Two Themes For 2012: Stock Picks

Two approaches to build a portfolio

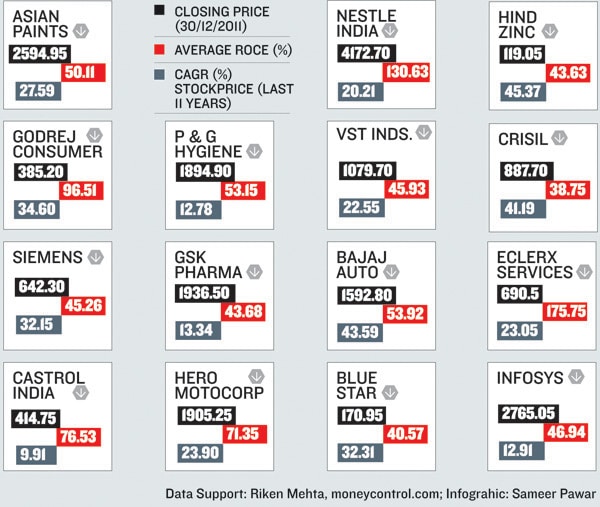

FORBES INDIA’S CAPITAL PRESERVATION PORTFOLIO

When the going gets tough, the tough get going. At a time when the equity markets are not at their best, Forbes India decided to look for companies that can navigate through tough times. Our basic rule was to look at companies that have been profitable throughout the last decade and have managed to protect shareholder wealth. If an investor had invested Rs. 1,000 in each of these 15 companies, by the end of 11 years she would have made Rs. 2.9 lakh or 32 percent annually. That is more than twice the number when compared to the BSE Sensex, which delivered 14 percent during the same period.

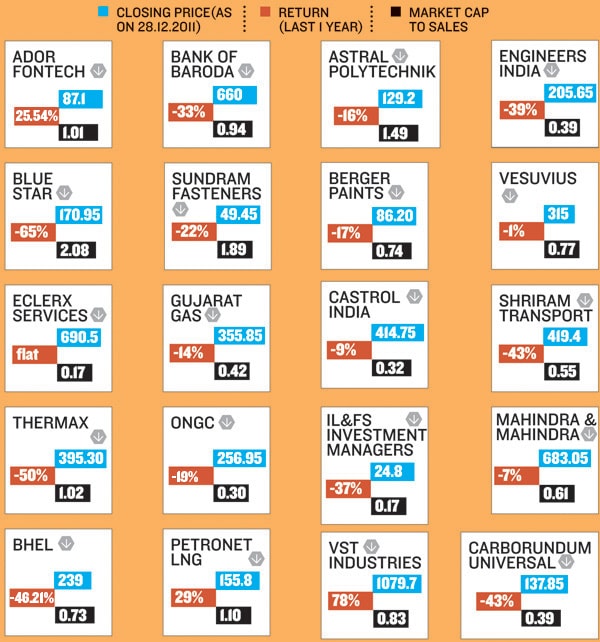

THE CHEAP, CHEERFUL AND CONTRARIAN PORTFOLIO

Our consulting editor for the Investment Guide has worked on the list of contrarian companies on this page. These companies have hit rock bottom on the bourses. The only way forward for them is up. While the Forbes India portfolio is a defensive play, Bhattacharyya, presents the offense.This portfolio is more intuitive and more cheerful. These companies are well managed and their fundamentals are intact. But they have been ignored by the markets. These companies are available at cheap valuations. Go for them if you feel contrarian.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)