Rein in Hopes of High Returns on Property

Pre-let commercial property can be a winner

Depends on whether you like Queen Elizabeth or the author Christopher Koch, 2012 was Annus Horribilis or The Year of Living Dangerously for the real estate industry. The developers were done in badly. The financiers of real estate industry saw very little returns. Don’t even talk about the buyers. In spite of low sales, prices refused to come down significantly.

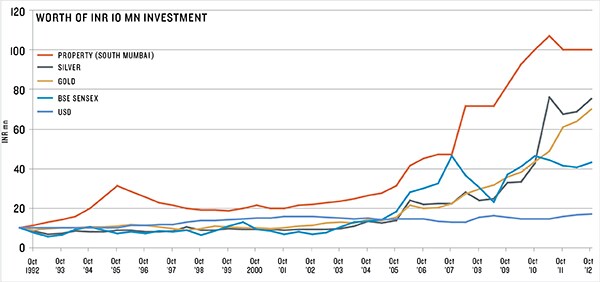

Given that there has been so much misery in this sector, should an intelligent investor even bother with this asset class? A little bit of history can put the decision in perspective. If we take the last 20 years—reforms started in 1992—then real estate would have outperformed every single asset class, be it stocks, bonds or gold.

That’s the long view and it means that in a country like India, where economic activity and urbanisation will only accelerate, an astute investment in real estate can be really profitable. Having said this, a saner head will also look at what has happened in the last five years. For those who invested in 2007, the returns would be much more moderate.

Add to this the fact that real estate is a risky investment. It is easy to buy, difficult to sell. Either you keep the asset or you sell it. It is not possible to slice and sell it, which you can do with shares. Then there is a question of legal problems. A lot of people go wrong on the titles.

In the investment climate that we are in, it is wise to keep in mind what Warren Buffett once said: “I buy on the assumption that they could close the market the next day and not reopen it for five years.” So, to play around in properties with a capital of less than Rs 2 crore to Rs 3 crore would amount to putting the money into one single asset. If things go wrong, your capital can get wiped out.

The way around this is to not be too aggressive in seeking returns in the current climate. One good investment is commercial properties that are let out to good MNCs. For those who can afford to put up the requisite capital and are able to pick up an office which is occupied by TCS or IBM—assuming they will stay put for five to 10 years—the rewards will be gradual but plentiful. The returns will consist of rental income in addition to capital growth.

Those who invest in mutual funds will know that there are equity funds, debt funds and then there are hybrids called ‘balanced funds’. Pre-let commercial property (with good tenants) is like a balanced fund where the benefit of appreciation will be less than 100 percent. That’s fair because someone else has made a riskier bet of investing when the building was under construction.

However, between the rental and the appreciation, the returns could be between 15 and 20 percent. If one is content with that kind of appreciation, roughly nine to 10 percent from rentals and seven to 10 percent from growth, net of expenses, net of outgoings but not net of currency risk (i.e. 15 to 20 percent rupee denominated returns, not dollar denominated) and if that’s acceptable, this is a strategy that blends aggression with caution. So don’t expect returns of 35 percent that developers make on greenfield projects. Instead, look at the safety of investment because the risk has declined.

If the investor has access to such deals on his own, it is a different matter but, in my view, it is perhaps more prudent to tag along with a real estate fund. For example, through one of the funds, we recently acquired 1.50 lakh sq ft of space occupied by TCS in Pune. We had three people coming to us and saying, “We’ll tag along with you, taking 10,000 square feet.” There’s a cost to tagging along. Let’s assume the market value is Rs 5,000 and we got it at Rs 4,000. We’ll give it to that person at Rs 4,500. He still gets a Rs 500 advantage to the market.

Investors in the fund don’t mind because they get a benefit of Rs 500, which the fund calls ‘downselling’. It is a win-win situation for everyone. The developer is happy that the inventory is off his books. The investor is happy to get a good and a safe option and the real estate funds get to acquire a larger asset at a truncated value. All investors are not alike and there will be some who might want a more aggressive approach. They could look at developer financing. This strategy needs even more capital than the previous one, mind you!

What is the big problem with developers today? They’re not able to sell and they don’t want to reduce the price. So we came up with a solution of ‘bulk buying’.

Now a fund, or even a high net-worth individual, can approach the developer and say, “I’m taking up 100 flats in your development. If the going price is Rs 5,000, I’ll take it at Rs 3,500.” It goes without saying the developer must be vetted properly, must enjoy a good reputation and the entire funding is through an ‘escrow’ arrangement, to ensure intended utilisation of funds lent.

Many good developers are fine with such transactions. Again, going along with a good fund ensures that the paperwork has been vetted and that the money will be used only for construction. The investor can later downsell those flats.

So the message is, manage your risk, be content with slightly reduced returns and come out as ‘winners’, at a time when others are losing their shirts.

Good luck!

Pranay Vakil

Profile: Co-founded Knight Frank India, the real estate consulting firm.

Known For: Has an unmatched knowledge of Indian real estate, with over 18 years of experience in providing consultancy services to multinational and local corporations on mergers and takeovers in the real estate market.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)