Investing Abroad: Home, Risky, Home

It is time Indians hedged against the home-country risk and put their money in more affordable markets overseas

When the world is speculating whether India will become the fastest growing economy in 2001 beating a slowing down China, it sounds heretical to tell Indians to invest abroad. But did anybody tell you that GDP growth and stock market performance are not really correlated? GDP numbers are about the recent past while investing is all about the future. Why else should a small number of seasoned investors build nest eggs outside mother India?

As the world’s financial and property markets got beaten up by the impact of the 2008 recession, India recovered quickly and its markets peaked to pre-crisis levels. This created a valuation differential between India and many other markets attracting a handful of HNIs to invest there.

The RBI had allowed a foreign investment limit of $200,000 per person each year. But for long, all this money went into real estate. Only recently have HNIs begun taking overseas equity seriously. Outward remittance in equity has grown about 44 percent this year, albeit on a tiny base. Those wanting to take a higher exposure often pool funds with family members, and have built sizable portfolios of as much as $1 million. “It is mostly the new money HNIs that have begun taking the initial steps through mutual funds and ETFs, and then moving on to other asset classes,’’ says Rajesh Saluja, CEO of ASK Wealth.

Why Go Global?

History has shown that no single stock market can be the world’s best performer for two years in a row. Like a musical chair, the hot destinations keep changing. “Stock market performance need not reflect GDP. That is a myth you and I live with,” says Arindam Ghosh, head of retail sales at J.P. Morgan Asset Management.

In fact, India has not been the best performer even once in the last decade. This clearly makes out a case for investing in multiple markets. The idea is to build a portfolio so it has uncorrelated elements in it, says Atul Singh, head of global wealth and investment management at BoA-Merrill Lynch. He says an investor must keep a large chunk of his money still in India, but hedge against the risk that India may falter by putting a small portion in other markets. The other strategy is to invest in asset classes not available or frequently traded in India. Foreign exchange and some base metals come in this category.

Investing in equities or commodities abroad is only slightly more cumbersome than investing in local stock exchanges. Indian brokerages have tied up with global partners and opened overseas offices to enable the purchase of stocks directly. This will enable you to build a customised portfolio, but could be a risky affair. Sitting thousands of miles away, an Indian investor will not be able to gauge the ups and downs of foreign markets and may not be nimble enough to get out of a tight situation.

That’s where the mutual funds come in. These funds pool in money from local investors and invest in stocks or other assets. Birla Sunlife International Equity Fund and Mirae Global Commodities Fund are examples of such funds. The risk here is that the local fund manager may not be the best person to take calls on foreign markets.

A growing number of feeder funds eliminate this risk. They invest their corpus into funds run abroad. In fact, most Indian fund houses have adopted this model. These funds typically get entry load exemption from the underlying fund so that the Indian investor pays a manager’s fee for only the Indian leg of the investment. JP Morgan JF Greater China Equity Offshore Fund is an example of this category.

A hedge against dodgy fund managers can be an Index fund. If it is a hybrid fund also investing in India, that is even better. One such fund allowing Indian investors to buy into China is the Hang Seng Benchmark Exchange Traded Fund. This ETF offers a tax-efficient way of investing overseas because the fund invests at least 65 percent of the assets into Indian equities and only the rest is allocated into foreign equities. This ensures there is zero tax on long-term capital gains.

What’s on the Horizon

Several new products will be launched early next year. Religare-Macquarie Private Wealth will open an Agri fund to invest exclusively in listed and unlisted farmland companies in Australia, New Zealand, China and Brazil. “Macquarie has a $6-billion agriculture portfolio globally and our experts believe there will be a huge demand on food, dairy and oilseeds in the coming years with the huge urbanisation in India and China,” says Rohit Bhuta, director at Religare-Macquarie. The fund will allow individual investors to take a direct exposure to companies, almost like private equity players. Religare-Macquarie also plans funds dedicated to the mining, clean technology and biotech sectors.

Infographic: Sameer Pawar

Motilal Oswal AMC has filed an application with the regulator to launch Nasdaq 100. “This will be an access point so investors can experiment with entering the international market. The fund is liquid as investors can get in and out of it in real time,’’ says fund manager Rajnish Rastogi.

The Flip Side?

Currency risk is probably the biggest drawback. A strengthening rupee will cut down returns when the dollars are converted back into the Indian currency. Returns will have to be higher than the rupee appreciation during the investment. Investors have to bear the risk in most cases.

Investments overseas are also taxed at higher levels, a disincentive from the days when foreign exchange was still a precious national reserve that had to be conserved. There is a case here for liberalisation but that’s not yet on the horizon.

Where to Invest?

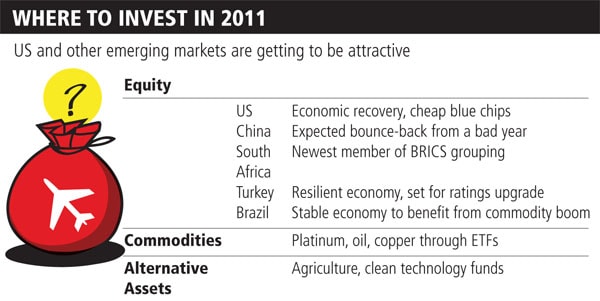

Geographic diversification, particularly to countries that have no correlation with India, is ideal. For 2011, fund managers tracking markets around the globe say the United States, China, South Africa and Turkey look like good bets for equity investments.

The US The world’s largest economy may still have a large unemployment problem, but the companies are doing quite well. Valuations of blue chips have been beaten down so much that they have started looking attractive now. “The agility and ability to bounce back that US has, nobody has,’’ Ghosh says. Investment in US equity is a good medium- to long-term call, he says.

China The market didn’t do well at all in 2010. By the law of averages, they should start doing well sooner than later. There is a creeping inflation problem and the associated tightening of money supply. The most likely scenario is a fall in growth rate to, say, below 7 percent. But even with controlled growth, Chinese companies are projected to post a healthy earnings improvement in 2011. Equity prices have already picked up in anticipation and stocks are no longer as cheap as they were six months ago. But several fund managers are willing to bet that stocks will catch up in the short to medium term.

South Africa Now that BRIC grouping is set to officially turn to BRICS in 2011, South Africa is emerging as the fifth largest emerging market in the world. The huge growth in demand for commodities, particularly from India and China, is set to give the largest economy in Africa a big boom. South Africa is already China’s biggest trading partner, with bilateral trade topping $100 billion. The Chinese boom also has a correlation with South Africa, as the latter leads in the production of several mineral resources.

Turkey Though not in the European Union, Turkey is fast emerging as a good destination for many fund managers. Inflation is now under control and like India, Turkey too has a big advantage of a huge population of young people. It is a large manufacturing base for the European market. Fund managers say ratings might soon go up to investment grade. Unlike Brazil and India, Turkey has no taxes on foreign fund inflows, making the market more attractive for 2010.

Brazil With abundant natural resources, this country should do well in a year when commodity prices are expected to go up. Because of its export links to the US, its stock market has not seen the kind of valuations some other emerging markets have. This opens up an opportunity. This country is politically stable, has low debt and enjoys rapid economic growth.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)