Two Equity Approaches For 2013

Forbes India's capital preservation portfolio versus a contrarian one

In 2012, the Forbes India investment special introduced two portfolios to the readers. The capital preservation portfolio was meant for the conservative investor.

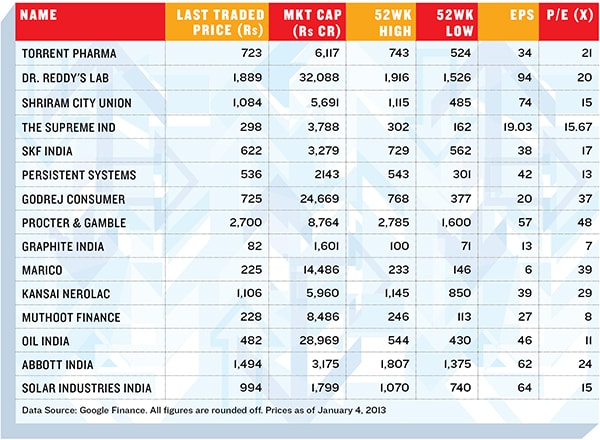

Last year, our basic rule was to look at companies that have been profitable throughout the previous decade and have managed to protect shareholder wealth. This portfolio returned 25 percent against the 23 percent (till November) by the Sensex.

The year 2013 is an election mode year. The markets have returned 26 percent over the last year and there is a very high chance that we may not see this return in the new year.

At a time when the equity markets are already run up before an election year, Forbes India decided to look for companies that can navigate through volatile times. Our basic rule was to look at companies that have very low stock market risks and have been profitable for the last three years. We have looked at low beta stocks that are generally considered low risk. If the Nifty moves up by 100 percent, a stock with a beta of 2 will move by 200 percent.

If an investor had invested Rs 1,000 in each of these 15 companies, by the end of one year she would have made Rs 21,150, or 41 percent annually—in comparison, the BSE Sensex delivered 26 percent during the same period.

FORBES INDIA’S CAPITAL PRESERVATION PORTFOLIO

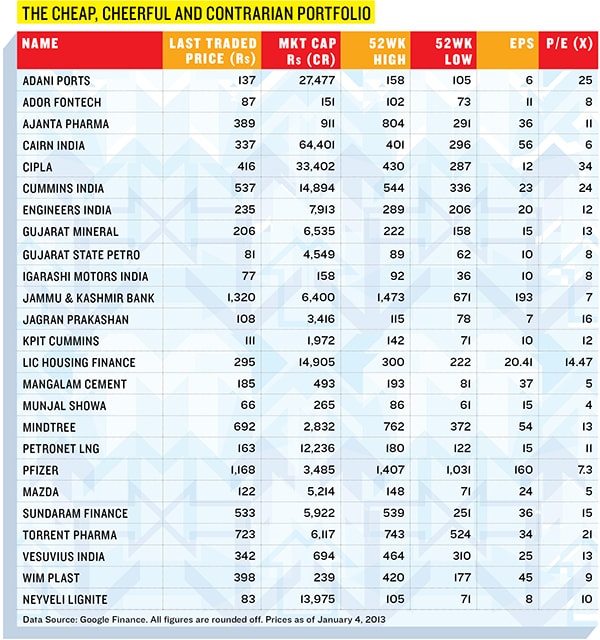

We introduced this portfolio in 2012 for investors who like to be contrarian. Over the last one year, it returned 27 percent in tune with the Midcap 200 returns.

Sanjoy Bhattacharyya, our consulting editor for the investment special, has come up with the list of contrarian companies on this page. These are not large caps. This portfolio has done well for the last year with an overall return of 47 percent. But being small, mean and lean, these companies are worth watching. While the Forbes India portfolio is a defensive play, Bhattacharyya presents the offense. These companies are well managed and their fundamentals are intact. But they have been ignored by the markets. These companies are available at cheap valuations. Go for them if you feel contrarian.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)