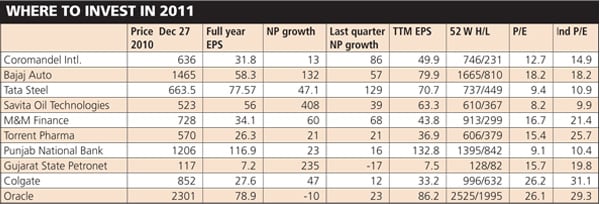

Gems on Bargain: 10 Stocks We Recommend You Invest in 2011

Ten stocks that combine high growth potential, healthy profit margins and low price-to-earnings multiples

The change in sentiment is palpable on Dalal Street. Just two months ago, stock market pundits were vying with each other to assign aggressive ‘fair value’ targets to BSE Sensex and NSE Nifty. The projected earnings of Sensex stocks in 2011-12, in the range of Rs. 1,250-1,275 were quickly discounted into the price and people started talking about profitability expectations for the following year, 2012-13.

But the warning signs were all there. Companies had failed to sizzle the markets with their second quarter (July-September 2010) results and the interest rate cycle had turned upwards. Not a day passed without the news of yet another scam breaking out. For a while, the market seemed to ignore these details. Everybody seemed to take comfort from the fact that Indian markets had proved to be one of the year’s best performing in the world, attracting half of all portfolio fund flows to Asia.

The rude awakening came in the form of the housing scam. “We got into the mood for a bloodbath almost immediately,” recalls the research head of a Mumbai brokerage. Suddenly, corruption and political troubles came to the fore. The market hasn’t been the same since. Investors and brokers have turned very cautious and have become ready to penalise any stock they think is low-quality. This anger was seen even in some IPOs that failed to garner enough money even while the issues of public sector companies couldn’t handle the subscriptions they received.

In this unforgiving environment in which both fundamentals and sentiment are wounded, what kind of companies should an investor choose?

First of all, at 23 times trailing earnings and 16 times the earnings of 2011-12, the market is fully valued. There is absolutely no margin for error. The investor has to be obsessed with buying cheap and compare individual P/E ratios with industry averages before taking a decision to buy. At the sight of any more danger or earnings disappointment, the market will flee to safety, abandoning highly priced midcaps and ‘multi-bagger’ stocks. This is not the time for adventure.

Indian companies will have to contend with high interest rates in 2011. This means any company exposed to high debt or planning to borrow more will be penalised. Also, firms depending on borrowing-led consumption, like home builders and car makers, will hurt. Companies with strong cash flows will benefit.

There are several companies that smartly invested in capacity expansion when cost of funds were low and are ready to start production from the new capacity just as demand picks up. These firms will be able to benefit from the economic growth without having to incur a heavy cost.

Our recommendations comprise a set of 10 companies that will not only thrive in a high interest rate regime, but also find themselves the beneficiary of the strongest growth impulses in the economy. These are the themes that will drive the economy forward despite the turbulence in macro indicators.

Theme: Agricultural Growth

Stock: Coromandel International

At a growth rate of 4-5 percent, agriculture is expected to play a crucial role in GDP growth in the coming year. Indian farmers have begun to invest handsomely in improving yields and Coromandel has positioned itself as a complete farm inputs company. While the company has a strong franchise in fertilizers, it is the new businesses such as speciality nutrients that will be the key growth driver. This new revenue stream now accounts for 10 percent of sales, but is seeing a 40 percent annual growth rate. The profit margins are about three times that of the fertilizer business at 10-12 percent.

Theme: Freedom from Interest Rate Impact

Stock: Bajaj Auto

Unlike cars which are mostly bought through loans, three out of four two-wheelers are bought with own cash. Bajaj Auto would thus be able to bypass the interest rate impact as it seeks growth. After the exit of Honda from Hero Honda, the spotlight is on the second largest two-wheeler maker in the country. Investors who are bearish on Hero Honda could shift to Bajaj for the two-wheeler play. Under managing director Rajiv Bajaj, the company is focussing on a stronger product line and growth opportunity in emerging markets.

Theme: Control of Raw Material Costs

Stock: Tata Steel

Neither JSW nor Steel Authority of India has the kind of raw material arrangements that Tata Steel enjoys. The company is 100 percent self-reliant and will not be affected by price increases in iron ore or coking coal. At the same time, it will fully benefit from increase in steel prices. This will lead to improved profitability. It is also the cheapest steel stock among its peers.

Theme: Demand for Industrial Consumables

Stock: Savita Oil Technologies

The company supplies industrial lubricants, waxes and other industrial consumables. It has been showing a scorching growth in net profit for some time now. With a good promoter, sound business model and a great dividend record, it is poised to benefit from industrial growth in the coming year. It is also attractively priced.

Theme: Rural Growth

Stock: Mahindra & Mahindra Financial Services

The company has a strong presence in rural markets and derives about 90 percent of its revenues from there. Its business model reflects the company’s nuanced understanding of the rural segment. As the demand for tractors grows, the company will be a direct beneficiary.

Theme: Domestic Pharma Play

Stock: Torrent Pharma

Torrent has a very strong domestic focus, an advantage as the attention of global pharma majors turns towards India. The ongoing consolidation has created a lot of excitement about drug companies and this highly profitable company will be in the limelight. The company’s penetration in smaller cities and towns will be an advantage in the coming years.

Theme: Suppressed Value in Banking

Stock: Punjab National Bank

With banks accounting for almost a fourth of the market capitalisation of index stocks, it is hard to ignore the sector. But even the well-run public sector banks have not been able to get the valuation of nimble private sector competitors. Punjab National Bank has a stellar record in operational parameters, but still trades below industry average P/E. The rapid credit growth will keep the bank busy in the months ahead.

Theme: Increased Use of Natural Gas

Stock: Gujarat State Petronet

From Bharat Petroleum to Petronet LNG, some really large companies are investing serious money in the changing energy mix of India in favour of natural gas. In the coming years, hundreds of miles of pipeline will carry natural gas to nooks and corners of India. Gujarat State Petronet is a strong play on this theme, trading at surprisingly low P/E.

Theme: Retail Expansion

Stock: Colgate-Palmolive

The spread of organised retail is opening up under-explored markets to fast-moving consumer goods companies. With 3 million rural distribution outlets and a leadership position in oral care products, Colgate is at the right place at the right time.

Theme: US Economic Recovery

Stock: Oracle Financial Services Software

The resurgence of the US will bring back big-time technology spending and Indian companies stand to gain. However, mainstream software services companies are highly priced. Oracle Fin is one of the few tech stocks that still have some headroom for appreciation. When US banks invest in technology to comply with new regulations, Oracle will rake in the moolah.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)