathy, to run Azim Premji Investments (API).

Illustration: Malay Karmakar

But if your wealth is just about a few dozens of crores, don’t bother having your own office. Go for a multifamily office, which helps you share the cost of managing it with other rich families.

What is the minimum size of a family office? “It is for people who have liquid financial assets over Rs. 50 crore,” says Rajesh Saluja, CEO, ASK Wealth Advisors. “Family office is at the top of the pyramid in wealth management space. For any amount below that, the cost of managing the assets will shoot up.” Most family offices in India agree with this threshold. Client Associate is the only exception that takes families on board with an investment corpus of just Rs. 10 crore. Bottom of the Pyramid, as it were.

The main benefits of a family office are customised solutions to specific problems, low cost and flexibility. “Via a family office, you can invest wherever your heart desires” with more freedom than what wealth management houses can offer, says Richa Karpe, director of investments at Altamount Capital Management. Even wealth management services charge between 0.25 percent and 2 percent of assets under management, depending on the investment plan. A family office would cost only between 0.5-2 percent, says Karpe.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)